Axie Infinity price readies for a quick 15% gain as AXS bounces off the last support

- Axie Infinity price slipped below the 50% retracement level and is currently bouncing off the range low at $45.93.

- Investors can expect a 15% ascent to $55.11 as bulls make a comeback.

- A four-hour candlestick close below $44.27 will invalidate the bullish thesis for AXS.

Axie Infinity price has been in a downtrend since posting a range high on February 7. The recent crash expedited the retracement for AXS, but bulls are likely to make a comeback.

Axie Infinity price to recover losses

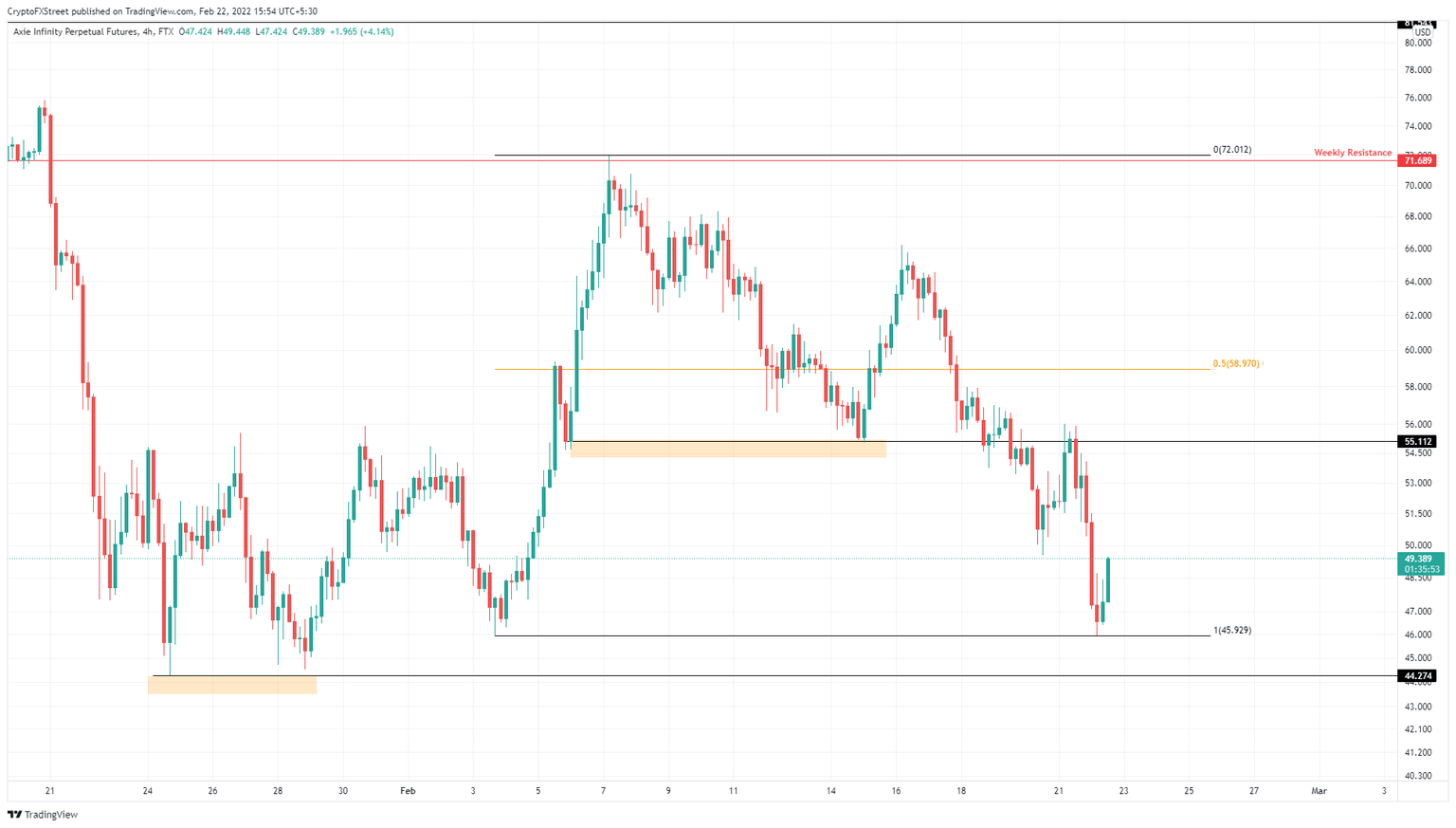

Axie Infinity price rallied 56% between February 4 and 7, setting up a range extending from $45.93 to $72.01. The range high coincides with the weekly resistance barrier, making it a challenging level to crack.

The exhaustion of bulls seems to have led to a full retracement and AXS is currently bouncing off the range low at $45.93. Going forward, investors can position themselves to capitalize on the expected forthcoming leg-up.

The first hurdle that Axie Infinity price will encounter is the $55.11 barrier, signaling a 15% gain. However, this is not a point where AXS is likely to reverse. Hence, investors can expect the altcoin to extend even further to retest the 50% retracement level at $58.97, bringing the total ascent to 21%.

Regardless, market participants can hope for a gain that ranges between 15% to 20% as Axie Infinity price bounces off the range low.

AXS/USDT 4-hour chart

While optimistic, this bounce for Axie Infinity price is dependent on Bitcoin price action given its impact on the overall cryptocurrency market trend. A failure for the big crypto to sustain its current bullishness could negatively impact AXS. In such a case, if Axie Infinity price produces a four-hour candlestick close below $44.27, it will invalidate the bullish thesis.

This development could lead AXS to retrace to the weekly support level at $37.66, where buyers can band together for a comeback.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.