Will Ethereum price slide to $1,350 over the weekend?

- Ethereum price currently hovers around $1,536, which is the the midpoint of the $1,479 to $1,593 range.

- A minor run-up to $1,593 could be possible but the altcoin remains bearish and eyes a revisit of $1,350.

- A daily candlestick close above $1,633 level will invalidate the bullish thesis for ETH.

Ethereum price has consistently performed better than Bitcoin in the recent past, but this outlook could be coming to an end. Investors can expect ETH to trigger a correction to stable levels. Market participants should note that this is a short-term bearish move and will provide patient buyers a chance to accumulate the altcoin for the long term.

Ethereum price shows weakness

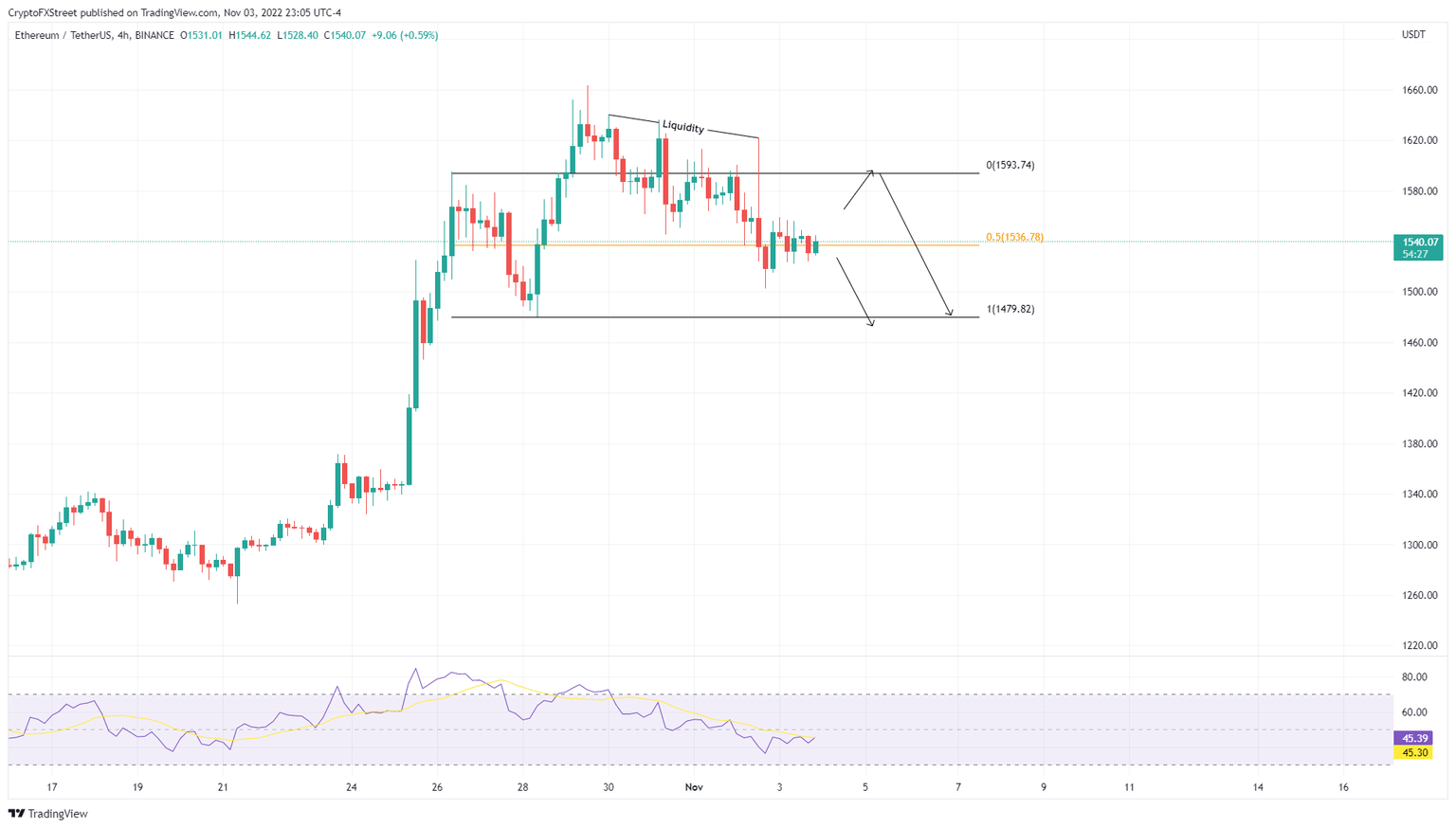

Ethereum price rallied 32% between October 21 to 29 and set up a local top at $1,663. This swift ascent has already produced a string of lower lows after October 29, but ETH is yet to produce a significant market structure shift by sliding below the October 28 swing low at $1,479.

The consolidation of Ethereum price from October 28 has resulted in a range, extending from $1,479 to $1,593. after a range high deviation, ETH is currently hovering around the midpoint at $1,536. Interestingly, the momentum indicator Relative Strength Index (RSI) has slid below 50, which indicates that the sellers are in control of the narrative.

Investors can expect Ethereum price to sweep the range low at $1,479, which is the low-hanging fruit traders can take advantage of. However, a continued sustenance below this level could trigger a rebalancing of the inefficiency between $1,446 and $1,349.

Traders can be conservative and book profits at $1,389 and/or $1,364 support levels. This downward move in Ethereum price would roughly constitute a 10% gain for the bears.

ETHUSDT 4-hour chart

While things are looking dicey for Ethereum price, a persistence above the range’s midpoint at $1,536 followed by a flip of the $1,633 hurdle into a support level will invalidate the bearish thesis.

This retaliative move could indicate that the buyers in control and would likely propel Ethereum price to $1,708.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.