Bitcoin Cash Price Prediction: BCH drops after failing at critical resistance – Confluence Detector

- Bitcoin Cash has three healthy support walls on the downside.

- The number of addresses holding 10,000-100,000 tokens has dipped over the last few days.

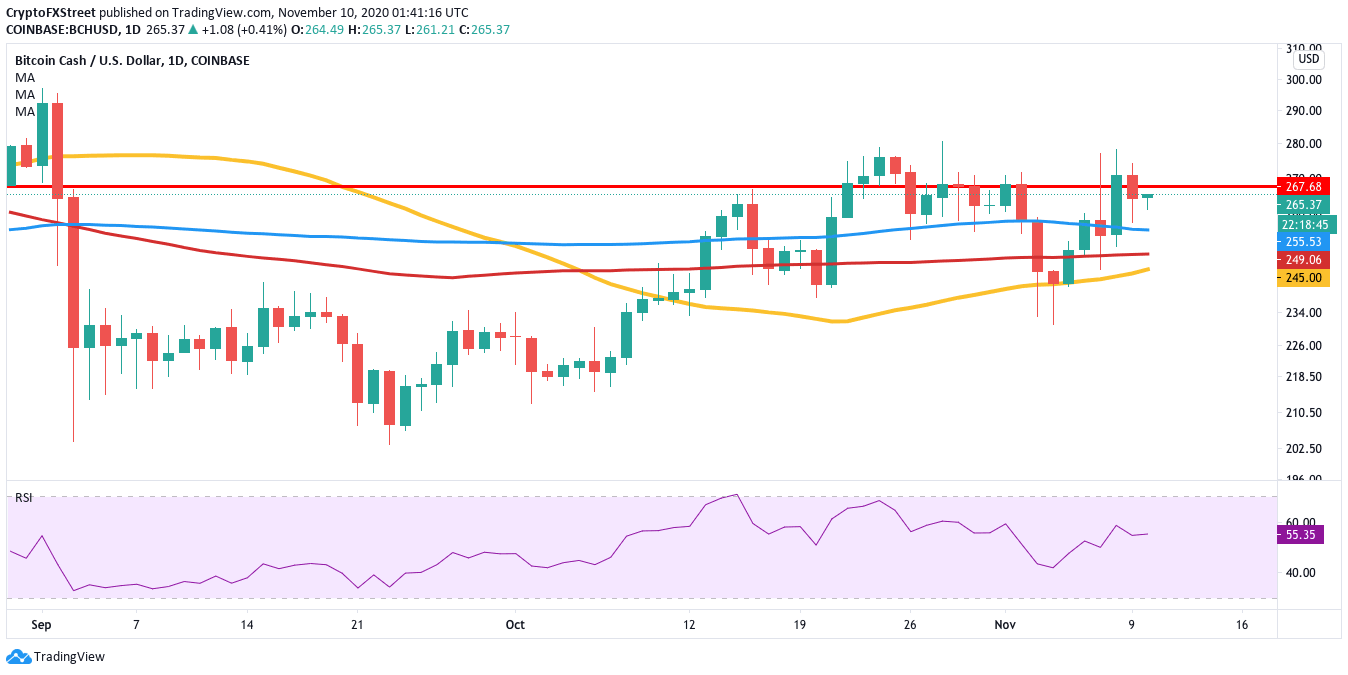

Bitcoin Cash bulls managed to bounce from the 50-day SMA and take the price up from $241.30 on November 4 to $270.35 on November 8. Since then, the price has dipped to $266.60, at the time of writing. Technical analysis shows that the Bitcoin fork is going to drop even more.

Bitcoin Cash faces immediate resistance

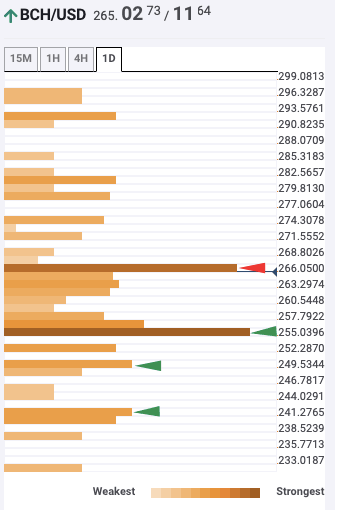

The daily confluence detector is a handy little tool that helps us visualize strong resistance and support levels. According to the tool, BCH faces strong resistance at $267. This barrier looks strong enough to absorb an immense amount of buying pressure.

BCH daily confluence detector

The three healthy support walls in the confluence detector coincide with the 100-day SMA ($255.50), 200-day SMA ($249) and 50-day SMA ($245) in the daily chart. These walls seem strong enough to absorb a tremendous amount of selling pressure. As such, we can effectively cap off the downside at the 50-day SMA.

BCH/USD daily chart

Adding further credence to our bearish credence is Santiment’s holders distribution chart. As per the chart, the number of addresses holding 10,000 - 100,000 tokens dipped from 177 on November 7 to 171 at the time of writing. This shows that the whales have been selling off their holdings, which is a very negative sign for BCH.

BCH holders distribution

While the market's overall outlook looks pretty bearish, the buyers can still flip the script around. If they somehow manage to flip the $267 resistance into support, they will have the license to take the price up to $300. However, this optimistic outlook seems unlikely for now.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20%5B07.03.37%2C%2010%20Nov%2C%202020%5D-637405735191363623.png&w=1536&q=95)