Aster Price Forecast: ASTER skyrockets as whales, DeFi TVL fuel rally

- Aster increases over 18% on Wednesday, supported by growing demand from whales.

- Aster’s DeFi TVL hits $1.85 billion, the highest level on record as interest in the perpetual DEX token surges.

- The RSI depicts overheated market conditions with volatility in the broader crypto market likely to dampen Aster’s rally.

Aster (ASTER) extends its rally trading above $2.34 at the time of writing on Wednesday. The newly launched native perpetual Decentralized Exchange (DEX) token is up 18% on the day, reflecting growing demand, especially from whales.

Aster rallies amid rising risk-on sentiment

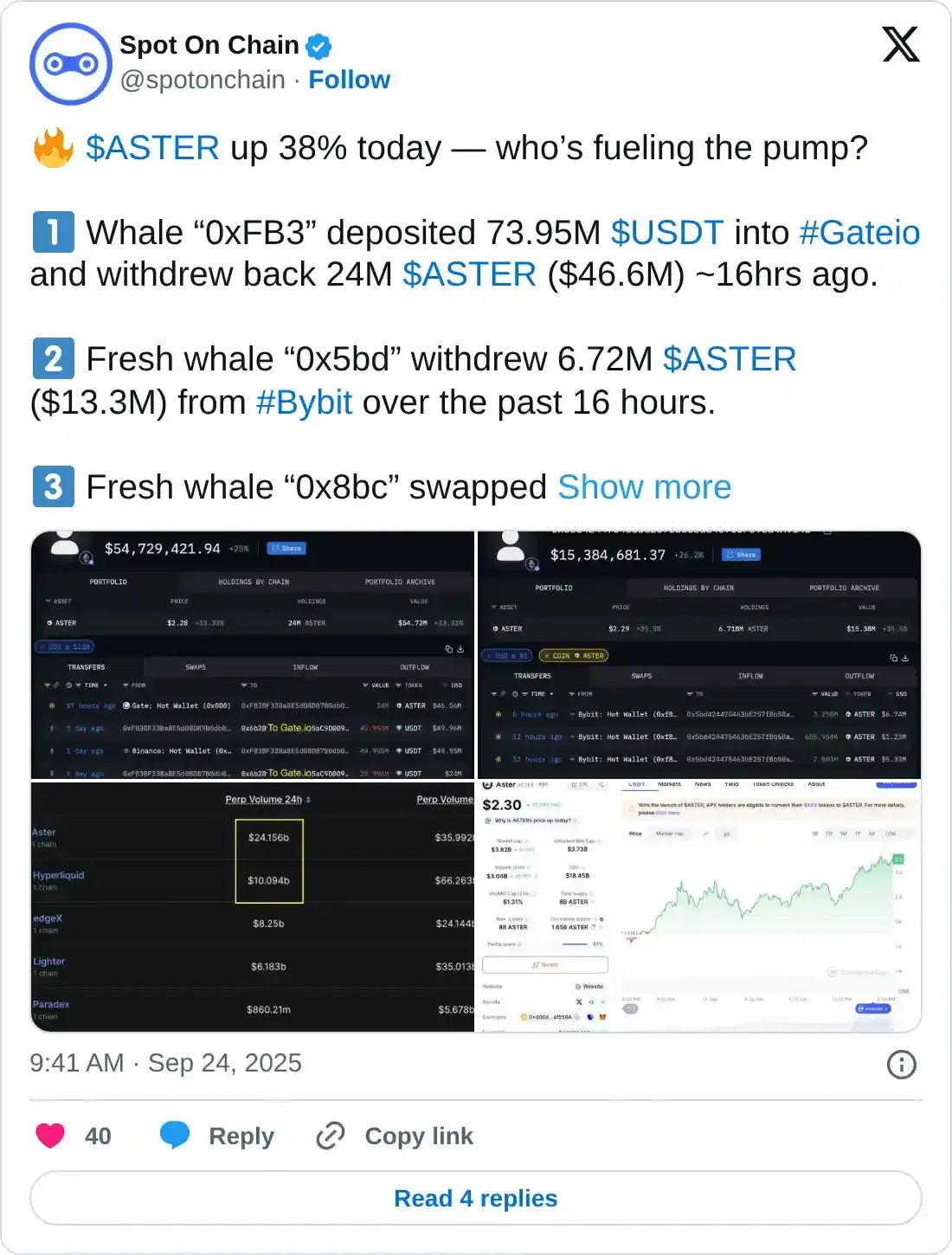

According to data shared by SpotOnChain, large-volume holders are aggressively buying ASTER tokens. One wallet identified as “0xFB3” is reported to have deposited USDT worth $73.95 million into Gate.oi exchange and withdrew 24 million ASTER, valued at $46.6 million, on Tuesday.

