Bitcoin edges higher toward $8,500, looks to snap four-week losing streak

- Bitcoin gains more than 7% on a weekly basis.

- Recovery is likely to gather momentum if BTC/USD closes above 200-day MA.

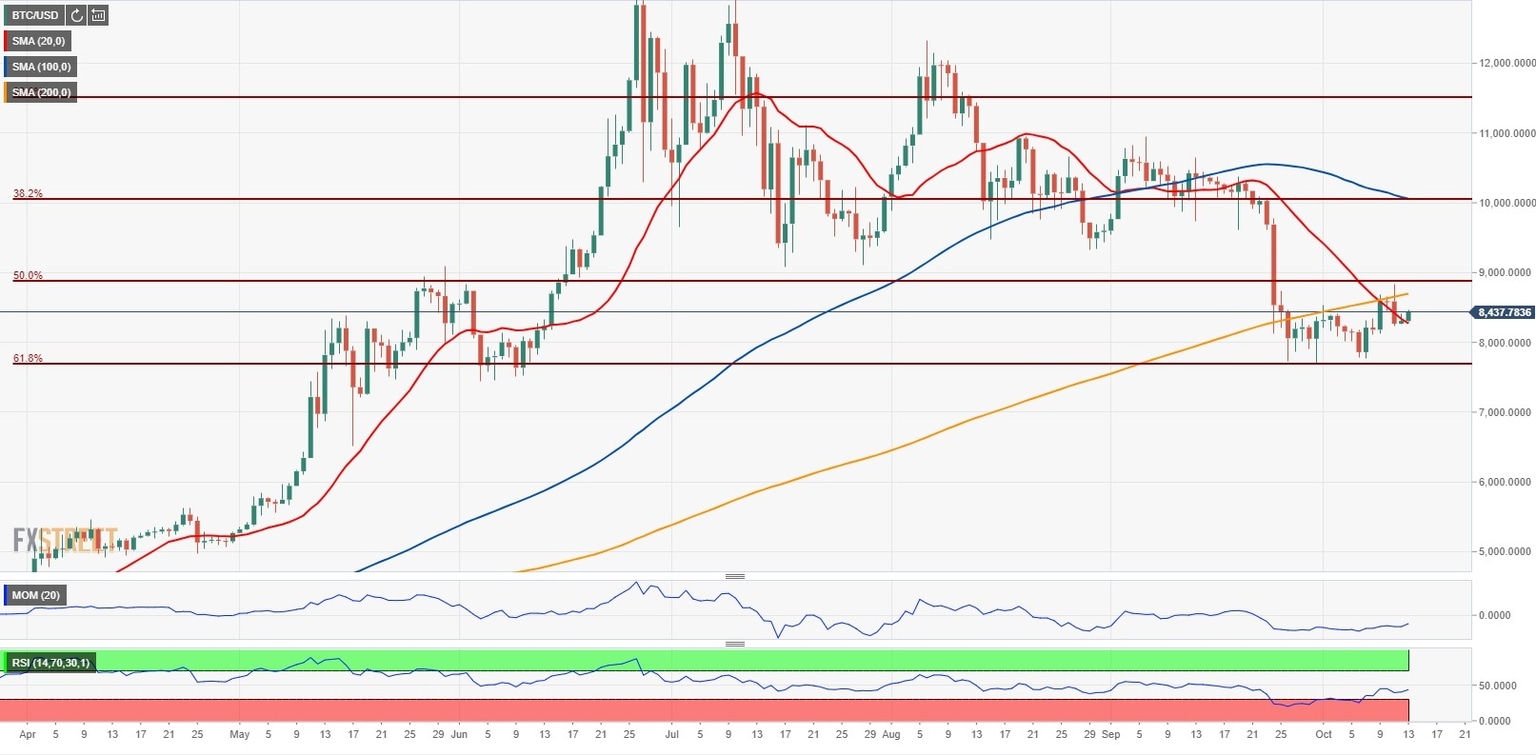

Bitcoin (BTC/USD) closed the last three weeks with losses and erased nearly 25% during that period. After touching its lowest level since early June at $7,715 last week, the BTC/USD pair staged a technical rebound this week and was last seen trading at $8,450, adding 7.4% since Monday.

However, the lack of fundamental drivers behind Bitcoin's recovery suggests that this move was technical and is unlikely to gather momentum unless it makes a daily close above the critical 200-day moving average (MA).

Technical outlook

Looking at the weekly chart, the Relative Strength Index (RSI) for the BTC/USD pair seems to have recovered to the 50 mark, suggesting that sellers have lost control of the pair's price action. On the daily chart, the RSI is edging higher as well and the pair is looking to post its first daily close above the 20-day MA since September 17th, supporting the view that the bearish pressure is weakening.

The pair could face the initial resistance at $8,700 (200-day MA) and target $9,000 (psychological level/Fibonacci 78.6% retracement of June rally) ahead of $10,000 (psychological level/Fibonacci 61.8% retracement of June rally) if it successfully holds above that level.

On the downside, $7,600/$7,700 aligns as an important support area (starting point of June rally/September 26th and 30th low) followed by $7,200 (May 19th low).

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.