Argentinians engage in Bitcoin buying spree, Coinbase CEO advocates BTC as antidote to inflation

- Bitcoin purchases in the largest Argentine crypto exchange nears the highest weekly volume in 20 months.

- High inflation is pushing more investors to leverage Bitcoin as a store of value.

- Coinbase CEO says crypto can update the global financial system.

Bitcoin (BTC) price correction has seen many Argentinian investors buying the dip as inflation in the country has reached a whopping 276%. The spike in inflation is not just localized to Argentina but across the world. Coinbase CEO Brian Armstrong mentions that people are realizing that BTC is the antidote to inflation.

Argentina has a rich history with inflation

Bitcoin purchases in the Argentine crypto exchange Lemon have risen rapidly since the first week of March, reaching 34,700—the country's highest weekly volume in 20 months— according to Bloomberg. This follows an increasing inflation rate in the country, as the high cost of living and mountains of debt threaten to send the country to its sixth economic recession in 10 years.

With inflation in triple digits during the past few years and the deteriorating value of the peso, many Argentinians turned to the US dollar to protect themselves from currency devaluation. However, a recent 10% gain in the peso saw citizens shift from the Greenback to Bitcoin.

Also read: Bitcoin price correction is harsh, but late bulls could still have an opportunity to buy the dip

Can Bitcoin serve as a hedge against inflation?

Considering the recent Bitcoin surge following the Bitcoin spot ETF approval and approaching halving event, the largest digital asset seemed attractive to Argentinian investors. And with the recent crypto market price correction, many may see it as the perfect buying opportunity.

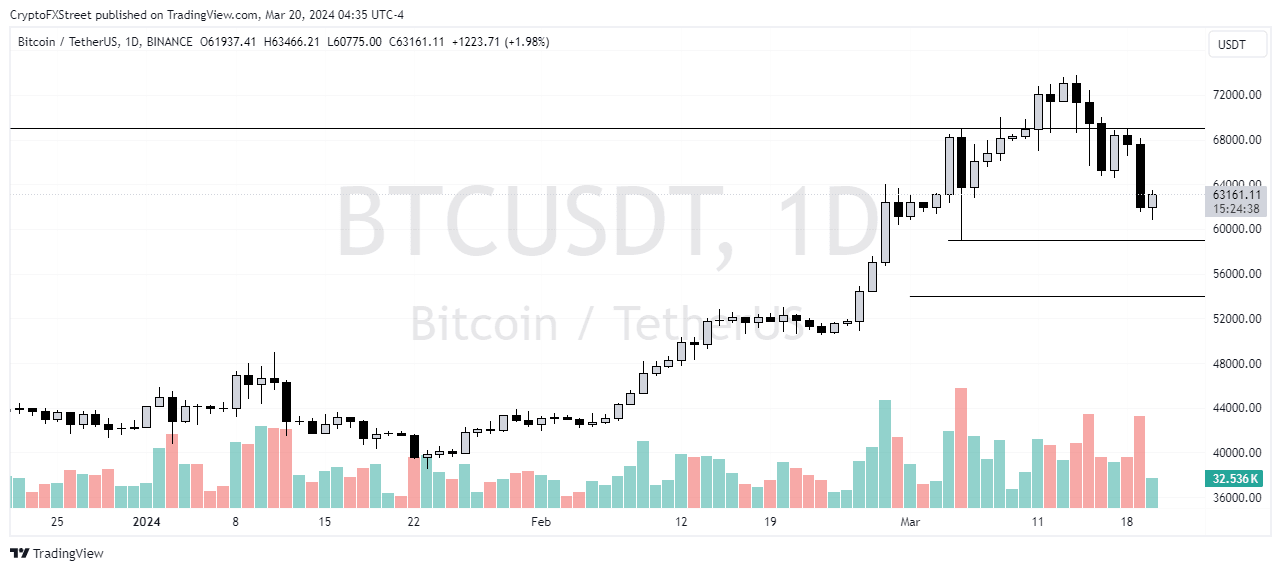

BTC/USDT 24-hour chart

Beyond Argentina, high inflation rates persist in many other countries worldwide. For example, in sub-Saharan Africa and a larger part of South America, some people use Bitcoin as a store of value, strengthening its digital gold narrative. This narrative is hinged on Bitcoin's deflationary design, using a supply cap of 21 million tokens and seasonal halving.

Read more: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC stuck under $65K ahead of FOMC

Coinbase CEO Brian Armstrong reinforced Bitcoin's argument as a means to circumvent inflation in a recent Bloomberg interview. He stated that although the average person doesn't think about quantitative easing, they notice the rising prices of gas and food at the grocery store and increasingly realize that "Bitcoin is the antidote to inflation."

He further added that a cryptocurrency like Bitcoin is “sound money”, and people want to see crypto update the financial system globally.

Author

FXStreet Team

FXStreet