Axie Infinity Price Prediction: AXS prepares for a 20% lift-off [Video]

-

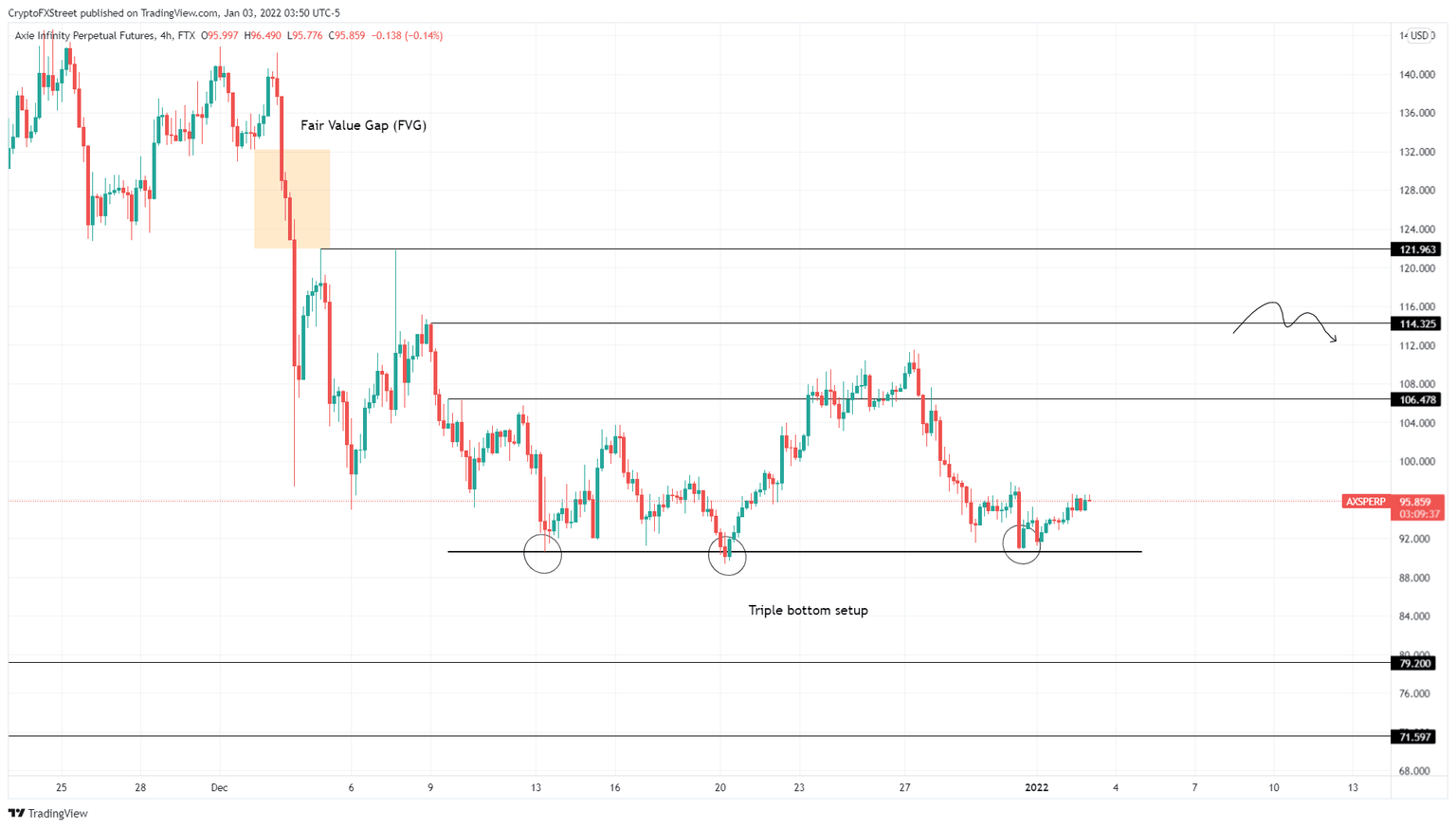

Axie Infinity price is coming off the triple bottom setup, suggesting a bullish outlook.

-

A 20% upswing is likely, allowing AXS to retest the $114.33 resistance barrier.

-

A breakdown of the $90.59 support level will invalidate the bullish scenario.

![Axie Infinity Price Prediction: AXS prepares for a 20% lift-off [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Cryptocurrencies/AxieInfinity/AxieInfinity_XtraLarge.jpg)

Axie Infinity price has set up a bullish reversal bottom and shows signs of an emerging uptrend. If the buyers band together, it could trigger an uptrend that will allow AXS to slice through the recent swing high. This run-up will allow the altcoin to collect the buy-stop liquidity resting above the recently erected swing highs.

Axie Infinity price to trend higher

Axie Infinity price set up three swing lows around the $90.59 support level over the past two weeks. The third tap off this barrier led to a 6% upswing to where AXS currently trades - $95.85.

Opening a long position here will allow users to capitalize on a run-up that pushes Axie Infinity price to retest the immediate resistance level at $106.48, constituting an 11% climb.

While users can play it safe and take profits there, there is a high chance AXS could reach for the next ceiling at $114.33. In total, this move would constitute a 20% advance. In a highly bullish case, Axie Infinity price could tag the $121.96 resistance barrier and liquidity resting above it.

AXS/USDT 4-hour chart

Despite the bullish outlook for Axie Infinity price, a retracement that pushes AXS to produce a 4-hour candlestick close below $90.59 will invalidate the bullish thesis and indicate weak buying pressure. In that case, Axie Infinity price could slide 12% to retest the $79.20 platform.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.