Axie Infinity price needs stable support so AXS can skyrocket by 35%

- Axie Infinity price needs to slide lower and retest the 70.5% retracement level at $53.62.

- This move will set the stage for an expansion to $72.01, coinciding with the weekly resistance barrier.

- A four-hour candlestick close below $45.93 will invalidate the bullish thesis.

Axie Infinity price has seen multiple downswings since February 7. The most recent one is currently searching for a stable support level so AXS can kick-start a new uptrend.

Axie Infinity price prepares for liftoff

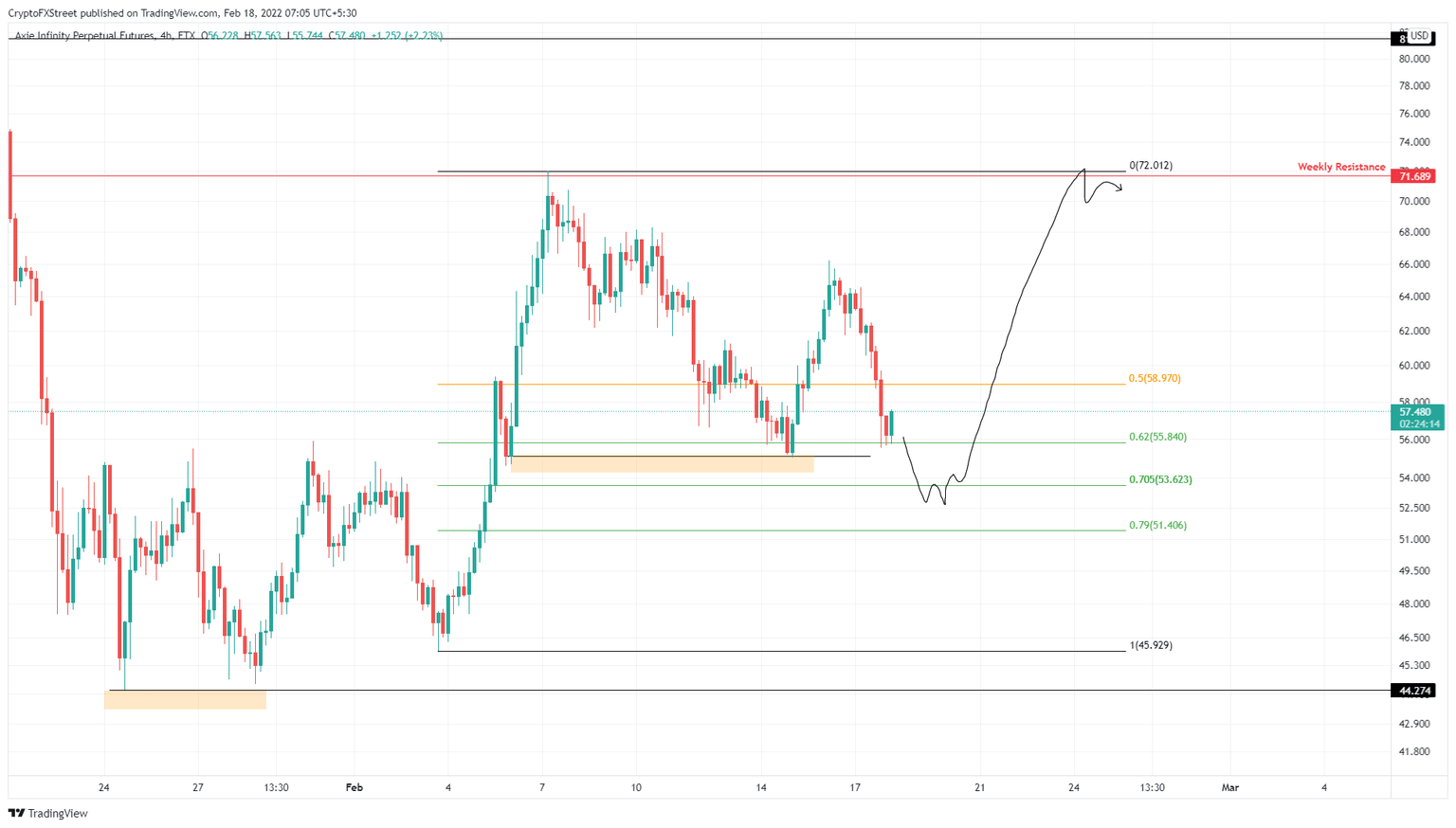

Axie Infinity price set a range, extending from $45.93 to $72.01 as it rallied 56% between February 3 and 7. This exponential upswing took a break at $55.11 and set a swing low there. The retracement from the range high set up another swing low around $55.11, creating a double bottom formation.

This technical formation facilitated a quick 20% ascent but left the residual liquidity below $55.11. Therefore, the current pullback will likely sweep below $55.11 and retest the 70.5% retracement level at $53.62 before heading on another ascent.

Doing so will allow Axie Infinity price to make a run for a higher high above the recent swing high at $66.20. This move will likely extend to the range high at $72.01, coinciding with the weekly resistance barrier.

In total, the uptrend would constitute a 35% gain for Axie Infinity price.

AXS/USDT 4-hour chart

Regardless of the liquidity pool, if Axie Infinity price slides below $53.62, it will indicate that the sellers are driving AXS into a deep discount phase.

If this bearish momentum pushes Axie Infinity price to produce a four-hour candlestick close below the range low at $45.93, it will invalidate the bullish thesis. In this case, AXS will likely slide lower and collect the liquidity resting below $44.27 to give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.