Bitcoin bull run next? Bitfinex stablecoin ratio ‘blows up’ in 2023

Bitcoin (BTC $29,493) is facing the prospect of a “big bull move” as stablecoin buying power returns, on-chain data hints.

Analysis courtesy of on-chain analytics platform CryptoQuant now shows stablecoin supply metrics repeating historical bull market patterns.

“Major leading indicator” flips bullish for BTC price

Bitcoin is in peak accumulation mode, according to CryptoQuant’s stablecoins ratio metric, and the results have always been positive for BTC price action.

As noted by market cyclist and on-chain analyst Cole Garner, when denominated in United States dollars, the stablecoins ratio for exchange Bitfinex recently hit its highest since late 2022.

This came at a time when markets had sold off significantly after the FTX meltdown, paving the way for a resurgence that took the BTC price 70% higher in Q1 alone.

“Bitfinex Bitcoin to stables ratio blows up in advance of every big bull move. A major leading indicator,” he commented in a tweet on July 27.

Bitfinex stablecoin ratio annotated chart. Source: Cole Garner/Twitter

Similar bullish inferences come from the stablecoin supply ratio (SSR) — the Bitcoin market cap divided by the market cap of all stablecoins.

SSR has remained low through the 2023 BTC price recovery, indicating that “big players” could be waiting on the sidelines for an entry. This, in turn, offers a key argument for future price rises, per CryptoQuant contributor SimonaD.

“Since the end of March, we can see in the chart that the trading volume has registered a decrease and SSR a stagnation, while we have an increase in the circulating supply of the stablecoin Tether (the largest stablecoin in terms of volume), followed by an increase of Bitcoin’s price,” she wrote in one of the platform’s Quicktake market updates on July 26.

A possible interpretation would be that big investors have stocked up on stablecoins and are waiting for better prices. The recently increase in the price of Bitcoin may actually be the result of a rotation of the money already existing in the market.

Bitcoin stablecoin supply ratio (SSR) trends annotated chart (screenshot). Source: CryptoQuant

“Noteworthy shifts” among Bitcoin whales

As Cointelegraph reported, “big players” have exhibited signs of reorganization at current levels.

Related: Bitcoin Bollinger Bands echo move that ended in 40% January gains

In focus are Bitcoin whales, which recently accounted for over 40% of exchange BTC inflows — the largest in over a year.

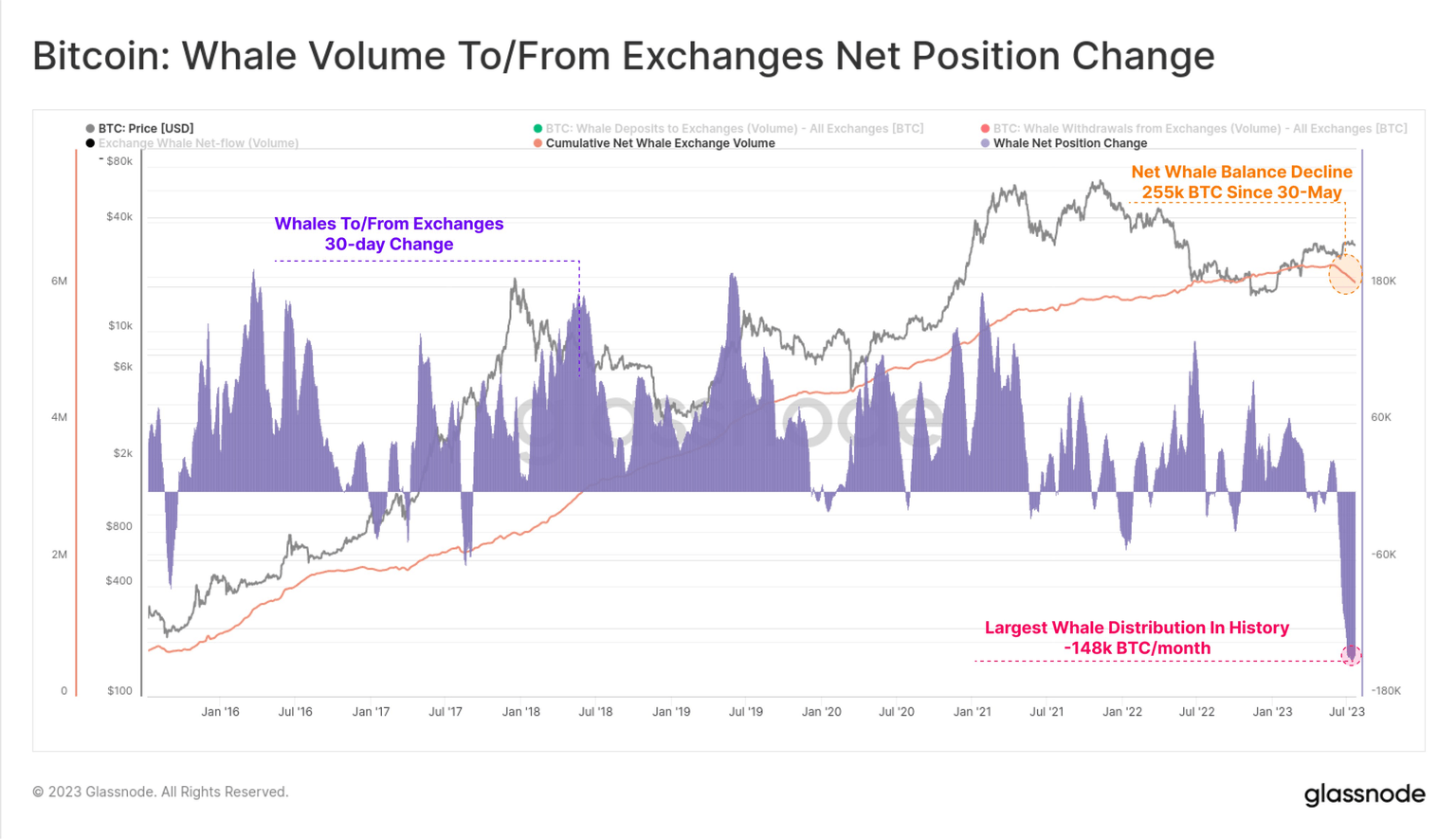

“Isolating for coins flowing between Whale entities and exchanges, the chart below shows that the aggregate Whale balance has declined by -255k BTC since 30 May,“ on-chain analytics firm Glassnode, which originally covered the trend, noted in a follow-up analysis.

This is the largest monthly balance decline in history, hitting -148k BTC/month. This indicates that there are noteworthy shifts happening within the Bitcoin Whale cohort worth diving deeper into.

Bitcoin whale volume to/from exchanges net position change chart. Source: Glassnode/Twitter

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.