Another wallet, identified by SpotOnChain as “0x5bd,” withdrew 6.72 million ASTER, worth approximately $13 million, from the Bybit exchange. The risk-on sentiment persisted on the same day, with a whale address, “0x8bc”, swapping $1.19 million in USDT for 595,580 ASTER for $2.00 per token.

SpotOnChain also highlighted on X that whale “0x5e3” swapped 1,090 Binance Coin (BNB) worth approximately $1.11 million for 549,194 ASTER in one transaction at $2.00 per token, which occurred on Tuesday.

Aster is a DEX for trading perpetual contracts backed by YZi Labs, formerly known as Binance Labs. It is the latest DEX on the BNB Chain, joining PancakeSwap, Venus (V3), Lista DAO and Biswap.

YZi Labs’ support appears to be legitimising Aster’s status in the perpetual DEX sector, which is currently dominated by Hyperliquid (HYPE). With BNB Chain being one of the leading protocols in the industry, investors are keenly following its growth curve and competitiveness.

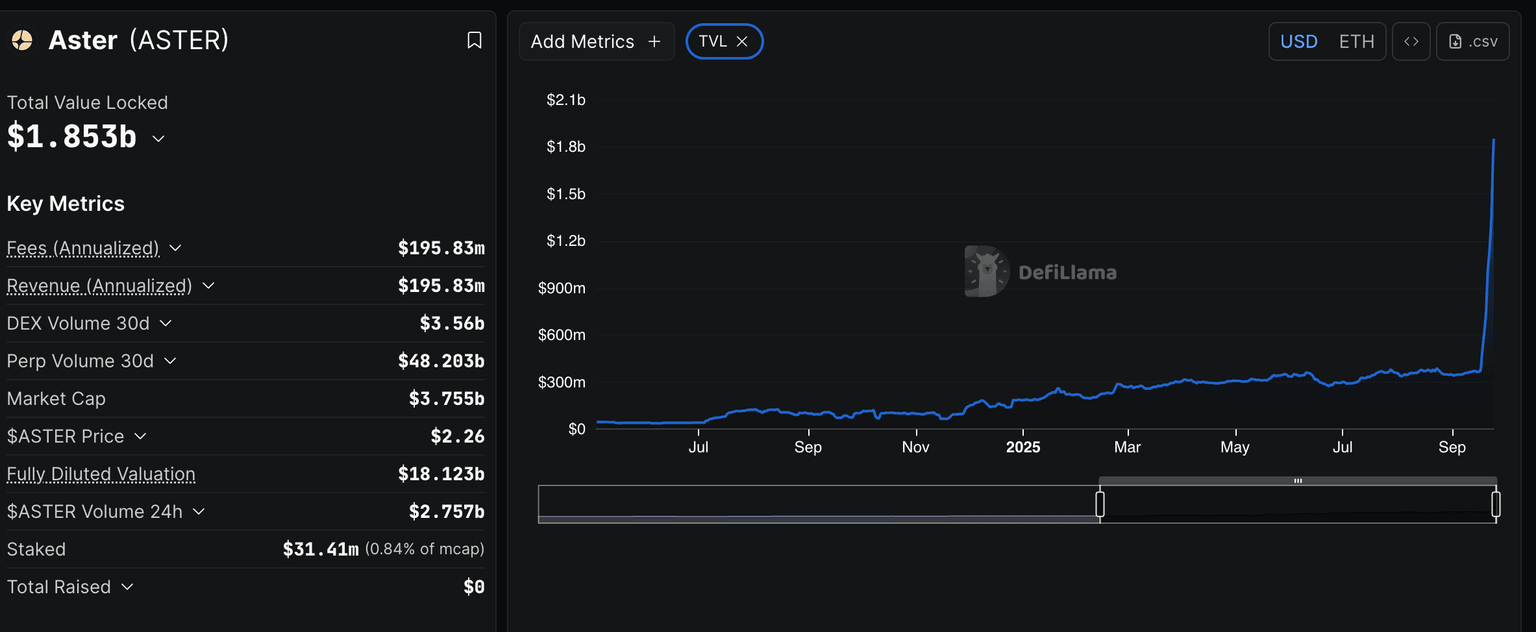

DefiLlama corroborates the surge in interest and investor confidence in the token. The chart below shows a significant increase in Aster’s Decentralized Finance (DeFi) Total Value Locked (TVL), which has reached a record $1.85 billion. Before the official launch of Aster’s perp DEX, the TVL, which refers to the notional value of all tokens locked in smart contracts on the protocol, averaged at $347 million by September 1. The sharp rise in TVL backs investor confidence in the token and the ecosystem.

