AVAX price could lose a part of its 61% rally unless bulls push the altcoin to this level

- AVAX price noted a 7.4% rally in the last 24 hours as the value of the asset rose to $17.20.

- Avalanche would be able to chart two-month highs if it can achieve another 15% rally over the next couple of days.

- The looming fear of corrections could prevent bulls from engaging, which could result in the cryptocurrency losing its critical support at $14.20.

AVAX price has been running in the big leagues rising significantly over the last three weeks, breaching multiple resistance levels. The current slowdown, however, might be just a short stop before the rally rises again and reclaims these levels.

AVAX price needs a boost

AVAX price is currently trading at $17.20, up by more than 61% in the last couple of days as the investors' fear dissipated. The crypto market is on a recovery streak as well, led by the king coin, Bitcoin, which is up to $22,400 at the time of writing, marking a two-month high.

Avalanche, too is nearing a two-month high, provided it can rise above its resistances.

Despite the end of the buying spree noted in the last three weeks, AVAX price can still pull some green candles out of the traders as it is nearing its pre-November 2022 crash.

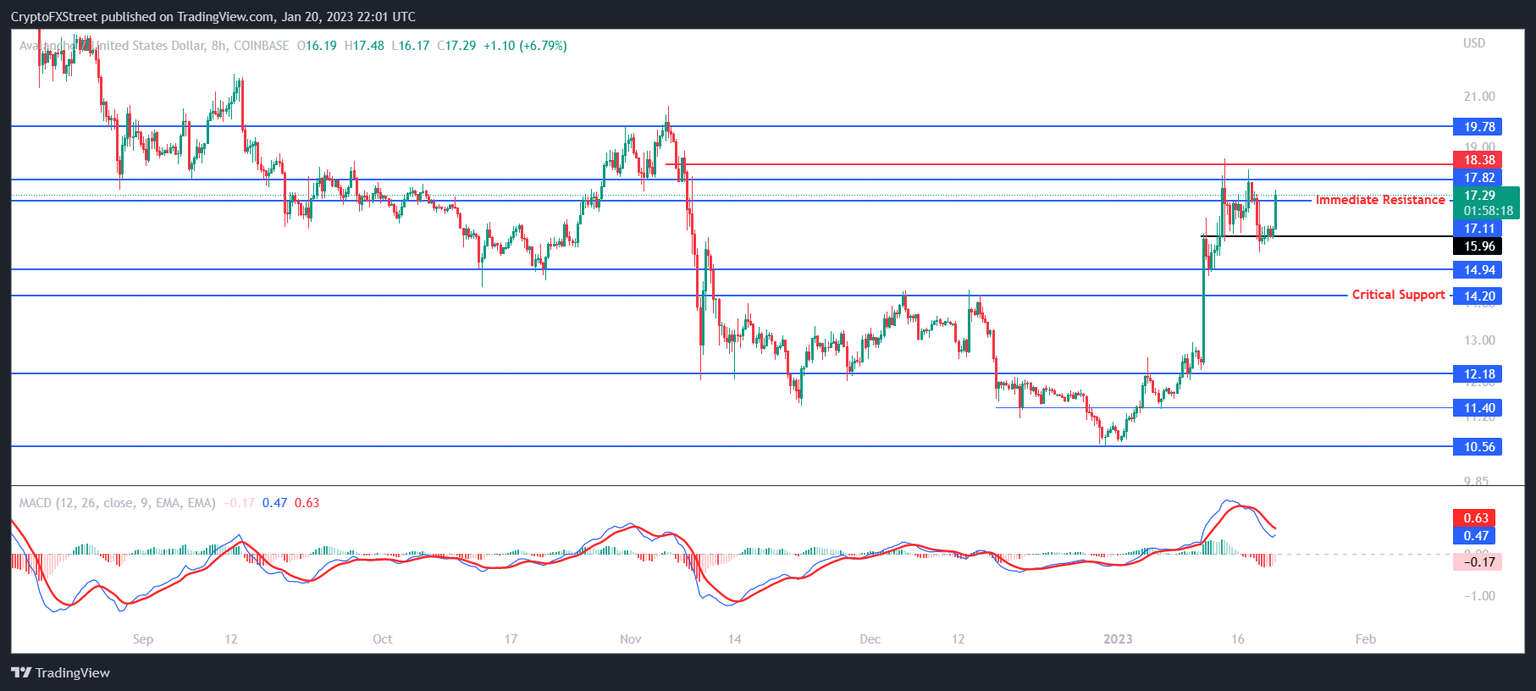

Should the altcoin flip the immediate resistance at $17.11 into a support floor, Avalanche would have the opportunity to rise further. Additional bullishness from the investors and markets would push the price above the critical resistance at $18.38 and toward $19.78, which would mark the two-month high of pre-crash levels.

The Moving Average Convergence Divergence (MACD) is also highlighting a potential bullish crossover forming on the indicator. The rising MACD line (blue), if crossed over the signal line (red), would invalidate the bearish crossover, essentially indicating a rise arriving over the next few days.

AVAX/USD 8-hour chart

However, being wary of the market's volatility is crucial, as noted by the corrections and sideways movement from the last few days. If the immediate support level at $15.96 is lost, AVAX price could decline to $14.94 with another chance to bounce off of at $14.20.

Although if Avalanche registers a daily candlestick close below this critical support, the bullish thesis would be invalidated, leaving the altcoin vulnerable to a fall toward $12.18.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.