Binance Coin price set to give up hope for a bullish breakout in 2022

- Binance Coin price slips below the low of September and prints a new monthly low for now.

- BNB price still has just too many bearish elements capping price action.

- With the ongoing tightening monetary conditions, hopes for a turnaround in 2022 are starting to diminish by the day.

Binance Coin (BNB) price is preparing for an eventful week. Currently, the ASIA PAC and European sessions are starting accompanied by slow and slim volume, with Japan closed due to heavy typhoons and the UK closed for the funeral of Queen Elisabeth. This gives traders a chance to start preparing for the trading week as at least five major central banks are set to hike their policy rate and make statements on how they see their rate policy evolving in the coming months. Expect to see more hawkish tones and hikes, squeezing the liquidity further out of cryptocurrencies, with BNB price collapsing once again as a byproduct on the back of this.

BNB price suffocates under tighter monetary conditions

Binance Coin price is already declining in what will prove to be a very heavy week for central banking and monetary policy. Traders will have their work cut out for them going through all the statements and trying to filter out what will be their next step. At the moment it is clear, the current tightening of monetary conditions by several central banks looks to be squeezing the life out of cryptocurrencies, with price action already on the back foot today with over 2% losses for BNB price.

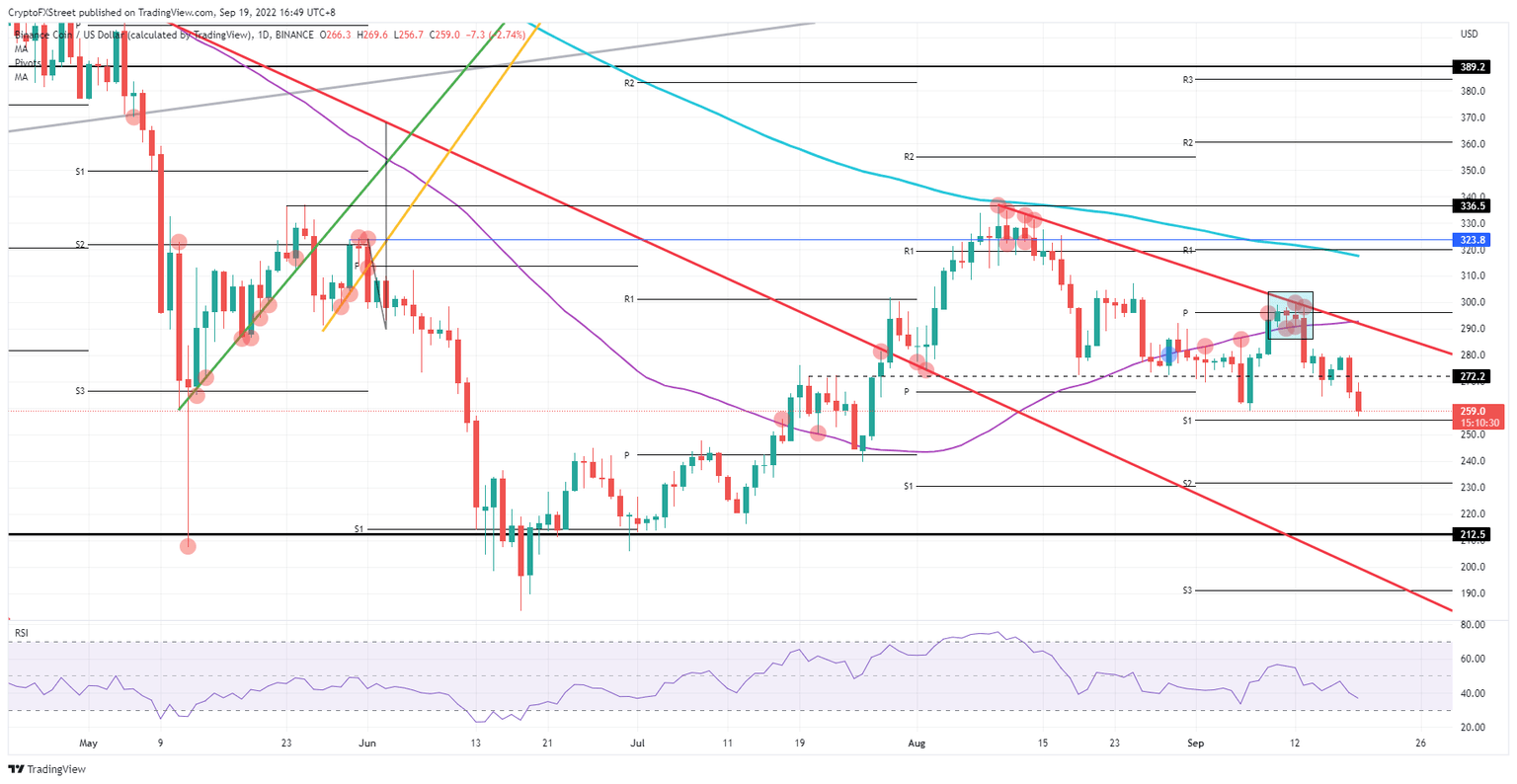

BNB currently finds support from the monthly S1 support pivot at $255.60, after it broke below the low of this month at $259.00. The risk now is that the Relative Strength Index (RSI) still has some more room to go before trading near the oversold barrier, which points to more downside this week. BNB price could drop as much as 11% towards the monthly S2, near $230, before it finds some bulls willing to start buying into the price action.

BNB/USD Daily chart

A simple bounce off the monthly S1 support level could be enough to swing price action back to the upside. Although the upside is limited, there are some gains to be had should BNB price pop back to $290. There it will face the red descending trend line and the 55-day Simple Moving Average as a double cap, muting price action from going any higher.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.