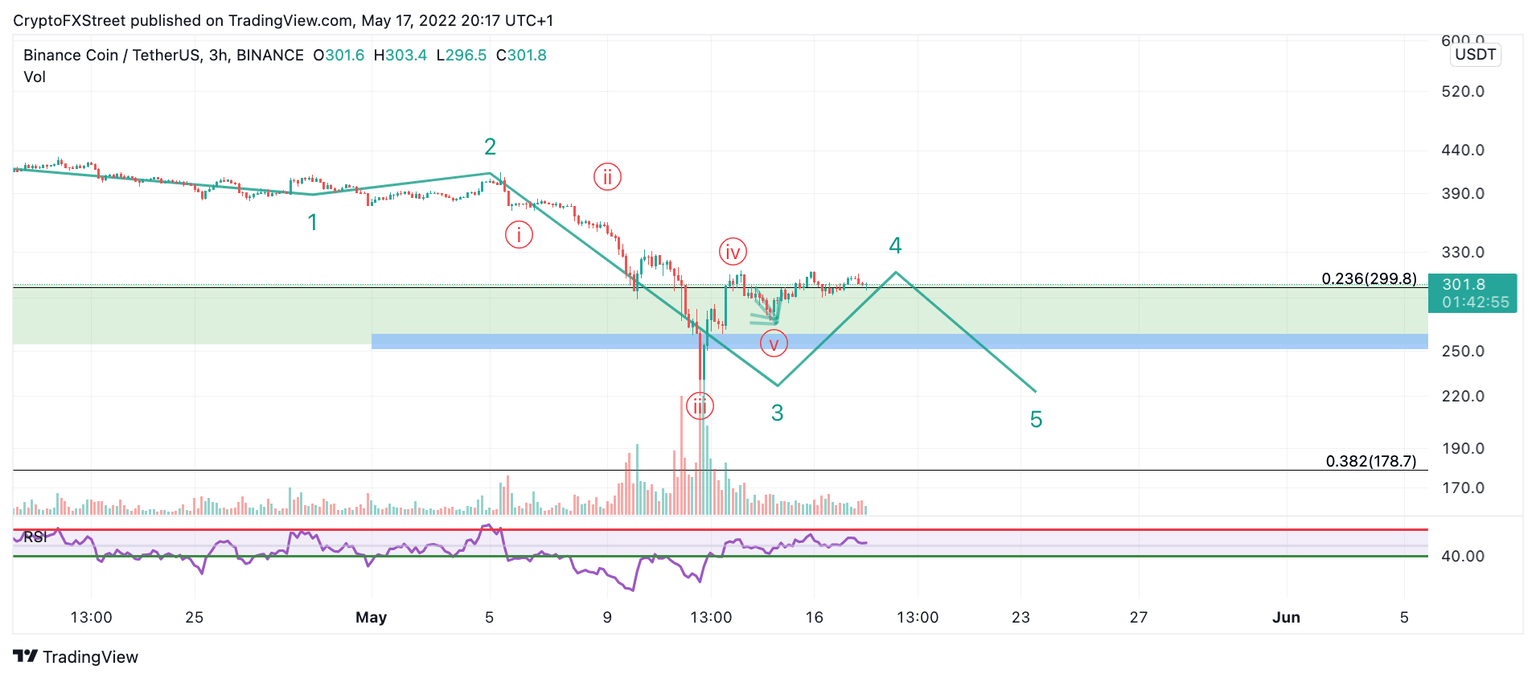

Binance Coin Price Prediction: Alternative count suggests a retest of $250

- BNB price is losing bearish momentum.

- Binance coin price has extended impulse waves.

- Invalidation of the bearish thesis is a breach above $360.

Binance coin price warrants the idea of a profitable countertrend opportunity in the coming days. Still, one more dip may be needed to fulfill the overall structure.

Binance coin price could retest monthly lows

Binance coin price is displaying a vicious bear rally that may be enticing retail traders to jump in. The decline appears to be unfolding as an extended impulse wave that could plunge towards $70 in the long term. However, the bears may be getting too overzealous in the short term. The impulsive waves are preventing 50% retracements within the trend. The current consolidation is also distinctly different in terms of time. The BNB price action could be showing early evidence of downtrend exhaustion.

Binance coin price could see another leg down before making a vicious countertrend rally to trap newly established shorts. The Relative Strength Index also provided confluence for one more low as the price is currently coiling within the 50 level as price trades range-bound. The targets for the bears are $250 and possibly $230 if market conditions persist.

BNB/USDT 3-Hour Chart

Invalidation of the bearish thesis is a breach and close above $360. The Elliott wave count could be deemed invalid if the bulls can produce said price action. The bulls could rally as high as $470, resulting in a 60% increase from the current BNB price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.