Aster DeFi TVL | Source: DefiLlama

Technical outlook: How high can Aster go?

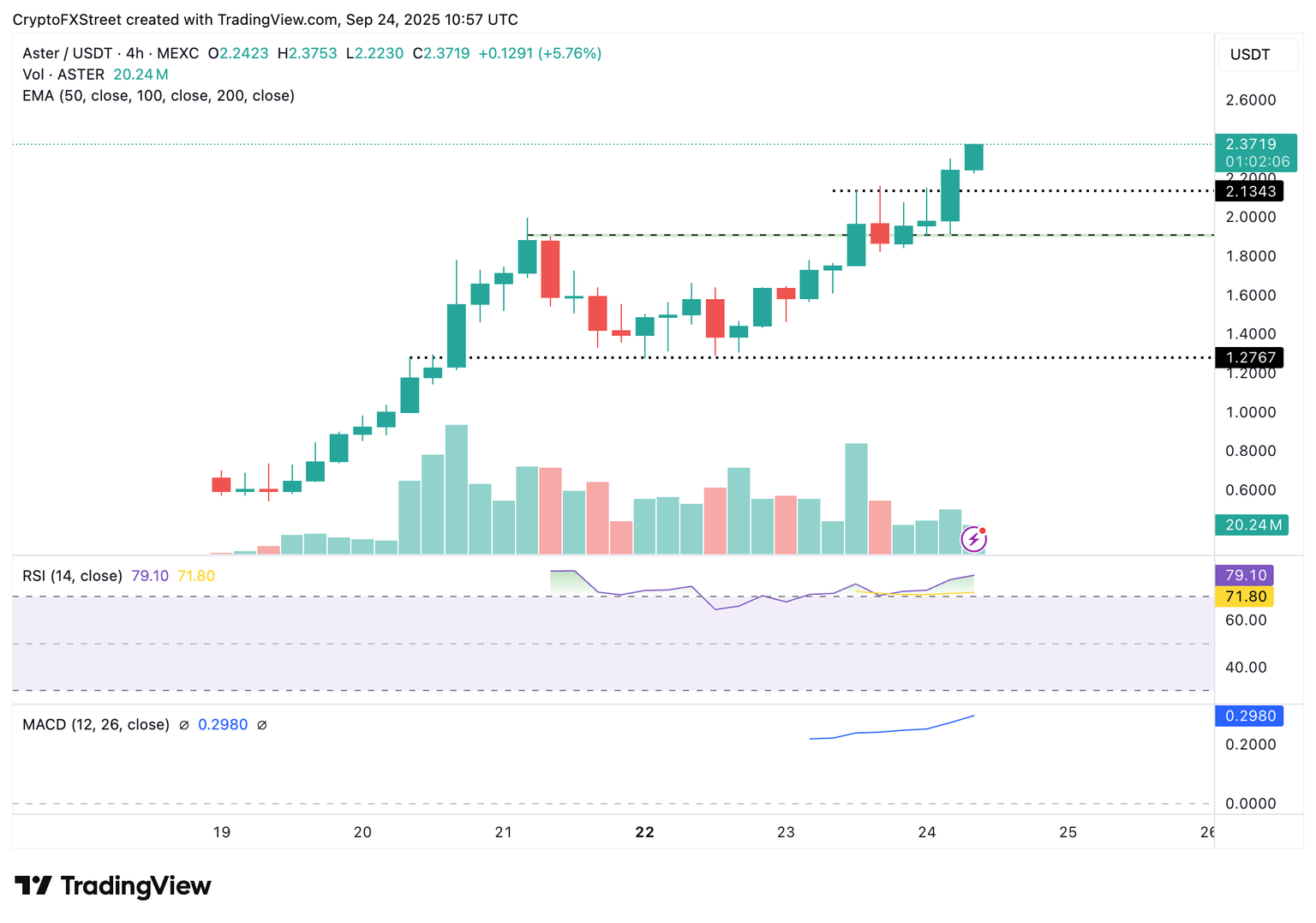

Aster has rallied, reaching a new record high of $2.43 on Wednesday, reflecting positive sentiment in its ecosystem. A minor correction has resulted in the token trading above $2.34 at the time of writing.

ASTER/USDT 4-hour chart

The Relative Strength Index (RSI), which has risen to 78, reinforces the steady bullish momentum. However, traders must be cautious because higher RSI readings indicate overheated market conditions, which often precede sudden corrections. Key areas of interest for traders are $2.14, which was previously tested as resistance earlier on Wednesday, and $1.90, which was last tested as support.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren