AVAX to present buy opportunity before surging to $125

- AVAX price looks to stop the downtrend it is presently in.

- A convincing bullish breakout requires bursting through two key resistance areas.

- AVAX is at the mercy of how long Bitcoin can sustain its bullish momentum.

AVAX price initially broke down below the prior rising wedge back on September 29th. Since then, AVAX has experienced a downtrend before entering into its current consolidation range. However, given Bitcoin's rally to new all-time highs, AVAX looks to end the consolidation and enter a new mark-up phase.

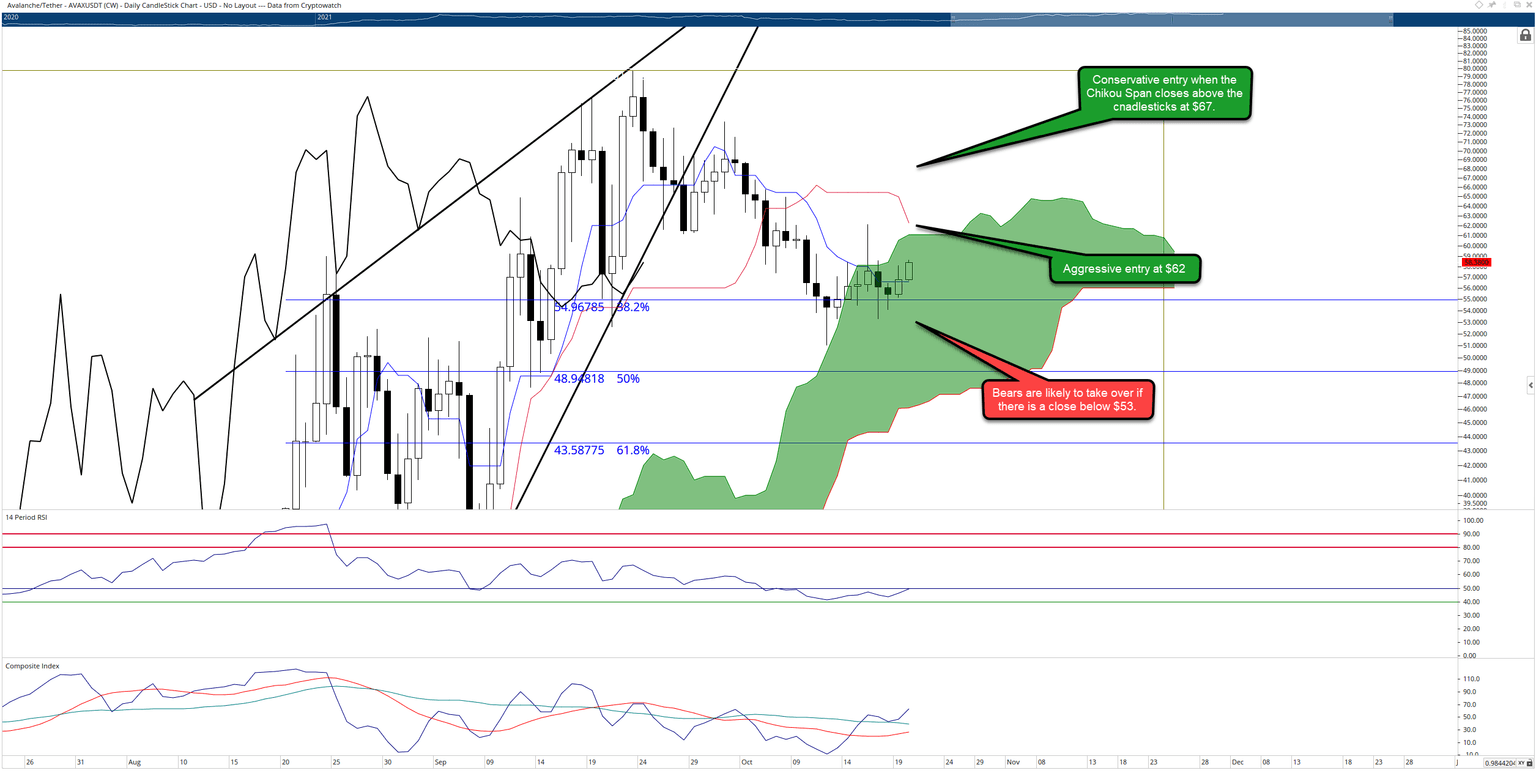

AVAX price seeks a breakout from the Cloud to target a new all-time high at $125

AVAX price looked as if its downtrend from the rising wedge would continue, but it found some support instead. The Tenkan-Sen and 38.2% Fibonacci retracement at $55 found buyers to hold AVAX from any further downside movement. Buyers now look like they could return to support AVAX even further by moving higher and towards new highs.

One sign that AVAX may have found a new floor is the Relative Strength Index. The two oversold levels in the bull market, 40 and 50, have acted as support and lend strength to any confirmed breakout. Ideally, bulls would want to see AVAX close with the Chikou Span above the candlesticks – this wouldn't occur until AVAX closed at $67. An aggressive entry could occur at $62 when there is a daily close above the Cloud. The projected new high from that breakout is at the $125 level.

AVAX/USDT Daily Ichimoku Chart

While it is currently an unlikely even, there is an opportunity for bears to invalidate the bullish scenario above. Some analysts may perceive the current AVAX price action as a bear flag. If that is the case, then short sellers will likely resume control of this market if AVAX were to close at or below $53.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.