Are AVAX bulls alive after another weekend crash?

- AVAX price has crashed 62% in the last month, denoting the bearish state of the crypto markets.

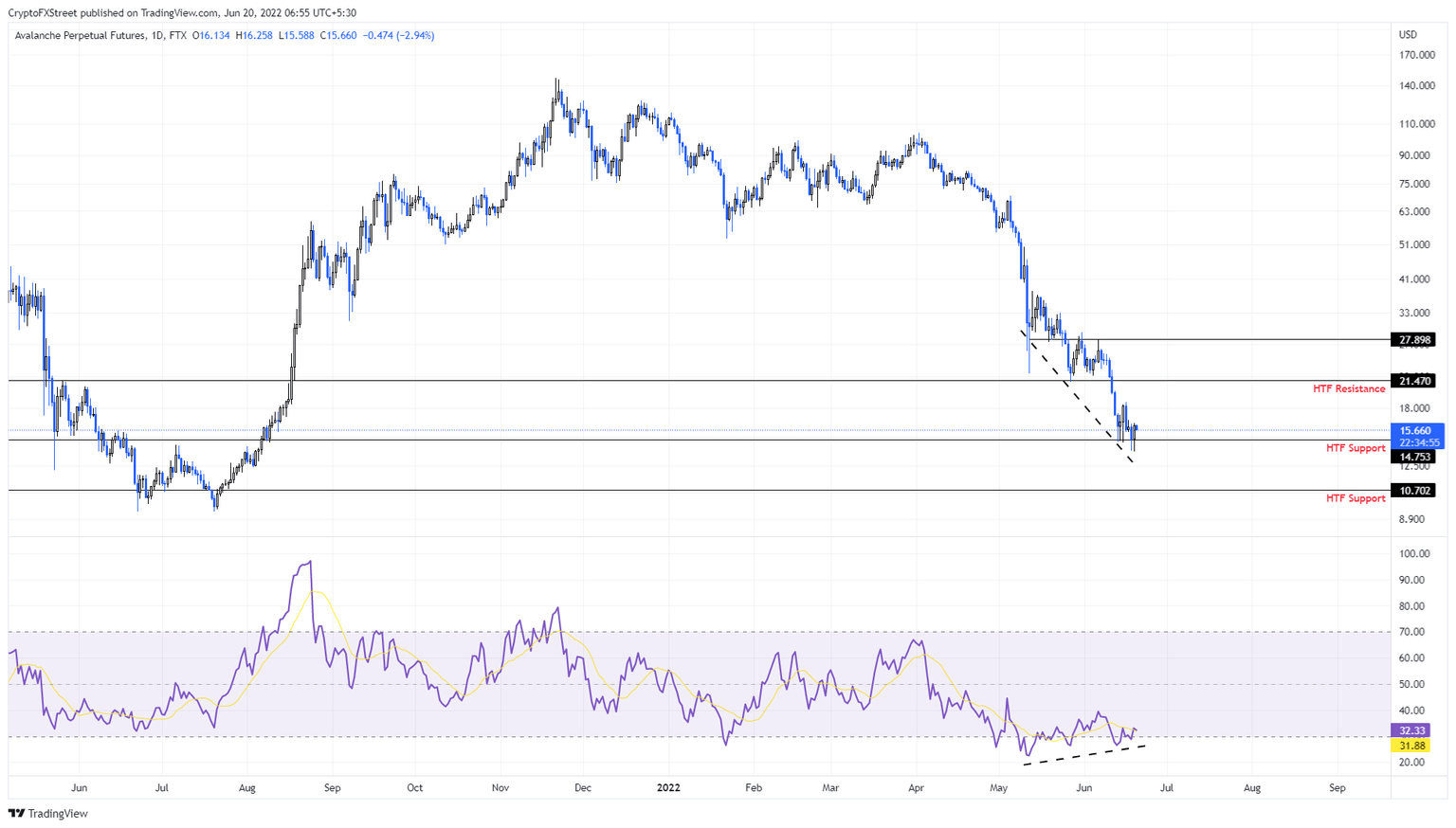

- A minor recovery off the $14.75 support level is possible if Avalanche bulls decide to give it a try.

- A daily candlestick close below the $14.75 barrier will lead to a 27% crash to $10.70.

AVAX price tried resisting the bearish pressure but was unsuccessful considering last month’s returns. Regardless, Avalanche price is retesting a stable high-time-frame support level, suggesting that a recovery could be underway.

AVAX price tries to bounce back

AVAX price crashed 67% in a week between May 5 and May 12 during the initial fallout of the Terra-UST empire. After this crash, Avalanche continued to shed 64% of its market value in the next month or so.

The second nosedive pushed AVAX price to flip the $21.47 support level into a resistance barrier and even tagged the next one at $14.75. This move, while extremely bearish, was completed in the form of lower lows and lower highs.

Interestingly, during this period, the Relative Strength Index (RSI) produced consistently higher lows. This setup is termed bullish divergence and often results in a spike in the underlying asset’s market value. In this case, investors can expect the AVAX price to bounce and recover.

Additionally, this bullish divergence is happening around the $14.75 support level, which adds credence to the recovery thesis. Moreover, the bears tried to knock over the said foothold six times over the past week and were unsuccessful, which also suggests that the sidelined buyers have been accumulating, absorbing the selling pressure.

Hence, investors can expect AVAX price to kick-start a recovery rally to the June 16 swing high at $18.68. If this level is cleared, a retest of the $21.47 hurdle seems likely.

AVAX/USDT 1-day chart

On the other hand, if AVAX price produces a daily candlestick close below the $14.75 barrier, it will flip this support into a resistance level. Such a development will lead to a 27% crash to the next stable support level at $10.70.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.