Aster Price Forecast: ASTER plummets 10% but whales remain unfazed

- Aster extends decline from new all-time highs of $2.43 as bulls struggle to hold around $2.00.

- Whales increase exposure despite the correction in the Aster price, reflecting rising demand for the DEX native token.

- Investor confidence in Aster remains steady, underpinned by rising staking balance above the $2 billion mark.

Aster (ASTER) holds around $2.00, down over 10% at the time of writing on Wednesday and aorund 17% from its record high of $2.43. The token backed by Binance’s YZi Labs reflects the negative sentiment in the broader cryptocurrency market, which has seen Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) extend the correction that began at the start of the week.

Aster declines as whales buy the dip

Large-volume holders have piqued their interest in Aster, a perpetual Decentralized Exchange (DEX) native token on the BNB Chain. As reported by Fxstreet on Wednesday, whales have been scooping up ASTER tokens in millions, reflecting optimism for the DEX’s role in the Binance ecosystem.

Despite the price correction, demand for Aster remains high, underpinned by whales increasing their exposure to the asset. According to data shared by SpotOnChain, a whale wallet has withdrawn 26 million ASTER valued at approximately $59 million from Gate exchange. The whale currently holds a total of 50 million ASTER worth around $105 million.

Aster whale holdings | Source: SpotOnChain

Another wallet, has also purchased 1.56 million ASTER, valued at approximately $3.52 million, from the Bybit exchange. This whale currently holds 8.28 million worth around $17.4 million.

Aster whale holdings | Source: SpotOnChain

According to DefiLlama, the surge in interest and investor confidence in ASTER has been mirrored by the steady increase in the protocol’s Decentralized Finance (DeFi) Total Value Locked (TVL), which has reached a record $2.13 billion on Thursday.

Prior to the token’s official launch last week, the TVL, which refers to the notional value of all tokens locked in smart contracts on the protocol, averaged $347 million by September 1.

Aster DeFi TVL | Source: CoinGlass

The sharp rise in TVL bolsters investor confidence in the token and the ecosystem, increasing the likelihood of the uptrend’s continuation beyond the record high of $2.43.

Technical outlook: Is Aster poised for recovery?

Aster holds around the $2.00 short-term support, largely supported by bullish sentiment in the ecosystem and demand from large-volume holders. A daily close above this level would confirm the bullish grip, and possibly increase the probability of a rebound toward its all-time high at $2.43.

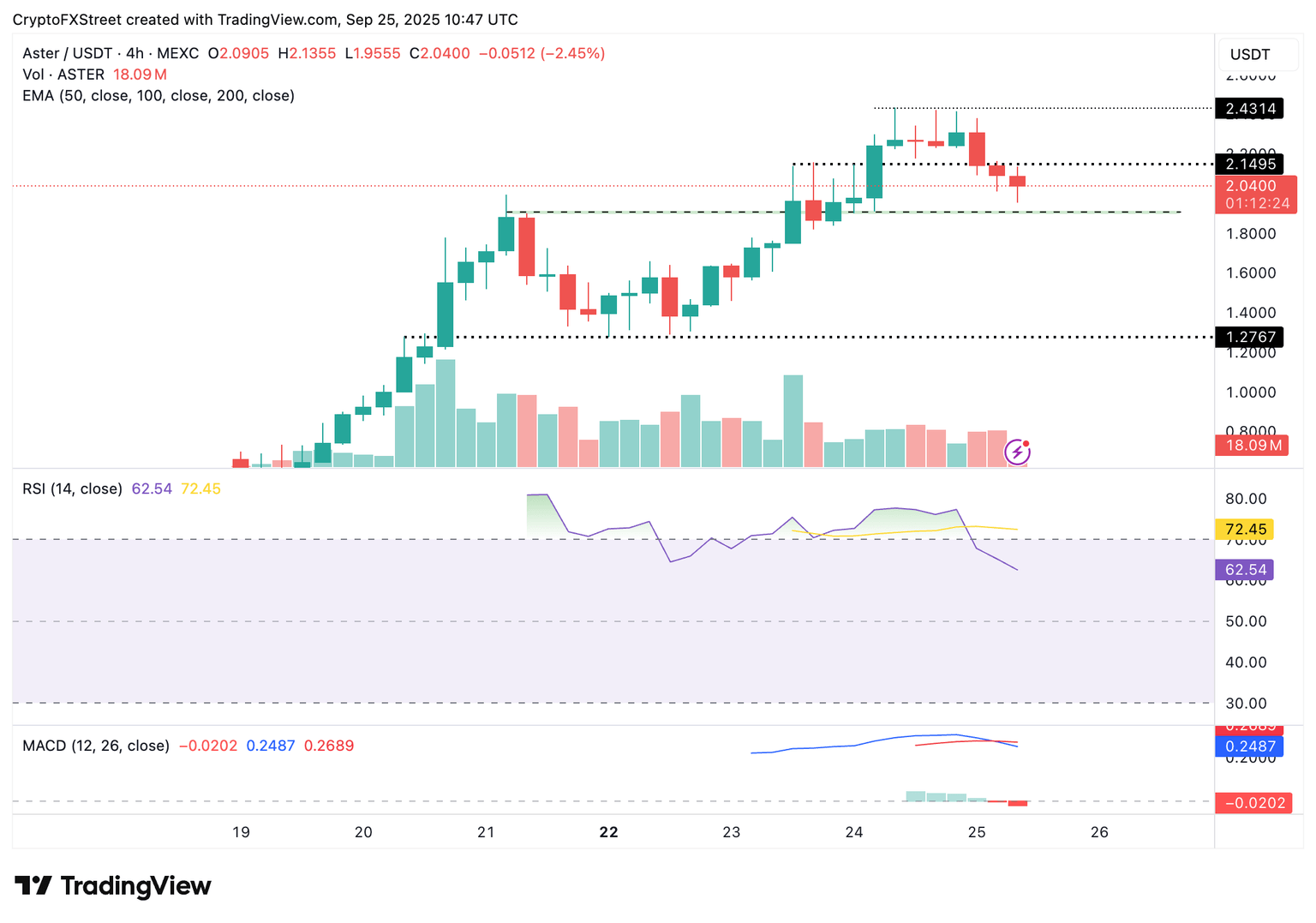

ASTER/USDT 4-hour chart

Still, traders should tread cautiously, considering the prevailing risk-off sentiment in the broader cryptocurrency market. Similarly, the decline in the Relative Strength Index (RSI) to 62 from the overbought region indicates that bearish momentum is building.

Therefore, a sustained correction below the short-term $2.00 support could result in the down leg extending to test the demand zone marked in green on the chart above at around $1.90. Other key areas of interest are $1.65, which was previously tested as resistance on Monday, and $1.27, which was tested as support.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren