Aave price eying up 50% move as AMM Market gets released

- Aave price hasn't moved much yet, but it's on the verge of a potential 50% break.

- The Aave protocol has just launched its AMM Liquidity Pool.

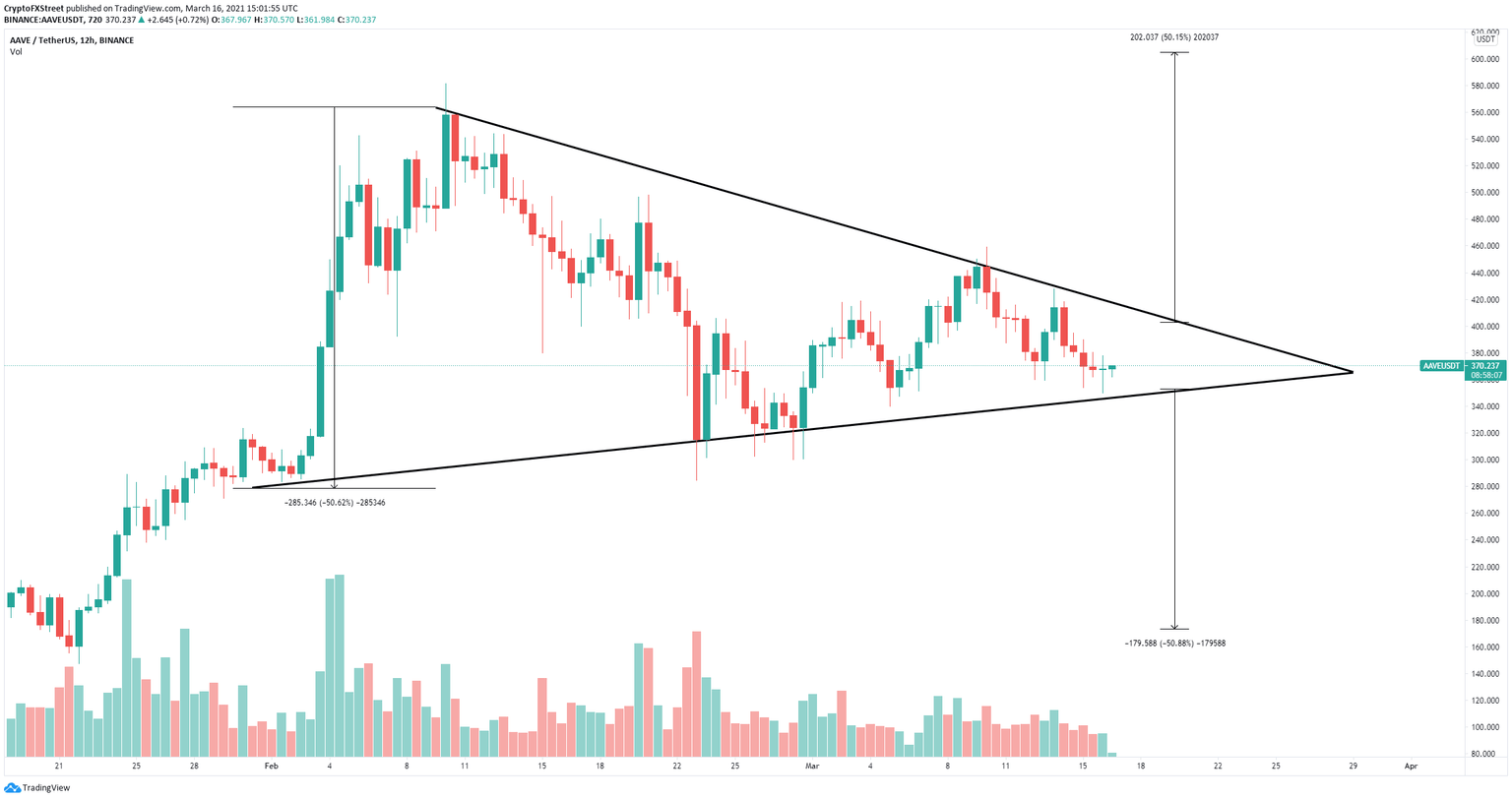

- AAVE is contained inside a symmetrical triangle pattern on the brink of bursting.

The Aave protocol has finally released its new AMM Liquidity Pool while AAVE price is on the verge of bursting. The pool will support several Uniswap V2 LP tokens.

Aave launches AMM Market to enable customers to use LP tokens as collateral

Aave Protocol has launched its brand new AMM Liquidity Pool, which will enable liquidity providers to utilize Uniswap and Balancer LP tokens as collateral in the Aave platform.

With the rise of Uniswap in 2018 and the emergence of “Automated Market Makers” (AMMs) in the DeFi ecosystem, users of Ethereum are now able to swap assets without the need for centralised third-party intermediaries. Users are able to facilitate the provision of liquidity and earn fees for doing so

For the support of new collaterals and AMM protocols, AAVE holders will decide as the Aave protocol uses a governance system.

Aave price is contained inside a tightening range ready to burst

On the 12-hour chart, Aave price has established a symmetrical triangle pattern which is on the brink of a massive move. The key resistance level is located at $404 and the support at $350.

AAVE/USD 12-hour chart

A breakout above $404 should quickly push Aave price towards a high of $600 but could stop at $460 and $500 first. This 50% upswing is calculated using the height of the pattern as a reference point.

On the other hand, a breakdown below $350 will drive Aave price to a low of $172 with a potential brief stop at $280.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.