Arbitrum Price Forecast: ARB near $0.22 as ‘Arbitrum Everywhere’ framework gains traction

- Arbitrum holds above $0.22 as volatility spikes across the crypto market on Wednesday.

- The ‘Arbitrum Everywhere’ framework builds apps beyond the Ethereum Layer-2 scaling, supporting builders in DeFi.

- 'Arbitrum Everywhere' functions through four interconnected pillars, including builder freedom and DeFi Unchained.

Arbitrum (ARB) edges lower, trading at $0.22 at the time of writing on Wednesday amid a steady decline in the broader cryptocurrency market. Since ARB hit $0.62 in August, marking its third-quarter peak, recovery has been elusive, reflecting a sticky bearish sentiment.

However, the ecosystem continues to hit new development milestones, according to a recent Messari report on the project. Key developments align, making Arbitrum a developer-friendly platform, underpinned by an adaptable enterprise-grade infrastructure.

Arbitrum Everywhere frame goes beyond Ethernet Layer-2 scaling

Arbitrum’s growth plan has shifted from scaling Ethereum using Layer-2 rollups (L2s) to building developer-friendly, scalable, diverse, and enterprise-grade infrastructure.

The ‘Arbitrum Everywhere’ framework spans the full application cycle, with developers launching on Arbitrum One, a shared liquidity layer. Launching on Arbitrum One supports seamless scaling as programs benefit from the ecosystem.

The Messari report stated that “As applications mature, builders can migrate operations to a configurable, customized Arbitrum Chain built with Arbitrum Nitro technology. Together, Arbitrum One and Arbitrum Orbit underpin Arbitrum Everywhere, positioning Arbitrum as a leading infrastructure layer for tomorrow’s apps.”

'Arbitrum Everywhere' operates through four vertical pillars: Builder Freedom, Enterprise-Ready, DeFi Unchained and a Digital Sovereign Nation.

Builder Freedom ensures that technology adapts to builders throughout the application life cycle. The Enterprise Ready pillar ensures that the infrastructure is validated by institutional-grade applications launched to execute on top of it. DeFi Unchained supports composable liquidity and has an active user base, strengthening the platform’s leadership in the Decentralized Finance (DeFi) sector. Lastly, the Digital Sovereign Nation is an economic engine managed by Arbitrum DAO and drives value to stakeholders through a growth flywheel.

Technical outlook: Can Arbitrum defend key support?

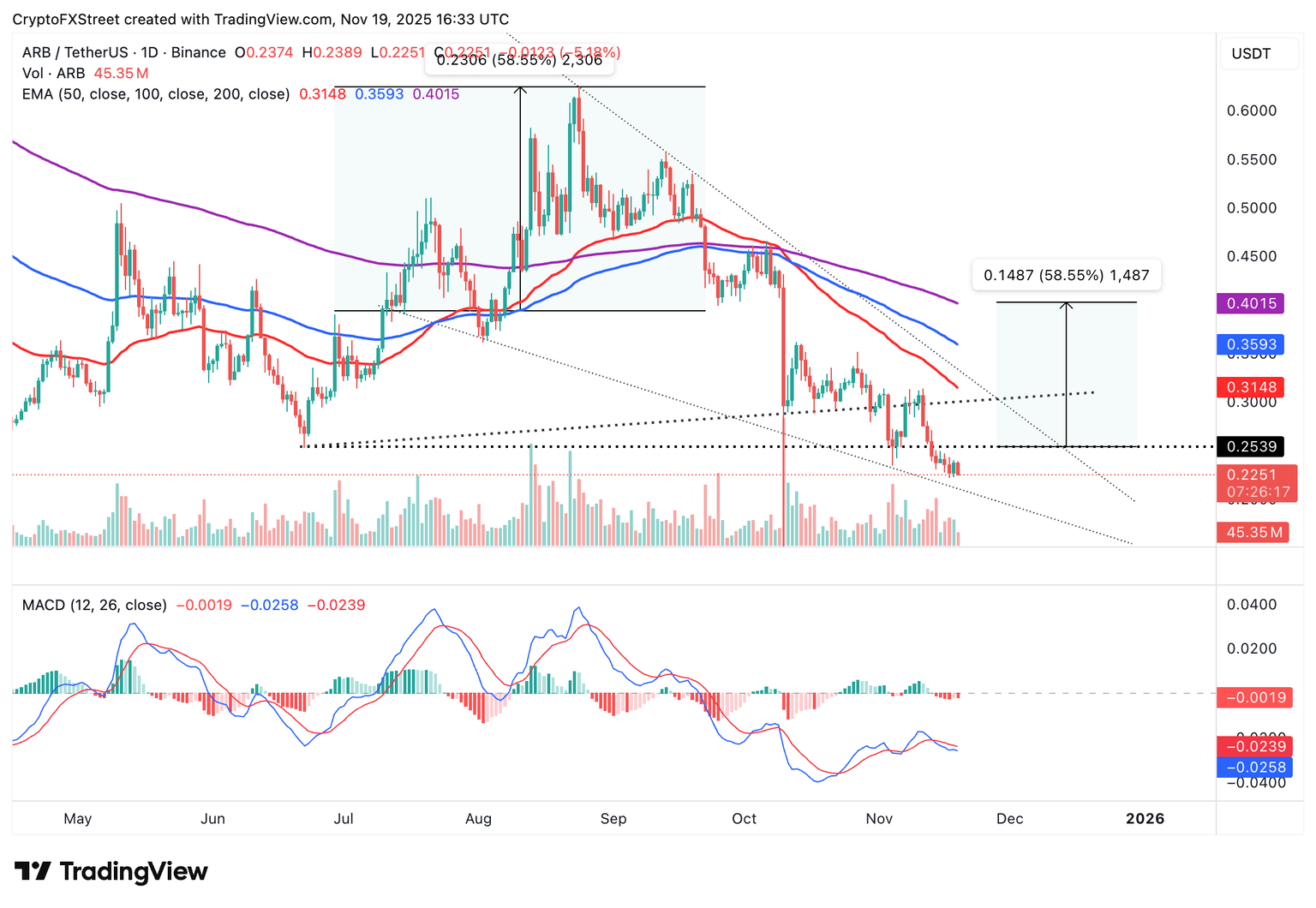

Arbitrum is trading above $0.22 amid heightened volatility in the broader cryptocurrency market on Wednesday. The token sits below key moving averages, including the 50-day Exponent Moving Average (EMA) at $0.31, the 100-day EMA at $0.35 and the 200-day EMA at $0.40, all of which reinforce the bearish outlook while highlighting key resistance levels.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart has maintained a sell signal since Friday, suggesting investors reduce their risk exposure.

Traders will be inclined to short ARB if the blue MACD line remains below the red signal line, which will contribute to selling pressure. Arbitrum may extend the downtrend below $0.20 if the immediate $0.22 support breaks.

Still, if investors buy the dip, ARB could reverse the trend toward a short-term hurdle at $0.25. A falling wedge pattern on the same daily chart estimates a 58% upswing to $0.40 if ARB breaks above the upper trendline.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren