Bitcoin Cash prepares for the third fork; bears get ready to push the price to $100

- Bitcoin Cash may experience an intense selling pressure ahead of the fork.

- A sustainable move $200 will open up the way to $100.

Fork happens

As the FXStreet previously reported, the disagreements between the Bitcoin ABC development team and the core BCH community led to the breakup. Bitcoin ABC developers decided to part ways with the project and create their coin based on the BCH blockchain. At the same time, the creator and the visionary of Bitcoin Cash, Roger Ver, compared the ideas suggested by the Bitcoin ABC development team with a totalitarian policy.

The hard fork will take place on November 15, resulting in creating a new digital asset, BCHN. After the split, all BCH holders will be eligible for the airdrop. It means that they will receive an equal amount of new coins in addition to BCH coins they already have in their wallets.

Read more details about the upcoming hard fork here.

Free coins or useless trash

When Roger Ver confirmed the fork, BCH attempted a rally, but failed to develop an upside impulse and crashed to the lowest levels since the end of March 2020. It might seem strange as traders tend to hoard coins before the airdrop as the number of new coins they receive depends on how many basic coins they have.

The lack of interest towards BCH ahead of the form might signal that traders and investors are skeptical about the fork and the resulting new asset. At this stage, it is not clear whether the cryptocurrency exchanges will support the airdrop and whether the new coins will have any value.

A famous billionaire Tim Draper, confessed that he had praised BCH in a now-deleted Tweet, but after some research, he realized that it has some security flaws. However, even Draper's endorsement failed to prevent BCH from hitting new lows.

What will happen to BCH after the split

If history is any guide, forks are painful for BCH. In 2018, when the chain split in two and gave birth to Bitcoin SV, BCH dropped from over $600 to $74 and managed to regain less than 50% from the fall. Considering the community's adverse reaction, this fork will lead to another substantial price decrease, and even promised airdrop will not change the attitude to the project.

As it stands now, the Ver's project has more supporters; however, the implications of the fork are hard to predict in the long run. Meanwhile, the technical picture implies that BCH/USD may continue moving sideways and may be vulnerable to further losses as the fork time moves closer.

