Bitcoin could aim for $66,000 if key support level holds

- Bitcoin’s price approaches its support level of around $62,000; reversal is possible if it holds.

- Ohio Senator Niraj Antani proposed a bill to enable tax payments with Bitcoin, while Metaplanet announced the purchase of 107.91 BTC.

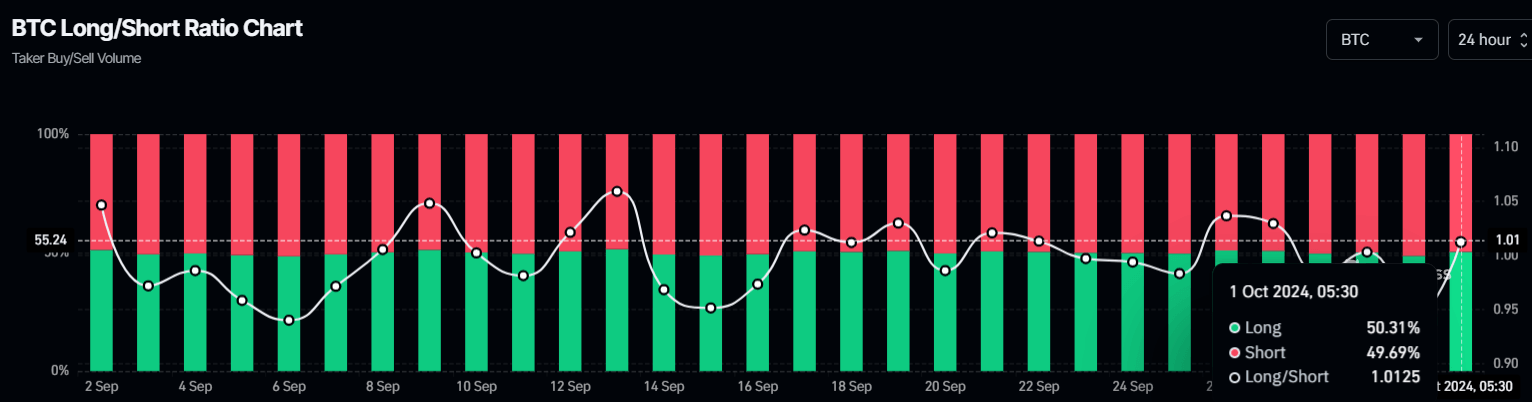

- BTC’s long-to-short ratio is at one, signaling a neutral sentiment among investors.

Bitcoin (BTC) extends correction and trades below $63,000 at the time of writing on Tuesday, approaching a key support level after dipping more than 3% the previous day. There are a few signs of optimism, as Ohio Senator Niraj Antani proposed a bill to enable tax payments with Bitcoin, while Metaplanet added more BTC to its holdings. However, on-chain data signals a neutral sentiment among traders as BTC’s long-to-short ratio marks at one.

Daily digest market movers: Bitcoin on-chain data show neutral investors’ sentiment

- Coinglass’s Bitcoin long-to-short ratio stands at 1.01, signaling a neutral sentiment among investors. When it is above 1, this ratio reflects bullish sentiment, suggesting that more traders anticipate the asset’s price to rise. The opposite occurs if it is below 1.

Bitcoin long-to-short ratio chart

- On Monday, Ohio’s Senator Niraj Antani tweeted that he had introduced a bill that would let people pay their state and local taxes with Bitcoin and other cryptocurrencies. This bill might lead to a rise in the use of cryptocurrencies in Ohio and open new avenues for state financial liabilities. If the bill is approved, Ohio will be among the first states to officially accept cryptocurrency as payment for taxes and fees.

TODAY: I introduced a bill the legalize the use of cryptocurrency to pay state and local taxes and fees. Cryptocurrency is not just the future — it’s the present. I’m proud to be the most pro-cryptocurrency Member of the Ohio Senate. READ: pic.twitter.com/9lpYdkoGWT

— Niraj Antani (@NirajAntani) September 30, 2024

- On Monday, Japanese investment and consulting firm Metaplanet announced that it purchased an additional 107.91 BTC, approximately worth $7 million, following a purchase of 38.46 BTC on September 10. This follows Metaplanet’s decision to adopt Bitcoin as a reserve asset to address risks related to Japan’s significant debt and Japanese Yen (JPY) volatility. The firm’s strategy mirrors that of MicroStrategy, led by Michael Saylor, positioning itself as the largest corporate Bitcoin holder. Metaplanet’s move could pave the way for broader adoption of Bitcoin and cryptocurrencies, among other companies. Currently, it holds 506.75 BTC at an average price of $65,217.10.

