Bitcoin Cash price could be poised for a 20% move according to key pattern

- Bitcoin Cash price has formed a potential inverse head and shoulders pattern.

- Only one key resistance level separates the digital asset from a 20% breakout.

- Bulls have the upper hand in the short-term after establishing a 4-hour uptrend.

Bitcoin Cash price has been trading below a key resistance level but remains bullish in the short-term. Now, BCH aims for more after establishing a key pattern on the 4-hour chart.

Bitcoin Cash price has to crack this key resistance point

On the 4-hour chart, BCH has formed a potential inverse head and shoulders pattern with its neckline at $545. A clear breakout above this key point would drive Bitcoin Cash price by 20% towards a high of $660.

BCH/USD 4-hour chart

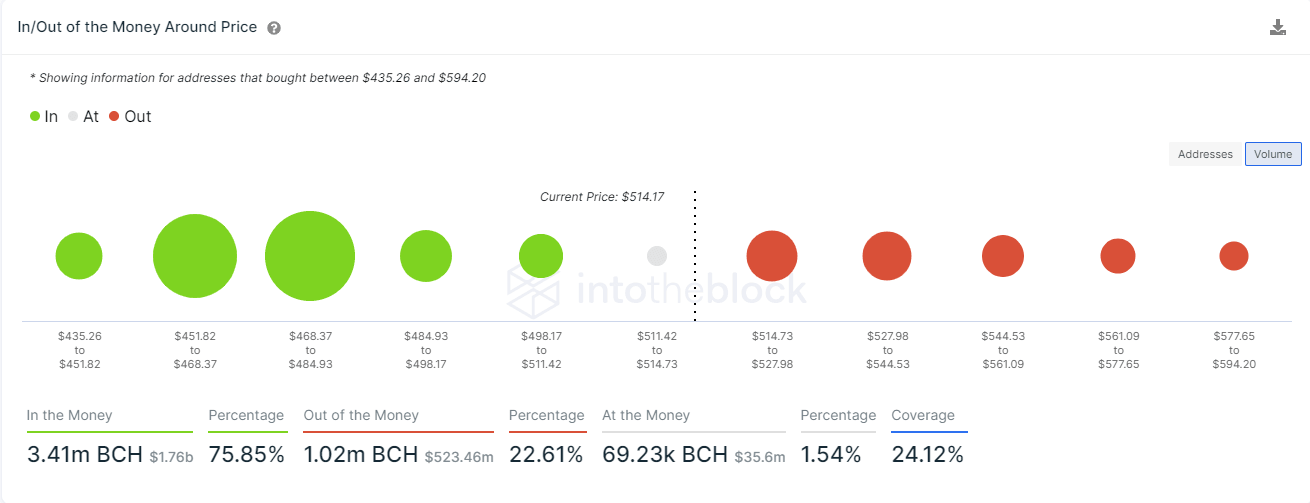

According to the In/Out of the Money Around Price (IOMAP) chart, there is practically no resistance. The most significant barrier is located between $528 and $544, coinciding with the neckline of the pattern above.

BCH IOMAP chart

On the other hand, although BCH does have strong support on the way down, a breakdown below the key area between $468 and $484 would drive the digital asset down towards $435, and would invalidate the inverse head and shoulders pattern.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.