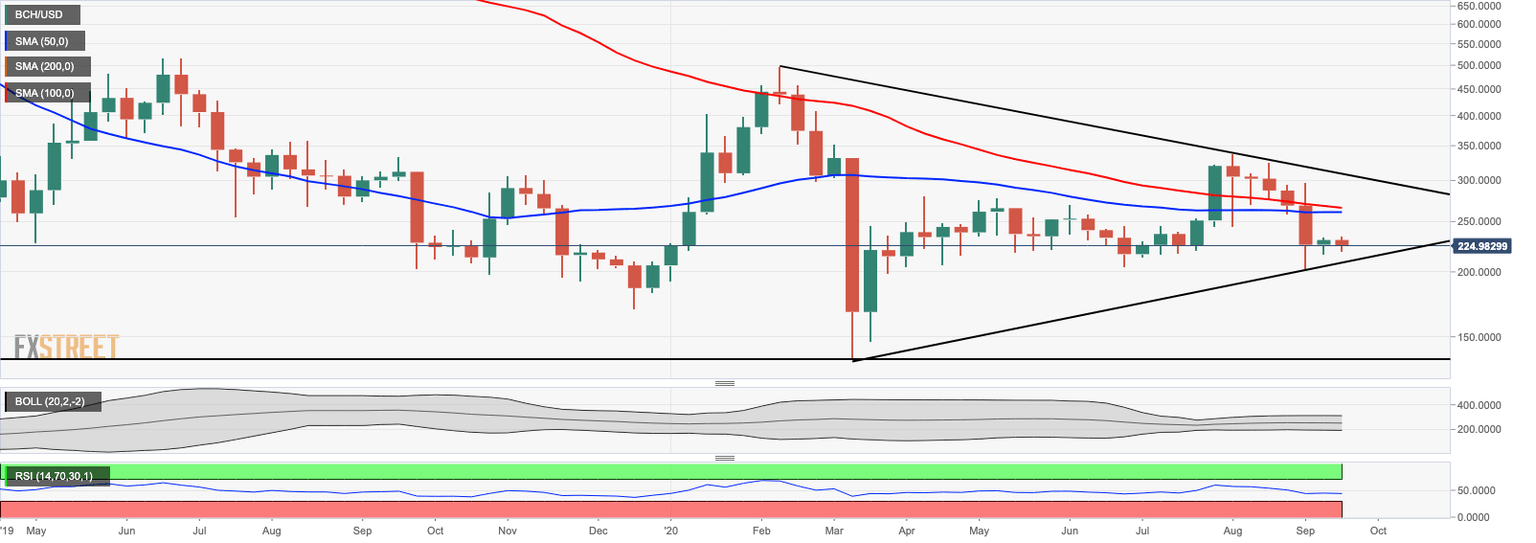

BCH/USD weekly chart

A symmetric triangle on a weekly chart implies that BCH/USD may continue moving within the current channel with the bearish bias. A sustainable move below its lower boundary will increase the downside pressure and bring the recent low of $135 back into focus. That's where a buying interest may trigger the upside correction. Otherwise, the sell-off will start snowballing with the next target at $100.

BCH/USD daily chart

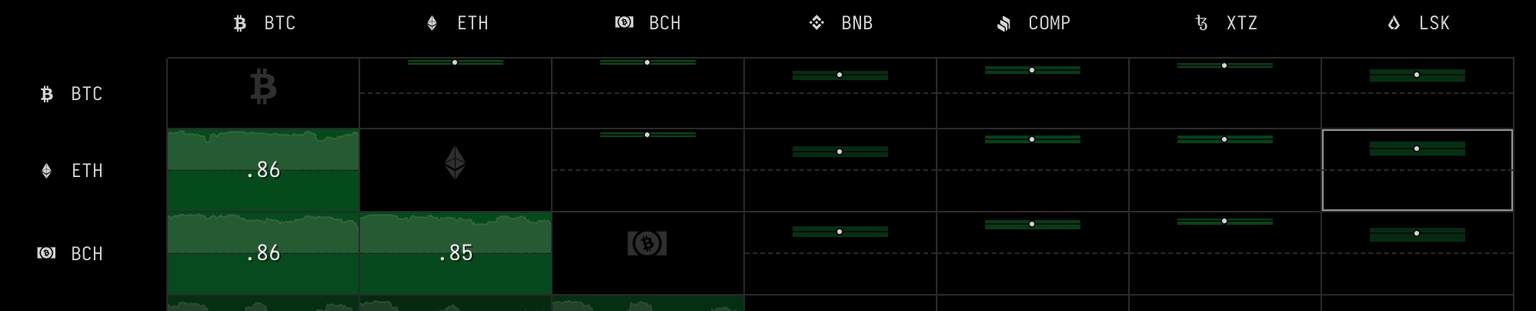

On a daily chart, BCH/USD is sitting in a tight channel, demonstrating the high level of uncertainty on the market. The price has been oscillating between $235 and $215 lines since September 4 with no clear signals of the breakthrough. Notably, the technical picture of BCH/USD is similar to Bitcoin's daily chart at this stage, which is confirmed by the relatively high direct correlation of the assets.

The correlation between BCH and BTC

Source: Cryptowat.ch

To conclude: Bitcoin Cash will have its second hard from that will give birth to another coin. All BCH holders will receive an equal amount of new assets; however, the proposed airdrops do not stimulate BCH buying at this time. Moreover, the coin is vulnerable to sharp losses, as the community is not happy about constant disagreements within the team.

From the technical point of view, BCH/USD is locked in a tight range, moving in lockstep with BTC. On the longer-term time frame, a symmetrical triangle signals that the price may continue moving to the North if the $215-$200 area is broken. Otherwise, BCH/USD may retest the upper line of the recent consolidation channel of $235.

Author

Tanya Abrosimova

Independent Analyst

-637356868091622124.png&w=1536&q=95)