Assessing the chances of a Bitcoin price pullback due to FOMC minutes

- Following a slower rate increase by the Fed on February 1, expectations have turned more hawkish on the back of an outstanding jobs report and higher-than-expected inflation figures.

- A hawkish shift by the Federal Reserve could weigh on Bitcoin and other cryptos’ prices.

- Crypto analysts suggest Bitcoin and other cryptocurrencies could take a dive before continuing their uptrend.

The Federal Open Market Committee (FOMC) slowed the pace of rate increases to 25 basis points (bps) at its latest meeting on February 1, which resulted in expectations of a dovish tenor from the Federal Reserve. However, subsequent data releases have resulted in an expected shift in tone to hawkish once again.

The importance of FOMC meeting minutes

Following the 25 bps hike in the January 31-February 1 meeting, the Federal Reserve seemed to be on the path to an equal increase to take its target range to 4.50%- 4.75% by March. At the time of the interest rate hike, the Federal Reserve stated,

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

However, the FOMC noted that future increases in the target range would be determined based on the tightening of the monetary policy and its effects on inflation. The FOMC meeting minutes could provide more clarity on the Committee’s stance and what could come next.

However, following the release of the Nonfarm Payrolls (NFP) in January, hawkish expectations returned to the markets. Rising by 517,000 against 185,000 of market consensus, the NFP data changed the market voice, thus making the upcoming FOMC minutes rather out to date. Commenting on the same, FXStreet analyst, Eren Sengezer stated,

"Minutes of the FOMC's first policy meeting is highly likely to be outdated since it took place before the impressive January jobs report and stronger-than-expected inflation figures, which have ramped up hawkish Fed bets."

Eren further added,

"Nevertheless, two non-voting of the FOMC, Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard, both said last week that they advocated for a 50 bps hike at the last meeting. In case the publication reveals that there was a serious discussion about possibly going back to bigger rate hikes, risk-sensitive assets are likely to come under renewed bearish pressure."

How could Bitcoin and other cryptos be affected

While the broader market cues have been switching between bullish and bearish, no single direction can be suggested at the moment. However, if the FOMC minutes reveal a consideration of a larger interest rate hike, analysts are expecting a dip in Bitcoin price.

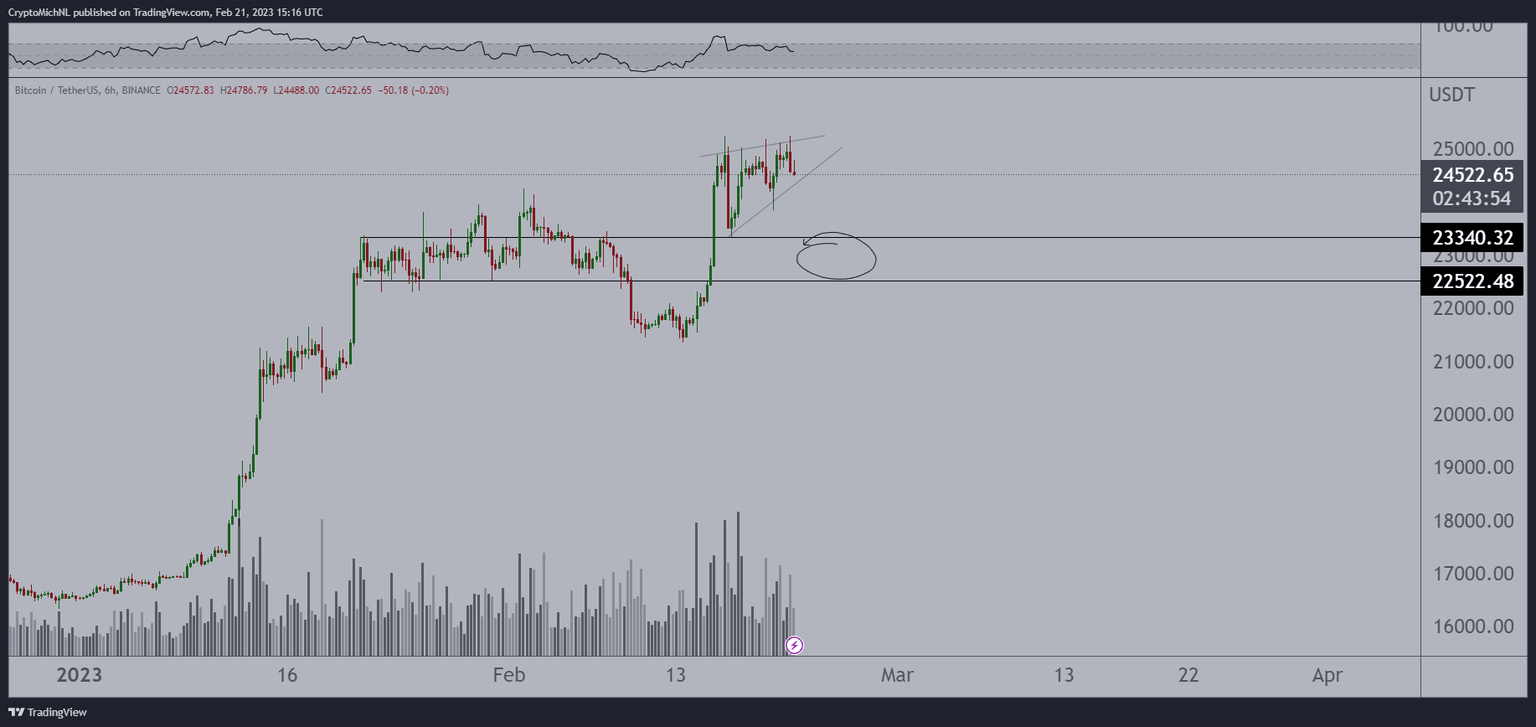

Crypto analyst Michael van de Poppe suggested Bitcoin price could decline to test the range of $22,500 and $23,300. Expecting a week of consolidation, van de Poppe stated,

"Markets correcting, which is great for people who look for entry points… [Bitcoin] might go down a bit more from here before we'll turn around."

At the time of writing, BTC is trading at $23,647, suffering a 3.23% drop on the day, nearing the support level of $23,200.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.