BCH/USD Technical Analysis: Bearish breakout on the horizon

- Bears have overtaken the bulls in the BCH/USD market.

- Technical analysis shows that a bearish breakout is on the horizon.

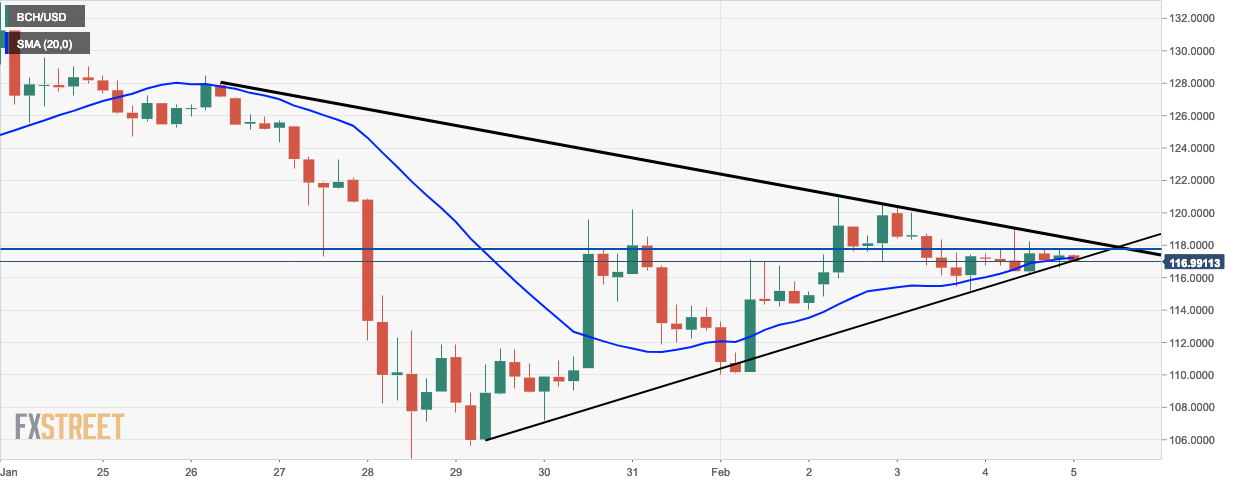

BCH/USD daily graph

- The BCH/USD daily chart forms a triangle which is ripe for a breakout.

- Short-term resistance lies at $121.50 which the bulls need to break through.

- The upward trending line has acted as strong support for the last 8 sessions.

- The 20-day simple moving average (SMA 20) curve is trending along the BCH/USD market and it looks like the curve will overtake the market soon. This indicates a bearish trend.

BCH/USD hourly graph

- The SMA 20 and SMA 50 curves cross over on Monday, February 4. This is an indicator of a bearish market.

- Bulls need to break through the resistance provided by the downward trending line to reverse the trend.

Key Levels

- Resistance 3: $121.6093

- Resistance 2: $120.3149

- Resistance 1: $118.8444

- Pivot Point: $117.5500

- Support 1: $116.0796

- Support 2: $114.7852

- Support 3: $113.3147

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.