Axie Infinity price is on the cusp of exploding by 40%

- Axie Infinity price dropped another leg lower on Saturday, hitting the $26-marker.

- AXS price rebounded on Sunday, with bulls able to close above the $31-handle.

- If bulls can keep price action above that $31-handle, support is confirmed, and AXS price could sprint to $44.45.

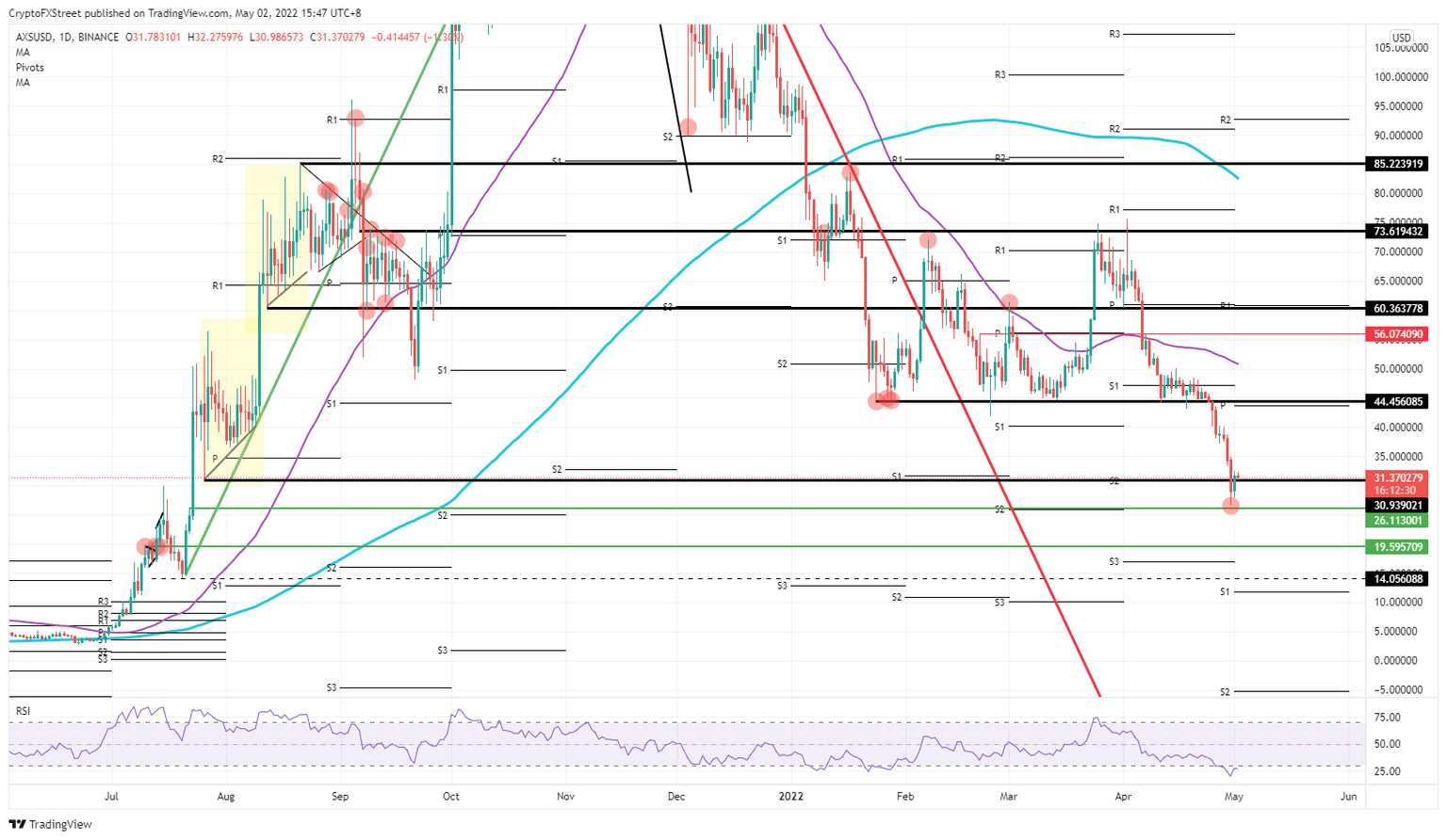

Axie Infinity (AXS) price has not been in a good place these past few days or even weeks for that matter. The strength of the Greenback has been really biting into AXS’s price action and setting the tone since it began its strengthening rally. For now, a floor looks to be set at $26.11, offering a rebound that bulls will use to close above $31.38 and get set for a rally back to $44.45, erasing the incurred losses since mid-April.

AXS price is set to swing back to the monthly pivot

Axie Infinity got caught in a bearish surprise over the weekend with bears not folding on their short positions and eking out those last few dollars of gains. The Relative Strength Index (RSI) breached the 30-marker and traded deeply in the oversold area. As the sell-side volume dried up, bulls saw the opportunity to recover and then buy above $31 and started to ramp price action up towards $31.

AXS price will need to stay and close above $31 by Monday’s close and in the handover towards Tuesday. This way, $31 gets confirmed as support and can be used as a launching platform to rally quickly back up to $44.45, which is the monthly pivot and a critical historic pivotal level. In the process, not only will AXS have erased a large part of the bearish move that occurred in April, but it will have booked a 40% gain in the books that will trigger some profit-taking.

AXS/USD daily chart

New tail risks have been added from geopolitics after India tripled its buying of Russian oil, angering the US and the European bloc in the process. Germany wants to extend an olive branch to India by inviting India into the G7 to make them change their minds. As this sets the scene for more aggressiveness on the battlefield, expect to see headwinds emerge with dollar strength pulling AXS below $20 towards $19.59, or even $14.05.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.