*Metaplanet purchases additional 107.91 $BTC* pic.twitter.com/pPrRBGrJsC

— Metaplanet Inc. (@Metaplanet_JP) October 1, 2024

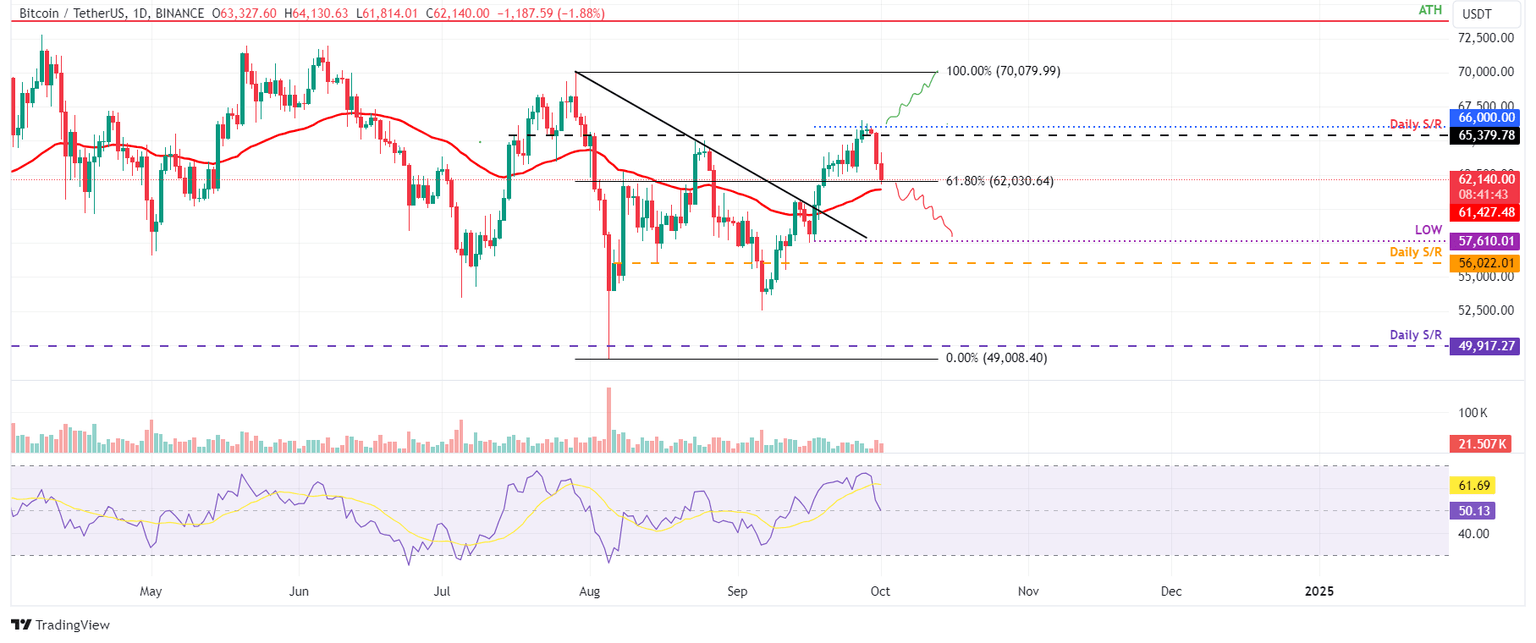

Technical analysis: BTC nears key support level

Bitcoin price faced rejection from its key psychological level of $66,000 on Saturday and declined 3.8% in the next two days. At the time of writing on Tuesday, it continues to decline below $63,000, approaching its key support level of around $62,000.

If the $62,000 level holds as support, Bitcoin could rise to break above its key psychological level.

The Relative Strength Index (RSI) on the daily chart has declined and is currently pointing downward, trading at 50, suggesting a slowdown of bullish momentum. However, If it continues to decline and closes below its neutral level of 50, it would indicate a rise in selling pressure and a further fall in Bitcoin’s price.

BTC/USDT daily chart

If BTC breaks and closes below the $62,000 level, it could extend the decline by 7% to retest its September 17 low of $57,610.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.