An even bigger mining difficulty drop? Five things to watch in Bitcoin this week

Bitcoin (BTC) starts a new week in familiar territory after a weekend of solid gains ended in a drawdown — what’s in store?

With another rally to near $36,000 under its belt, the largest cryptocurrency is showing signs of strength, but old resistance levels remain in place.

The conditions are complex — the ongoing miner migration and associated price action have alarmed many, and Bitcoin’s most accurate forecasting tools are seeing a real test.

With fundamentals finally showing signs of life, however, bulls may finally have something to celebrate.

Cointelegraph considers five factors at play when it comes to BTC/USD this week.

Stocks records and oil feud

It’s another eerie “Roaring Twenties” style mood on major markets this week thanks to the S&P 500 seeing new all-time highs for seven straight days.

Encouraging economic data from the United States plus the Federal Reserve keeping interventions has pushed the equities index ever higher in recent weeks.

“Markets are priced for the continuation of a scenario that could not be better constructed,” Chris Iggo, chief investment officer for core investments at Netherlands-based AXA Investment Managers, summarized in a note quoted by Bloomberg.

An interesting twist is oil, now at the center of another OPEC+ production row, which is itself gaining but sparking concerns about how much fuel will be available in August.

With the U.S. dollar steady, it seems that the equities narrative is the likely driver going forward — this scenario traditionally helping Bitcoin price action.

S&P 500 1-day candle chart. Source: TradingView

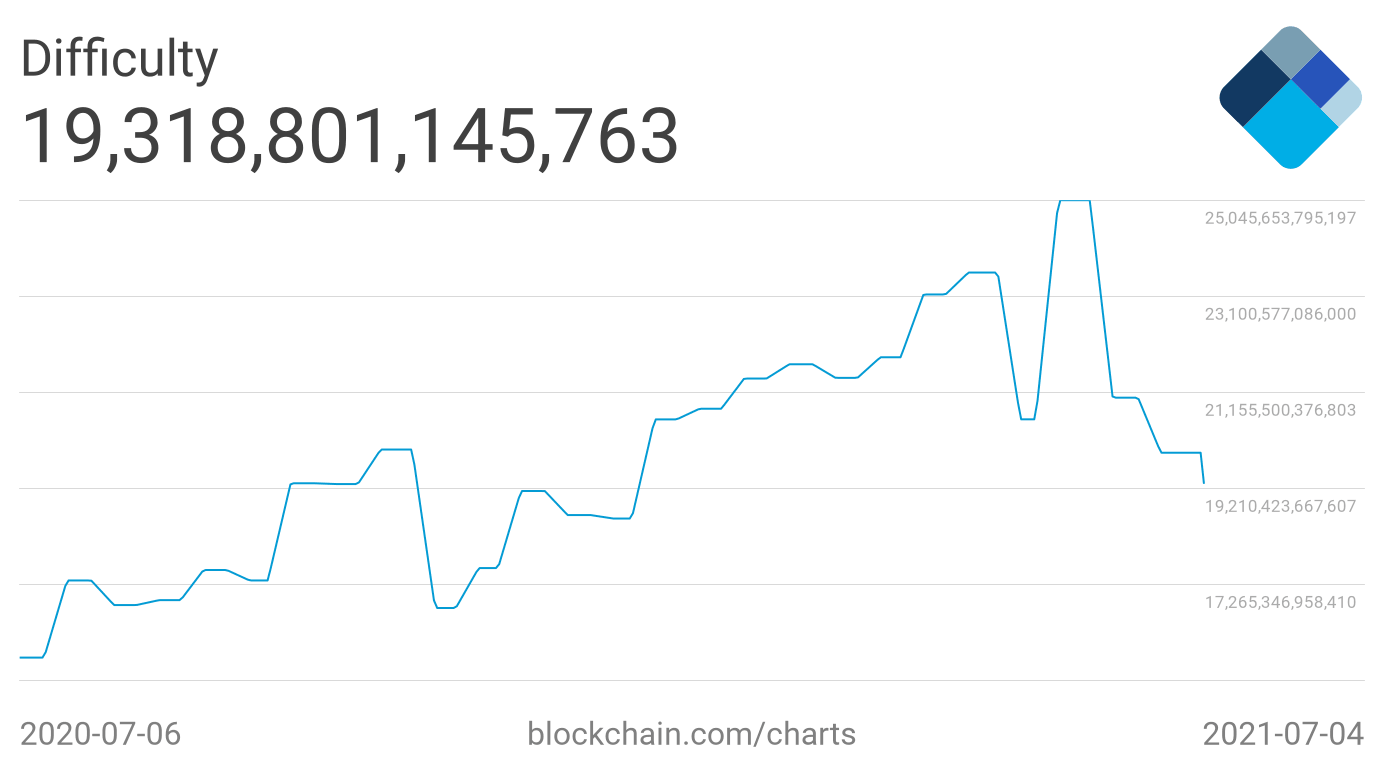

Fundamentals aren’t out of the woods

Bitcoin may have seen its biggest-ever difficulty decrease this weekend, but even that may not be enough to steady the ship.

