Bitcoin Cash price climbs 16% in a week, forecasting a 38.51% northbound move

- Bitcoin Cash price is recovering above a falling wedge pattern.

- The IOMAP on-chain model points to diminishing resistance along BCH’s recovery path.

- A daily candlestick close above the 100-day EMA will validate Bitcoin Cash uptrend; otherwise, expect a trend reversal.

Bitcoin Cash price is at the helm of a breakout, bolstered by a generally bullish cryptocurrency market. The largest cryptocurrency, Bitcoin (BTC), topped $21,200 after a 4.80% move on Friday. The crypto market is dotted mainly in green, with Ethereum trading at $1,664. BCH is looking forward to spreading its bullish leg to $158, but first, buyers must overcome resistance at $125.

Bitcoin Cash price explodes out of a falling wedge

Following immense declines that culminated with Bitcoin Cash price holding support at $95.00 in June, a recovery ensued, lifting the price in late July. The lack of buying pressure caused by unfavorable global economic conditions led to a widespread retracement across the crypto market – and BCH was not spared.

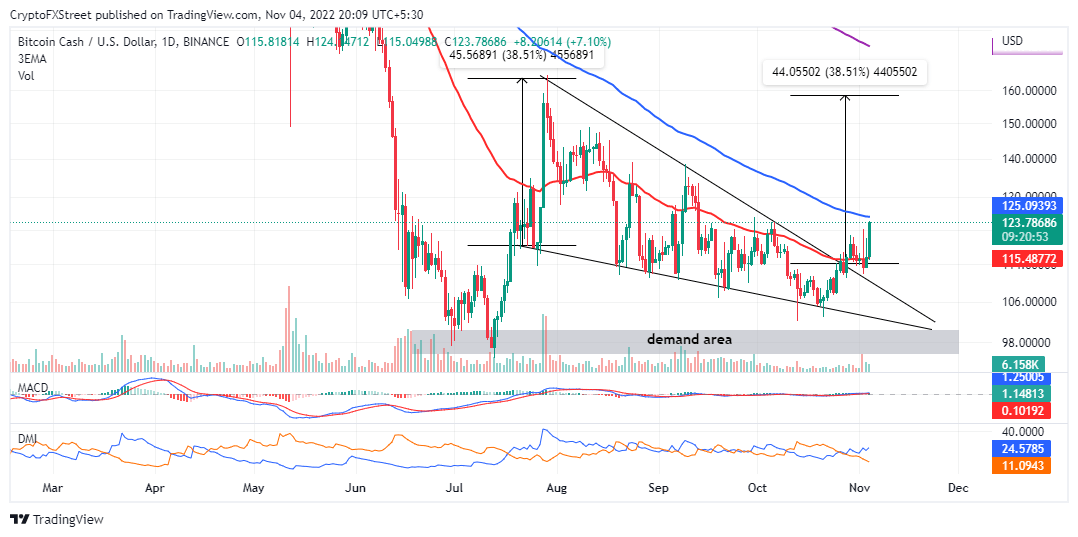

A prolonged downtrend, as observed in the daily chart below, suppressed the frequent reversal attempts made by bulls. The formation of a falling wedge pattern may finally mark the end of Bitcoin Cash’s woes.

BCHUSD daily chart

A falling wedge pattern occurs when an asset’s price falls between dropping support and resistance trend lines. The pattern is highly bullish and often signals the end of a prolonged downtrend or continuation of an uptrend.

However, there needs to be more than the appearance of this pattern to confirm a bullish breakout. Hence, traders must delay triggering long positions until the price breaks above the upper trend line, as seen with Bitcoin Cash.

A 38.51% move to $164 has been foreshadowed as BCH climbs the ladder above the wedge pattern. This profit target equals the distance between the pattern’s widest points and is extrapolated above the breakout point at $114.

The Moving Average Convergence Divergence (MACD) and the Directional Movement Index (DMI) indicators reinforce the bullish outlook in Bitcoin Cash price after recently flaunting key positive signals.

Bitcoin Cash price sits on top of robust support, as highlighted by IntoTheBlock’s IOMAP model. From the chart below, approximately 441,000 addresses purchased roughly 139,400 BCH between $114 and $117.

Bitcoin Cash IOMAP chart

As long as investors in that range steadily support Bitcoin Cash’s potential move to $164, a short-term trend reversal will not be detrimental. Furthermore, the same model reveals weakening resistance – a situation that might bolster its uptrend further.

Nevertheless, caution must be exercised to avoid sudden pullbacks. A daily candlestick close above the 100-day Exponential Moving Average (EMA) will go a long to cement the bulls’ influence on the price.

Conversely, BCH will bow to overhead pressure if the price fails to close the day above the moving average. Short-term selling orders could prove profitable, with the 50-day EMA (in red) as a potential profit target.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-638031743215403564.png&w=1536&q=95)