Bitcoin continues to decouple from global M2 in early 2026 as analysts remain divided

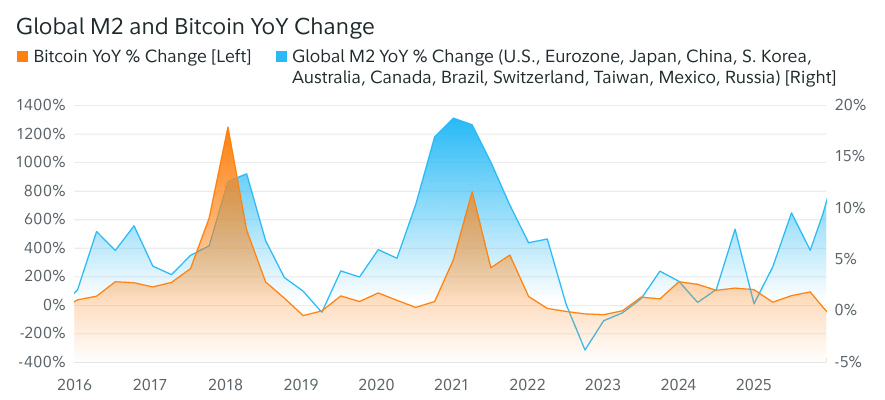

Since mid-2025, Bitcoin has exhibited signs of decoupling from the growth of the global M2 money supply. By 2026, this decoupling has become even more pronounced.

The historical correlation between these two factors once formed the basis for many bullish forecasts. Now, analysts are deeply divided over what this phenomenon means for 2026.

Analysts are divided in their explanations of the relationship between Bitcoin and global M2

The January report from Fidelity Digital Assets continues to express confidence in a positive correlation between the M2 money supply and Bitcoin’s price.

Fidelity emphasizes that Bitcoin bull cycles usually coincide with periods when M2 accelerates. Bitcoin, due to its scarcity, absorbs excess capital much more strongly than other assets.

“As a new monetary easing cycle has begun globally and with the Fed’s QT program ending, it is likely that we will see this growth rate continue to the upside throughout 2026, a positive catalyst for bitcoin’s price.” — Fidelity reported.

Analysts who support this view argue that gold and silver absorbed inflation-hedging demand in recent periods. They also say that renewed money printing across countries has become a major driver for Bitcoin.

Analyst MartyParty takes an even bolder stance. He compares Bitcoin’s price with the global M2 money supply using a 50-day lag. He predicts that this week could be the moment when Bitcoin’s price rebounds to catch up with the growth in the money supply.

“Bitcoin vs Global Liquidity – Lagged 50 days. M2 says we bounce here — Jan 12th.” — MartyParty predicted.

However, Fidelity’s chart shows that Bitcoin YoY growth and Global M2 YoY have lost correlation over the past year. The divergence has become even wider at the start of 2026. Bitcoin shows negative YoY growth, while Global M2 YoY is growing by more than 10%. This situation has triggered skepticism among other analysts.

Observations from Mister Crypto show that periods when Bitcoin’s price decouples from M2 growth often mark a major market top. These phases are typically followed by a bear market that lasts two to four years.

Meanwhile, analyst Charles Edwards takes a completely different stance to explain this phenomenon.

He argues that 2025 marked the time when the risk of a quantum computer breaking Bitcoin’s encryption became a real possibility. Therefore, the decoupling from M2 reflects this risk.

“This is the first time Bitcoin has decoupled from money supply and global liquidity flows. Why? 2025 was the first year Bitcoin entered the Quantum Event Horizon. The timeframe to a non-zero probability of a quantum machine breaking Bitcoin's cryptography is now less than the estimated time it will take to upgrade Bitcoin. Money is repositioning to account for this risk accordingly.” — Charles Edwards said.

In summary, the split among analysts reflects the growing complexity of the Bitcoin market. The bullish camp follows traditional historical models backed by Fed rate cuts and money printing. The bearish camp focuses on unprecedented events related to technological risk.

Bitcoin also enters 2026 facing other risks. These include risks from the yen carry trade and the possibility of a third world war as global economic and geopolitical conditions become increasingly complex.

These risks do not necessarily mean the end of Bitcoin. They may also create opportunities for many investors. These investors continue to believe that, regardless of how the world changes, Bitcoin will remain a long-term store of value, as it has demonstrated throughout its more than 15-year history.

Author

BeInCrypto

BeInCrypto

Since 2018, BeInCrypto has grown into a leading global crypto news platform. Through our award-winning journalism and close ties with industry leaders, we deliver trusted insights into Web3, AI, and digital assets.