XAU/USD outlook: Gold extends advance, inflated by US stimulus hopes

GOLD

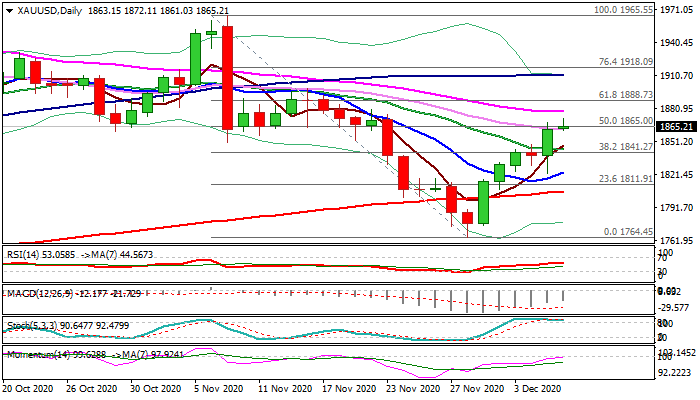

Spot gold hit new two-week high ($1872) on Tuesday, in extension of previous day's 1.3% advance, the biggest one-day rally since Dec 1.

Fresh hopes on a US fiscal stimulus deal to support the economy hurt by surging coronavirus infections, deflated dollar and provided fresh boost to the yellow metal.

Markets are pricing in that a deal will be reached and focusing on the size of the package, with expectations for the lower amount than markets anticipate that would provide further support for gold.

Fresh advance probes through 50% retracement of $1965/$1764 bear-leg and pressures falling 55DMA ($1877), break of which would expose key barriers at $1888/94 (Fibo 61.8%/daily cloud base).

Rising 14-d momentum is about to break into positive territory and magnetic thinning daily cloud support the near-term action, but overbought stochastic warns.

Traders focus on two key drivers – US stimulus and Brexit - and remain cautious as another stall in stimulus talks and prolonged Brexit uncertainty, could bring gold price under fresh pressure.

Broken 30DMA provides immediate support at $1861, with key supports at $1844/41 (20DMA/broken Fibo 38.2%)

Res: 1872; 1877; 1888; 1894

Sup: 1861; 1850; 1844; 1841

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.