Year ahead 2026 – Will Gold continue defying gravity?

- Gold skyrockets in 2025 amid safe haven flows and Fed cut bets.

- Investors anticipate more than two rate cuts for next year.

- Geopolitical conflicts, tariffs and central bank buying also drivers.

- Uptrend may extend towards the round figure of $5,000 in 2026.

Gold soars more than 50% in 2025

Gold emerged as the standout performer in 2025 among the major assets on our radar, delivering a remarkable year-to-date gain of roughly 60%. Even the once-mighty Bitcoin is headed into year-end with a loss of nearly 6%, while the S&P 500 has advanced about 17%.

The stars aligned for the precious metal in 2025, but this then raises the key question of whether there is still enough fuel in the tank for its powerful uptrend to continue. Gold has been breaking record high after record high this year, driven primarily by safe-haven inflows and growing expectations that the Federal Reserve may need to resume rate cuts at an aggressive pace.

Fed rate cut bets reduce Gold’s opportunity cost

Getting the ball rolling with the Fed, after remaining on the sidelines for the better part of the year, the Committee reignited its easing cycle in September with a quarter-point rate cut, followed by another same-sized reduction in October.

Although the probability of a third consecutive reduction in December was initially low following the October meeting, the weakness revealed in delayed data – held up by the US government shutdown – combined with dovish signals by key policymakers, including the influential New York Fed President John Williams, pushed those odds to roughly 85%. Looking ahead to 2026, markets are still pricing in around 60bps worth of additional easing, effectively two quarter-point cuts and a coin-flip chance of a third.

And although this outlook already appears overly dovish, there remains a risk that the implied rate path could be marked down even further. The current presidential terms across the regional Fed banks end on February 28, while Fed Chair Powell steps down on May 15. Against this backdrop, and with US President Trump pressuring for more forceful rate cuts, the risk is that the Fed adopts a markedly more dovish tone next year.

Geopolitical conflicts and tariffs drive flight to safety

Geopolitical tensions have also been a driving force for gold this year, reinforcing its role as a safe-haven asset. The wars in Ukraine and the Gaza Strip continued to rage, while frictions across the Middle East escalated, leading to missile and drone exchanges between Israel and Iran. Meanwhile, tensions between India and Pakistan flared in 2025, and the long-running Sudanese Civil War remained active.

However, military conflicts were not the only catalyst for safe-haven inflows into gold. Trump’s so-called “Liberation Day”, when he announced sweeping tariffs on nearly all nations worldwide, along with the ensuing threats and levies exchanged with China, further bolstered demand for the yellow metal.

Although markets were quick to shift focus as some conflicts eased or were temporarily resolved, gold continued to attract flows, potentially as investors sought to hedge their increasing exposure to riskier assets, such as equities, especially with valuations briefly surpassing their 2020 highs and uncertainty remaining elevated. After all, a new spat seems to have emerged recently, between China and Japan, triggered by remarks concerning Taiwan.

Taken together, the recurring emergence of geopolitical risks, coupled with an ultra-dovish Fed outlook, could provide sustained support for gold as we head into 2026.

Central banks double down on gold reserves

The de-dollarization theme may be another variable with a positive sign in the gold equation. Central banks have continued to diversify their reserves by piling up gold. Since Donald Trump’s election as US President, China has been a consistent buyer of gold, underscoring the nation’s willingness to gradually reduce reliance on US treasury assets and the dollar and mitigate the potential economic impact of future trade conflicts.

The Reserve Bank of India also added to its reserves in light of import price pressures, while several other emerging-market central banks – including the National Bank of Kazakhstan, the Central Bank of Turkey, and the Central Bank of Uzbekistan – have joined the trend.

Thus, with uncertainty surrounding US trade policies remaining high, central banks are unlikely to stop accumulating gold, which could continue supporting the metal in 2026.

Gold/Silver ratio

As noted in the first paragraph, gold outperformed the key assets we track most closely. However, it lagged both silver and platinum, with the former surging more than 100% in 2025. One factor behind some investors’ shift to silver may have been gold’s earlier steep rally, which drove the gold/silver ratio to levels seen back during the pandemic. However, with silver skyrocketing this year, the ratio tumbled, and it is now approaching the 70 mark – a threshold rarely and only briefly breached since 2014. This dynamic could signal a potential rebound in the ratio, potentially fueling a renewed acceleration in the gold rally, at least during the first months of 2026.

Downside risks remain far from negligible

However, this does not imply that the overly bullish outlook of the precious metal is without risks. One development arguing for a slowdown to a further rally in gold prices may be China’s decision to cut the tax exemption on certain gold holdings. This could dampen local demand and perhaps exert downward pressure on prices. Over the longer term, though, this measure could enhance market transparency and ultimately support investment demand.