At 27.94%, Saturday’s decrease easily beats any that have come before, reflecting the impact of China’s war on mining on the Bitcoin network.

According to data from monitoring resource BTC.com, however, the next adjustment may see an even larger drop.

As difficulty adjustments can only ever be estimated before they actually take place, and a lot can change over each two-week difficulty period, it is difficult to say just how much the metric needs to decrease to reflect the true state of the network.

Given the latest drop, mining is now significantly more economically attractive to many current and potential participants. As such, in the coming 13 days, more miners may well begin operating, increasing the hash rate and thus perhaps mitigating the need to decrease difficulty much further.

A look at hash rate activity in recent days shows that a U-turn may have already taken place, with the hash rate spiking above 90 exahashes per second (EH/s) versus lows of 83 EH/s last week.

At the time of writing, however, Bitcoin is on track to lower difficulty by another 28.68%.

“After yesterday’s record-breaking -27.9% difficulty adjustment, Bitcoin’s difficulty is now similar to the levels after last year’s halving event,” popular Twitter account Dilution-proof noted on Sunday alongside an annotated difficulty chart.

“Price, however, is +263% higher. This illustrates how incredibly profitable bitcoin mining has become for efficient miners.”

Bitcoin difficulty 7-day average chart. Source: Blockchain.com

BTC price action spooked at $36,000

The difficulty drop at least had good timing; once in, Bitcoin price action saw a welcome boost and climbed back toward the upper bound of its trading range.

Throughout the rest of the weekend, BTC/USD saw little by way of resistance and added around 5% before retracing.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

What could cap the enthusiasm further? For popular analyst Rekt Capital, two now-infamous moving averages (MAs) may be bears’ best friend in the coming days.

As Cointelegraph reported, BTC/USD saw a “death cross” event last month. This refers to the 50-day MA crossing under the 200-day MA, an occurrence that is traditionally regarded as a bearish signal.

In reality, “death crosses” have not always led to price losses, but their reputation remains firm this year.

Now, current price strength may get a taste of reality should Bitcoin reach either MA, currently floating above spot price.

“Once BTC is able to clear $36000... Next major resistance will be the ~$38000 area,” Rekt Capital explained on Sunday, adding a summary chart.

“Not only is this the Range High of the macro consolidation range Bitcoin is in now... But the two $BTC Death Cross EMAs (50 blue & 200 black) will likely act as confluent resistance there too.”

BTC/USD annotated chart with “death cross.” Source: Rekt Capital/Twitter

Trader Crypto Ed, meanwhile, warned on Monday that the weekend’s ground would ultimately be lost again.

“Full retrace coming up,” he said, arguing that the market needed “proper retests” of lower levels in order to fuel a true bullish resurgence.

BTC/USD corrected from highs of $35,900 to bounce off $34,000, a level that is still holding at the time of writing.

Volume fails to buoy bull case

The weekend rally was suspicious for those eyeing one classic market trait — volume.

Despite the brisk pace of gains, volume supporting them remained low, and as such, their reliability and ability to sustain themselves was in question from the outset.

On Monday, on-chain monitoring service CryptoQuant noted that volumes are still declining, pointing to a lack of interest from major prospective buyers.

“BOTH Inflow and outflow are drying out with the trading volume in the market. Seems like the whales are staying low without much actions,” the firm said in a blog post.

“Push to either side of the market would have a high possibility of triggering a relatively big reaction to the price.”

Bitcoin volume data chart. Source: CryptoQuant

On Saturday, however, statistician Willy Woo noted an instantaneous uptick in Bitcoin entities holding large amounts of BTC — a classic signal that whales are interested. This followed the downward difficulty adjustment.

As Cointelegraph reported, other investor profiles are also getting in on the spare Bitcoin supply, notably the so-called “Rick Astley” type, or hodler of last resort.

“Mr Astley is saying ‘shorters gonna get rekt,’” Woo commented alongside additional supporting data.

Investor confidence slowly return

Just how bearish is the average Bitcoin market participant now?

That question is traditionally answered by the Crypto Fear & Greed Index, and if to believe its readings this week, things may not be all that bad.

On Monday, Fear & Greed reached its highest score in nearly three weeks — 29/100. The last time this happened, BTC/USD was on its way to June’s local top above $41,000.

Fear & Greed uses a basket of factors to deliver sentiment estimates for cryptocurrency markets and thus helps identify when assets are overbought or oversold at a specific price.

Its bullish tops tend to reach 95/100 or more, leaving plenty of room for Bitcoin to grow before “extreme greed” enters and sparks a rout.

The index saw lows of 10/100 — “extreme fear” — on June 22 before rebounding.

Crypto Fear & Greed Index 1-month chart. Source: Alternative.me

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.