Binance Coin price could get a bid for higher targets if these factors play out

- Binance Coin price has found stable support on the Relative Strength Index.

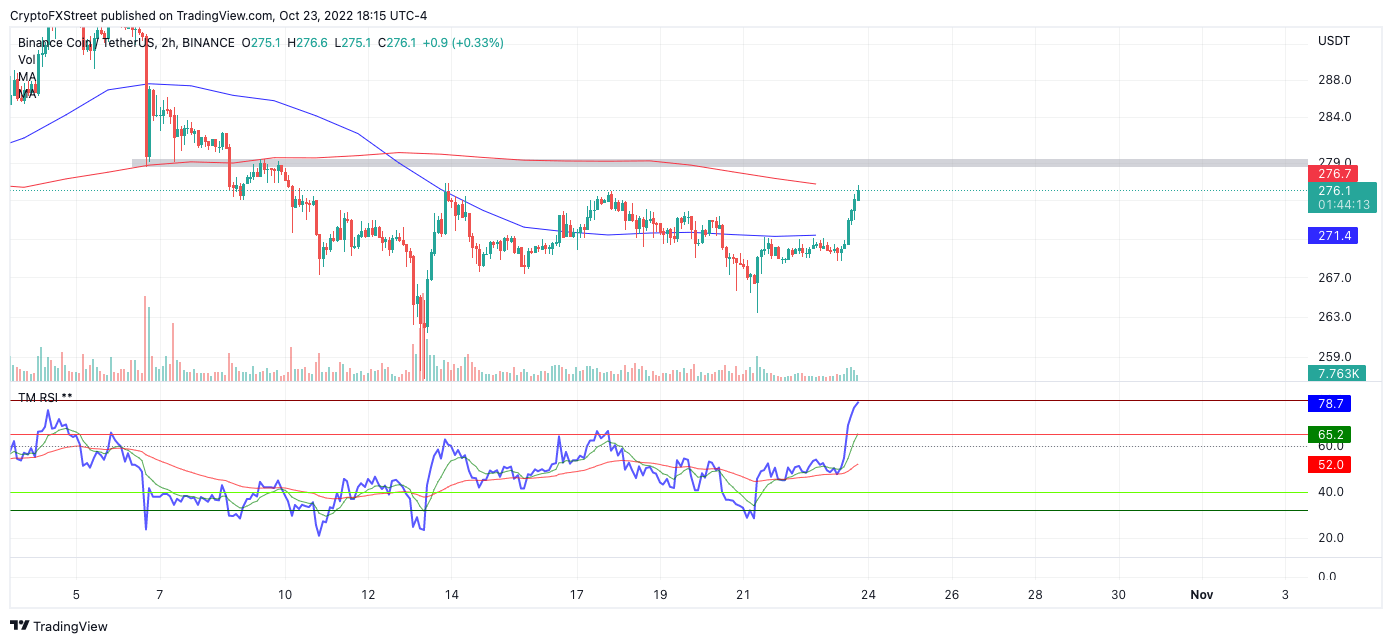

- The bulls have successfully reconquered the 8-day exponential moving average.

- Invalidation of the bullish thesis is a breach below $250.

Binance Coin price could witness a strong rally in the coming days. Key levels have been defined.

Binance Coin price has potential

Binance Coin price is showing tremendous strength on Sunday at $271, October 23. The decentralized smart contract token has rallied and produced a solid bullish trend to close the third trading week of the month. If market conditions persist, the bulls could rally toward higher targets.

Binance Coin price have successfully hurdled the 8-day exponential moving average and are now testing the 21-day simple moving average. The Relative Strength Index shows the bulls have found support before the ongoing rally. Sidelined bulls may witness this subtle cue and begin scaling into the BNB token to aim for $290 and potentially $300. Such a move would result in an additional 8% increase from the current market value.

BNB/USDT 2-Hour Chart

Invalidation of the bullish thesis could arise if the bears retag the $250 lows. In doing so, a sellers' frenzy could unfold, targeting $220 liquidity levels and below. Such a move would result in a 10% decline from the current Binance price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.