Binance Coin Price Forecast: BNB makes new all-time highs, bulls target $60 before ultimate upswing to $100

- Binance coin price has hit a new all-time high at $46.88.

- The digital asset seems poised for further gains in the near future, even up to $100.

BNB price was able to hit a new all-time high at $46.88 on January 18 after a long grind that started in March 2020. The digital asset has been trading inside a healthy and robust uptrend and could rise even higher.

Binance Coin price aims for $100 as on-chain metrics continue to strengthen

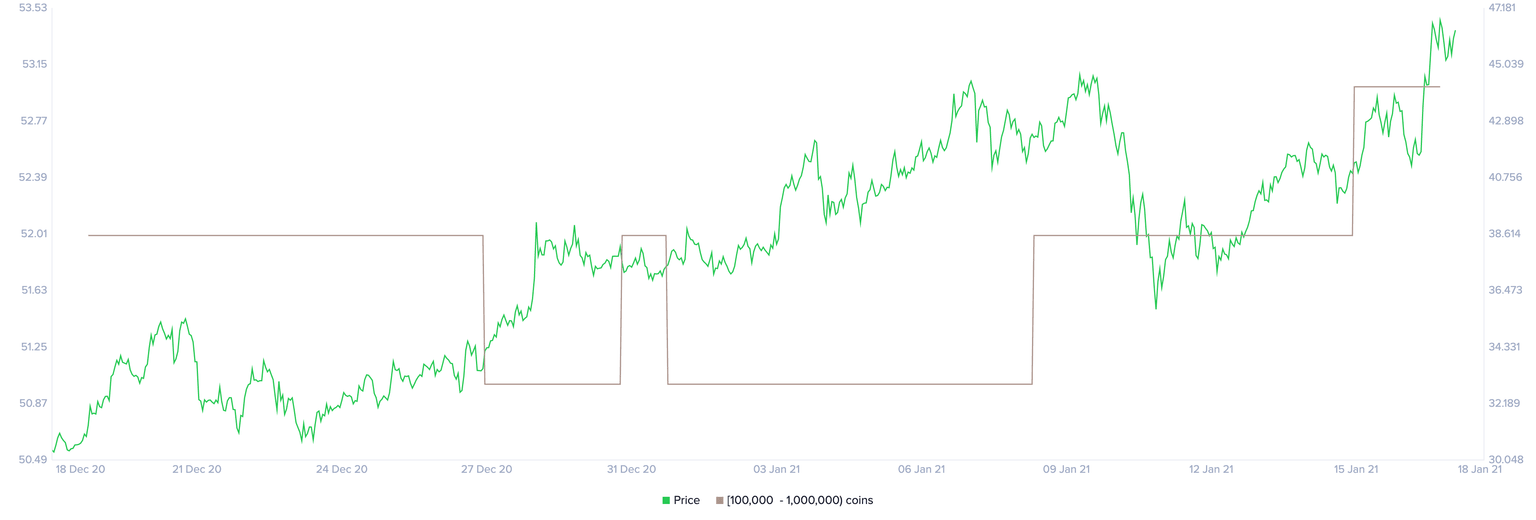

The most interesting metric in favor of BNB is the number of whales that have entered the network in the past week. Despite Binance Coin hitting new all-time highs, the amount of whales holding between 100,000 and 1,000,000 BNB ($4,600,000 and $46,000,000) has increased by two.

BNB Holders Distribution chart

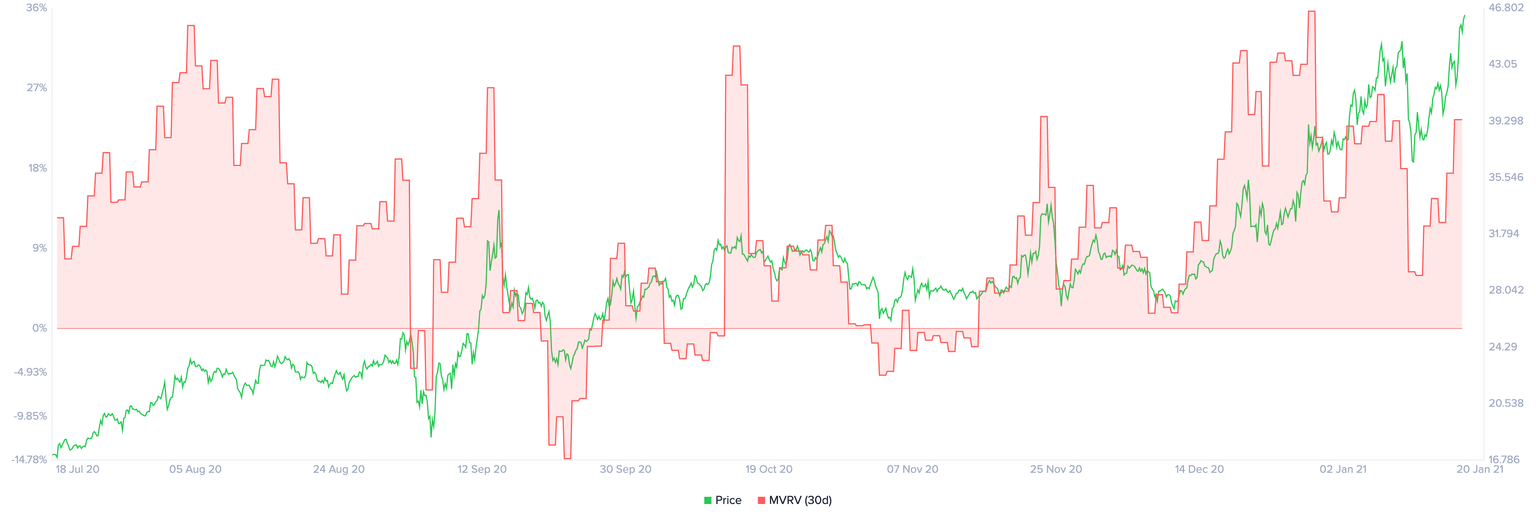

Additionally, the MVRV (30d) chart indicates that Binance Coin price is still far away from the danger zone, which shows when the digital asset is at risk of a pullback. It seems that BNB still has more room for growth.

BNB MVRV (30d) chart

The On-Balance Volume (OBV) indicator sits right at the top of a significant resistance level at 574.5 million. If the bulls can push BNB above this point, it will signal another leg up for Binance Coin in the short-term.

BNB OBV chart

There's a possibility this leg up takes Binance Coin price to the 161.8% Fibonacci level on the weekly chart, located at $60. BNB is currently in price discovery mode and can quickly rise higher.

BNB/USD weekly chart

However, although Binance Coin price has the potential to move up to $60 before a pullback, the TD Sequential indicator has presented a sell signal on the weekly chart. Validation of this call could push BNB down to $33.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637465793745241012.png&w=1536&q=95)

-637465793770243099.png&w=1536&q=95)