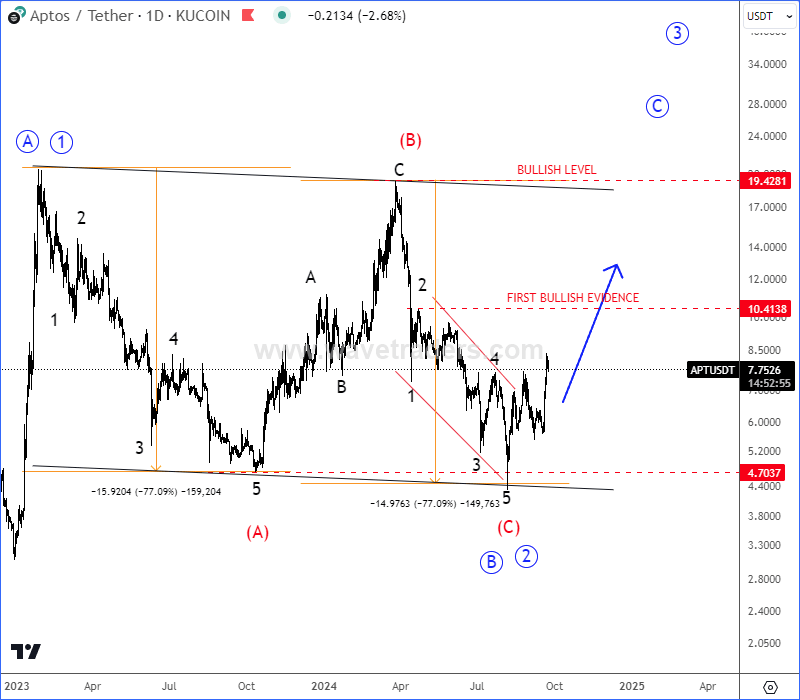

Aptos is ready for new rally

Aptos is a Layer 1 Proof-of-Stake (PoS) blockchain developed by Aptos Labs. It uses the Move programming language, originally created by Meta for the Libra blockchain, to enhance security and scalability. Aptos aims to promote web3 adoption and support a diverse ecosystem of decentralized applications (DApps). The blockchain can theoretically process over 150,000 transactions per second through parallel execution. The native token of the Aptos network is APT, with an initial supply of 1 billion tokens.

Aptos with ticker APTUSD made a big decline recently, but still looks like a larger (A)-(B)-(C) corrective setback in wave B/2. It's ideally finishing a zig-zag corrective pattern with equal wavelength of waves (A)=(C) and with an ending diagonal (wedge) pattern within wave (C) of B/2.

It's actually already bouncing from interesting channel support line and strong 4 support area that can be signal that bulls are back, but to confirm further rally within higher degree wave C or 3, it would be nice to see it at least back above 10 first bullish evidence level.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.