Aave price could drop 20% as demand barriers dissipate

- Aave price hints at a 20% correction as it nears the end of a bearish pattern.

- Transactional data shows non-existent support below the current price level at $395.

- A bullish scenario might come into play if AAVE climbs above $445.

Aave price has been trending higher but could drop soon due to the formation of a bearish pattern.

Aave price eyes a pullback

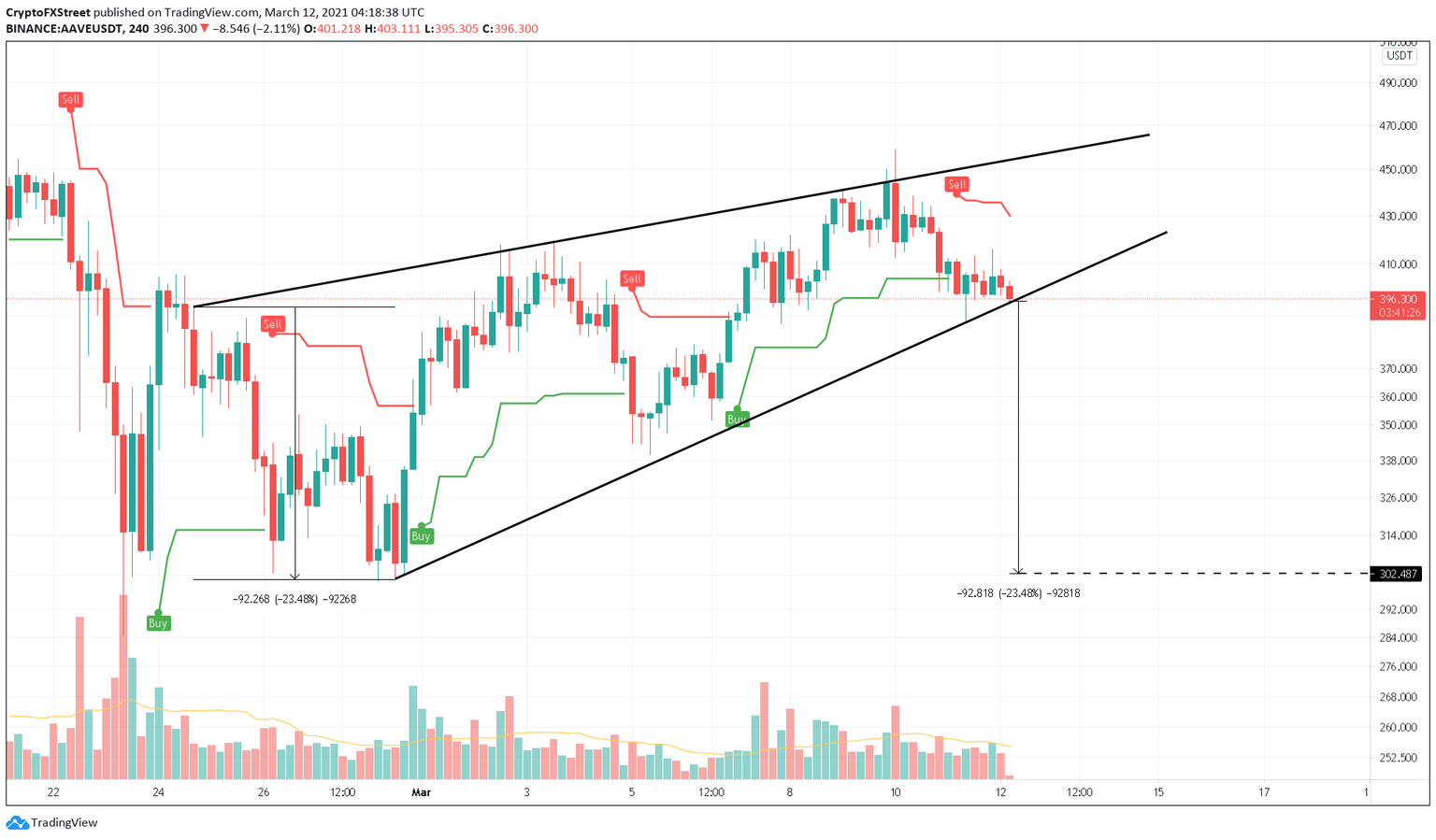

Aave price has formed three higher highs and three lower lows since February 24. Drawing trendlines along the swing highs and the swing lows results in a rising wedge pattern. This pattern forecasts a 23% downswing, determined by measuring the distance between the pivot points at the widest part of the wedge and adding it to the breakout point at $395.

Therefore, a 4-hour candlestick close below $395 will signal the end of the rising wedge pattern and kickstart a downtrend to $302.

Supporting this bearish thesis for Aave is the recently spawned sell signal by the SuperTrending indicator.

AAVE/USDT 4-hour chart

According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, Aave’s condition looks dire as it shows a massive cluster of underwater investors around the $408 level. Here, roughly 2,600 addresses that previously purchased 3.45 million AAVE are “Out of the Money.” Hence, these market participants might deter any short-term bullish momentum by selling their holdings to breakeven.

However, what’s worrisome is that the DeFi coin shows little to no support present below the current AAVE price. IOMAP cohorts reveal a tiny support level at $379, where 1,600 addresses hold 302,000 AAVE tokens.

Aave IOMAP chart

However, a sudden spike in buying pressure leading to a decisive close above $401 will temporarily remove selling pressure from the underwater investors present at that level. In such a case, AAVE price might surge higher.

A 4-hour candlestick close above $445 will invalidate the bearish outlook as it would create a higher high and signal a resurgence of bullish momentum.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.