Bitcoin bulls risk trading range loss as BTC price nears 2-month lows

Bitcoin (BTC $28,503) targeted two-month lows on Aug. 17 as United States inflation returned to spook cryptocurrency markets.

BTC/USD 1-hour chart. Source: TradingView

BTC price teases exit from months-long corridor

Data from Cointelegraph Markets Pro and TradingView confirmed the lowest BTC price levels since June 21 as BTC/USD wicked to $28,300.

The downside came after the U.S. Federal Reserve published the minutes of its July meeting to discuss future monetary policy.

Members of the Federal Open Market Committee (FOMC) revealed concerns that inflation might remain elevated without further interest rate hikes — something risk assets did not wish to see going forward.

“Participants discussed several risk-management considerations that could bear on future policy decisions,” the minutes read.

With inflation still well above the Committee's longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.

While the Fed equally voiced “uncertainty” over the effects of existing monetary tightening, Bitcoin and altcoin traders reacted bearishly to its language, sending BTC/USD through multiple recent support levels.

These included the 21-week and 100-day simple moving averages (SMAs) at $28,600 and $28,570, respectively.

BTC/USD 1-day chart with 21-week, 100-day SMA. Source: TradingView

Bitcoin also challenged the lower boundary of the multimonth trading range, previously highlighted by popular traders Daan Crypto Trades and Crypto Tony.

BTC/USD annotated chart. Source: Daan Crypto Trades/X

“$28,800 has now been lost on Bitcoin so i will be looking to short this down now while we remain below $28,800,” the latter told X subscribers on the day, adding that $28,000 was his first target.

BTC/USD annotated chart. Source: Crypto Tony/X

Markets retain rate hike pause bets

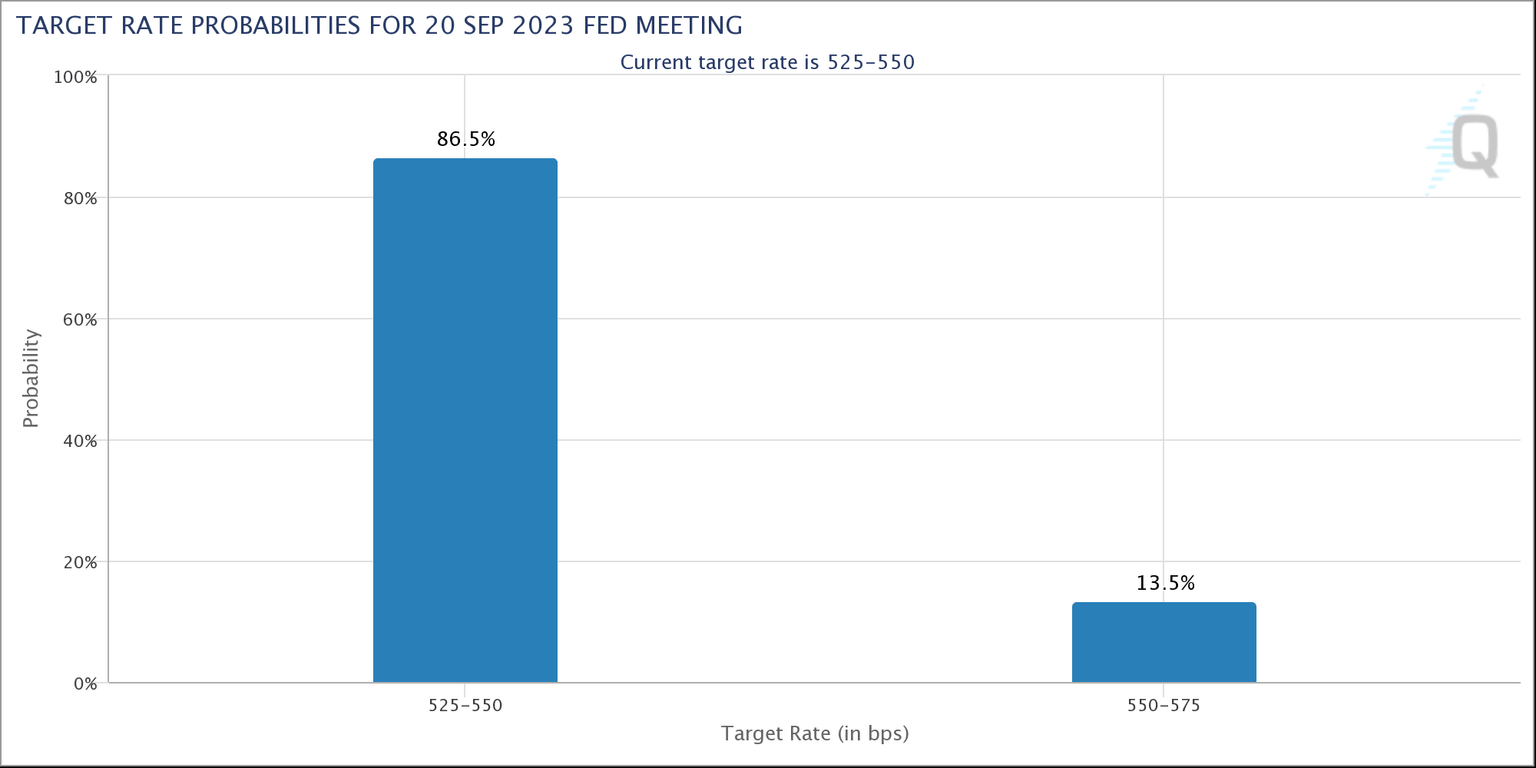

Meanwhile, not everyone appeared convinced that the next FOMC meeting in September would yield higher rates.

According to CME Group’s FedWatch Tool, the odds of the Fed keeping the current rate intact remained at nearly 90% after the release.

Fed target rate probabilities chart. Source: CME Group

Analysts themselves were also far from unanimous. In a forecast last week, Caleb Franzen, senior analyst at Cubic Analytics, said that it was disinflation rather than inflation, which was exhibiting “sticky” behavior.

“Disinflation + stronger earnings + stronger economic data + nearing the end of the rate hike cycle has been a perfect recipe for market returns and the development of an uptrend,” he argued.

While these conditions could change in the future, I don’t see any evidence that it’s changed yet.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.