Moreover, as gold prices consistently ventured into uncharted territory in 2025, India saw a huge drop in jewelry demand. Although people appear to have shifted to investment-oriented gold holdings, such as ETFs and other paper-based gold products, the nation saw a 16% drop in overall gold demand in Q3 2025. The global picture mirrored this trend. According to the World Gold Council, jewelry consumption worldwide saw a double-digit 31% y/y decline, even as investment demand remained robust and central bank purchases stayed strong. Consequently, total demand grew only 3% y/y in Q3.

Gold could hit $5,000 before slowing down

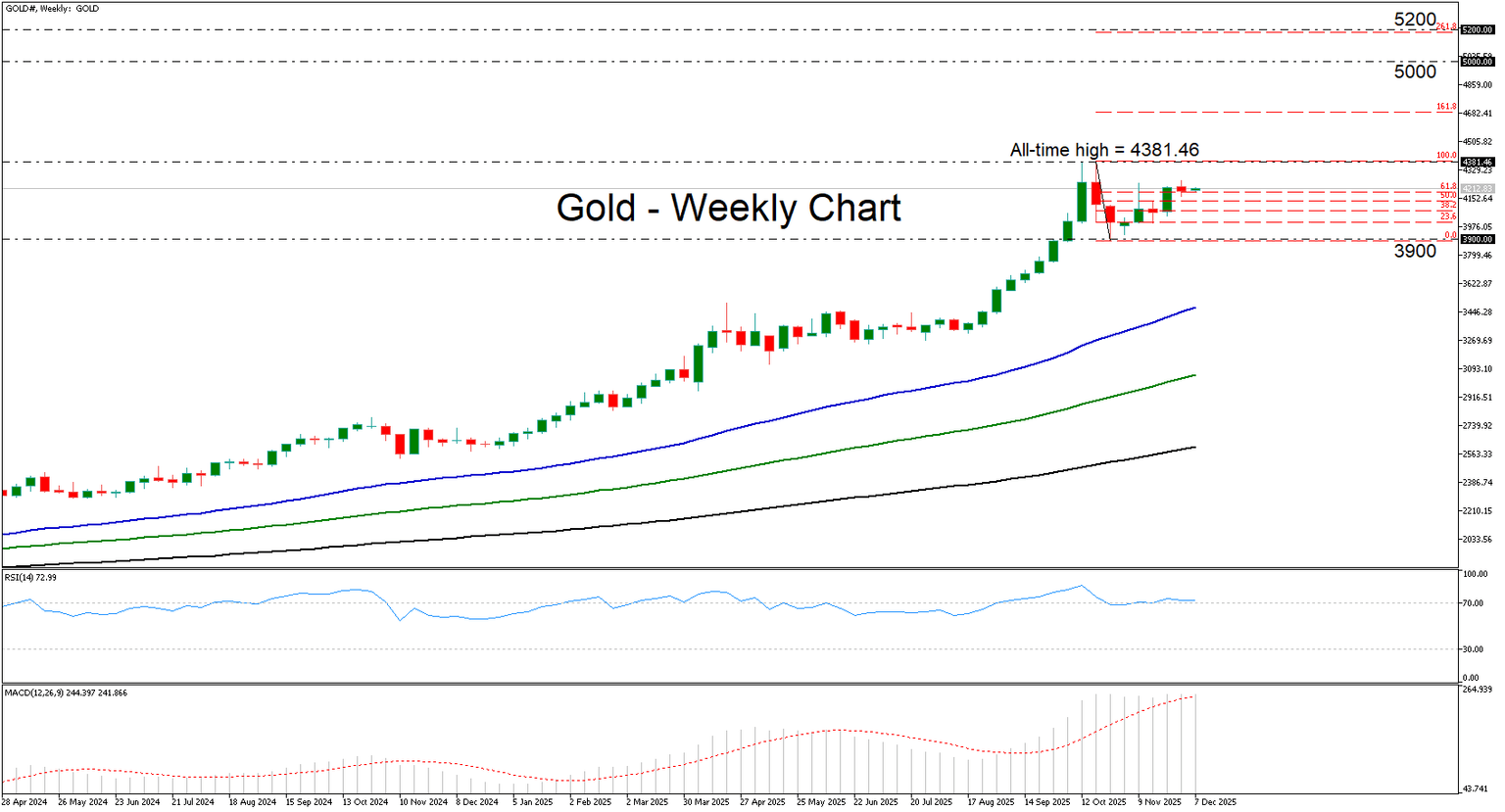

Overall, the factors that propelled gold to hit record high after record high in 2025 remain firmly in place, suggesting that the precious metal may extend its uptrend into the early months, or even the first half of 2026. The bulls could target the round figure of $5,000 or the $5,200 zone, which lies near the 261.8% Fibonacci extension level of the October 20-28 correction.

That said, further gains in gold would not only challenge retailers and investors but could also prompt some central banks to adopt a more cautious stance when it comes to piling reserves, with some of them perhaps deciding to take the sidelines again for a while. There is also the risk that the Fed implements fewer rate cuts in 2026 than currently baked into the cake by the market should the US economy perform strongly. Thus, if the Fed disappoints gold bulls, the precious metal could slow down or enter a sideways phase during the second half of the year.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.