XAU/USD outlook: Gold rises above $2000 as escalating crisis boosts safe-haven demand

XAU/USD

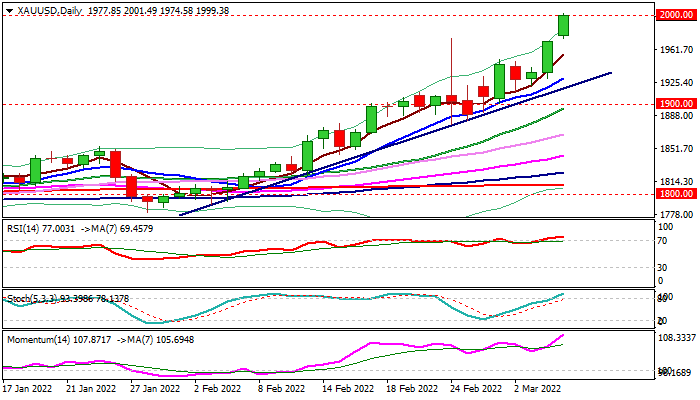

Spot gold hit $2000 per ounce this morning, for the first time since August 2020, as uncertainty about global economy in light of the consequences of the Russia-Ukraine war and Western sanctions on Russia, as talks about including Russian energy products into the package of restrictions, strongly increased global uncertainty and boosted safe-haven demand.

The yellow metal advanced 2.6% last week, as crisis deepened, but advanced 1.2% only in early Monday’s trading after starting the week with gap higher, signaling that the latest acceleration could extend much higher. Close above $2000 is needed to confirm strong bullish bias and expose targets at $2015/$2049 (Aug/Sep 2020 peaks) which guard a record high at $2074, posted in Oct 2020.

Further escalation of the crisis could inflate gold price above these levels and unmask next targets at $2100 (round-figure) and $2168 (Fibo 123.6% projection of the rally from $1676 (Mar 2021 low).

Solid supports lay at $1980/74 (broken Fibo 76.4% of $2074/$1676 / Feb 24 spike high), followed by daily Tenkan-sen ($1940) and trendline support at $1925.

Res: 2015; 2049; 2074; 2100.

Sup: 1980; 1974; 1950; 1940.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.