Bitcoin breaks back above $39K in largest single daily gain in 6 weeks

Sunday's price rise follows an unconfirmed report Amazon is looking to accept bitcoin payments by year's end.

Bitcoin briefly traded above $39,000 for the first time since June 16 and is currently trading its sixth consecutive day in the green.

Prices have continued to rally since July 21 with Sunday’s current price rise representing the largest single daily gain in over six weeks. The world’s oldest crypto is changing hands for around $38,250, having cooled slightly after hitting a monthly high of around $39,850.

“This price action is aligning with what we’ve been seeing the past couple of weeks,” said Daniel Kim, head of capital markets at Maple Finance. “Borrowing rates for USD have started to increase from its lows.”

“We’ve also been seeing a significant increase in demand for USDC (-0.14%) from institutional borrowers and the sentiment seems to be bullish following the news of Amazon participating in bitcoin (BTC, +13.03%),” Kim added.

An unconfirmed single-source story in City A.M. has reported retail giant Amazon is looking to accept bitcoin payments by year’s end and is looking at minting its own token by 2022. The retail giant is also looking for a Digital Currency and Blockchain Product Lead, CoinDesk previously reported.

CoinDesk attempted to contact Amazon but did not receive a reply by press time.

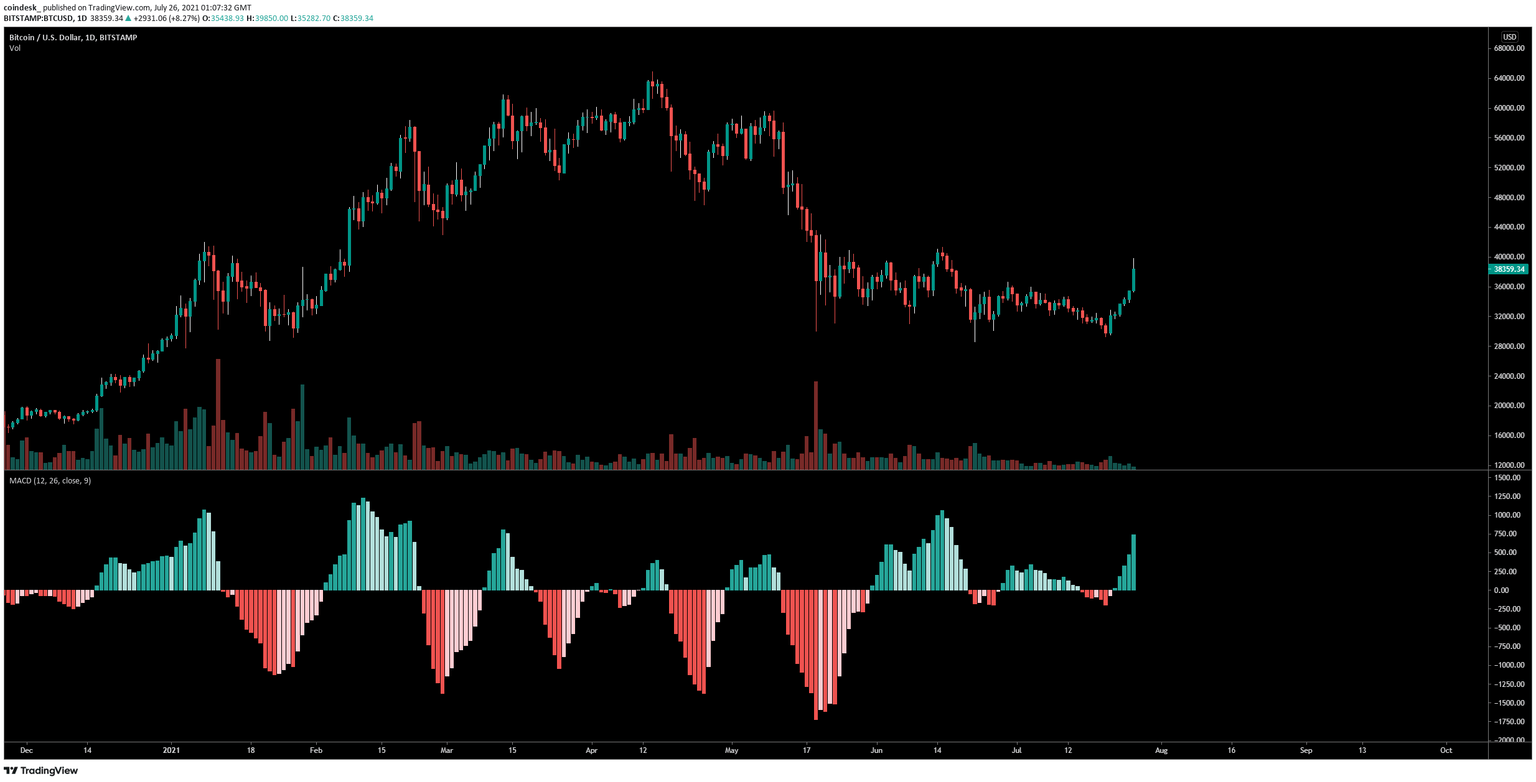

Bitcoin daily price chart

Source: TradingView

Daily volume on the Bitstamp exchange is still relatively lower than the average from previous days this year but is beginning to show some signs of revival from the breakdown witnessed in May.

Other notable cryptos in the top 10 by market capitalization are also posting gains over a 24-hour period with chainlink (LINK, +13.29%), polkadot (DOT, +11.94%) and bitcoin cash (BCH, +10.32%) up the most between 8%-12%.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.