Analyzing the kind of investors involved in the current Cardano price sell-off

- Cardano price is down 30% for the month of November.

- The bears have produced a breakout from a bearish pennant which could target the $0.20 zone.

- A breach of the $0.35 resistance zone could induce a countertrend rally into the $0.39 price territory.

Cardano price is enduring a strong downswing that is aiming to wipe out long-term investors' profits and liquidity. If market conditions persist, the smart contract token will continue to decline in the days to come. Key levels have been defined to gauge ADA's potential landing zones.

Cardano price braces for pain

Cardano price continues to pile on negative returns during November. Since the start of the month, ADA, the self-proclaimed Ethereum killer token, has fallen by 30%. Now, as the bears pack on more strength following days of consolidation above the recently breached $0.30 zone, traders must consider reviewing support levels dating as far back as 2020.

Cardano price currently auctions at $0.30. Like several top cryptos, the smart contract token produced a breakout from a bearish pennant pattern that formed during the last consolidation. Using classical technical analysis, a projection could be made from the pennant targeting $0.25. There is also a swing low near the $0.23 level established in 2020 that was never once challenged during the 2020 bullrun.

ADA/USDT 1-Day Chart

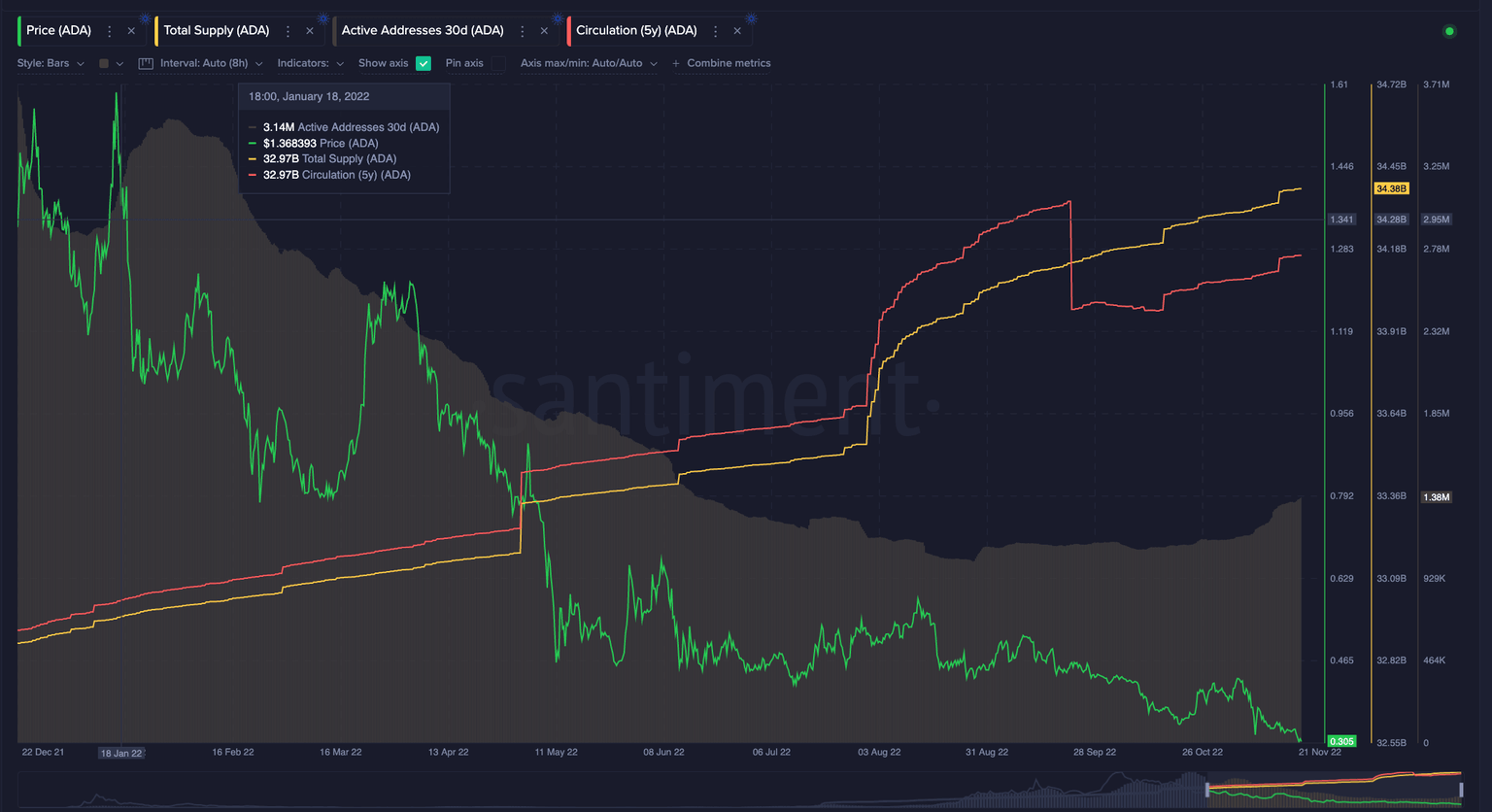

Santiment's Onchain Analysis indicators provide confounding evidence ADA's downtrend is far from over. Utilizing the Total supply, Circulation of 5-year Old Tokens, and Active Addresses within the last 30 days, one can spot a correlation between price and the kind of sellers involved. The Total Supply and 5-Year Circulation indicators are witnessing a steep incline as the ADA price persistently loses value. The Active Addresses Within 30 days indicator shows an uptick in activity during the recent sell-off, signaling investors are beginning to reach their limits and are planning to secure profits.

Based on the technical and on-chain factors, further decline is highly likely for the ADA price. However, invalidation of the bearish thesis could arrive if the bulls can reconquer the recently breached 8-day exponential moving average at $0.32. If the bulls succeed, an additional uptrend hike targeting the 21-day simple moving average near $0.36 would be on the cards. Such a move would result in a 20% increase from the current Cardano price.

In the following video, our analysts deep dive into the price action of Cardano, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.