Binance to spend $1 billion on acquisitions in 2022 as BNB price bleeds

- Binance Coin price slides further below $300 after a $570 million hack attack.

- Changpeng Zhao, the Binance exchange CEO, says that the firm may spend $1 billion on new acquisitions and investments.

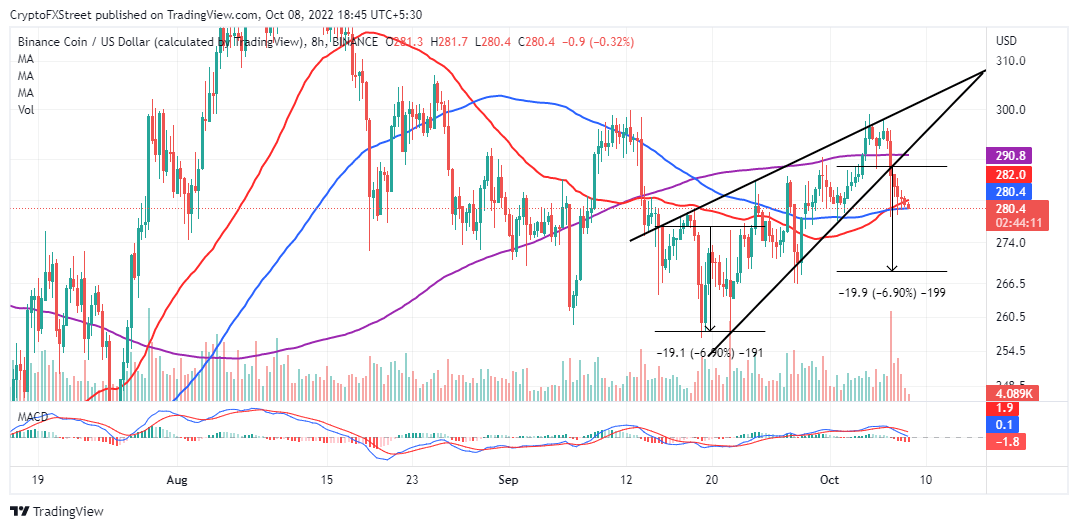

- BNB price breaks out of a rising wedge pattern; risks plunging to $268.

Binance Coin price is gradually erasing the progress it had made since September 19, when it respected an anchor at $258. The native exchange token almost brushed shoulders with $300 but topped at $299.

Its retracement to $280 comes in the wake of a whopping $570 million hack on the BSC (Binance Smart Chain). The attack raised questions about the security of DeFi (decentralized finance) platforms.

Changpeng Zhao (CZ), the CEO of Binance, in response to the saddening event, said that “software code is never bug-free.” He assured the crypto community that users did not lose money but emphasized cross-chain bridges to learn from such incidences.

Binance to sink at least $1 billion in new acquisitions

Binance Holdings Ltd may spend up to $1 billion on acquisitions and investments in 2022 despite the dominant crypto winter across the board. So far, the largest crypto exchange in the world has committed $325 million to 67 projects since the beginning of the year.

The company also has a $200 million investment in Forbes media in addition to $500 million toward Elon Musk’s bid on Twitter Inc. Binance is focusing on acquiring businesses that are doing well despite the prolonged market downturn. Until now, the firm is yet to express interest in any of the distressed entities in the crypto lending space.

BNP price pullback is not slowing down

Investors reacted to the hacking news by selling off BNB, culminating in a sharp drop from $299 to $280. The forces in the market saw Binance Coin price validate a rising wedge pattern breakout.

The pattern is highly bearish and often marks the beginning of a trend reversal. With trading volume dwindling, the support provided by the 50-day SMA (Simple Moving Average), red, may hold to prevent declines from stretching to $268.

BNB/USD eight-hour chart

Further losses are likely according to the MACD (Moving Average Convergence Divergence) indicator. The index is yet to come out of a sell signal it presented as BNB price slipped from highs around $299. Binance Coin price will carry with the downtrend to $268 unless its technical outlook improves in the short term.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren