WTI Oil’s uptrend faces hazards [Video]

-

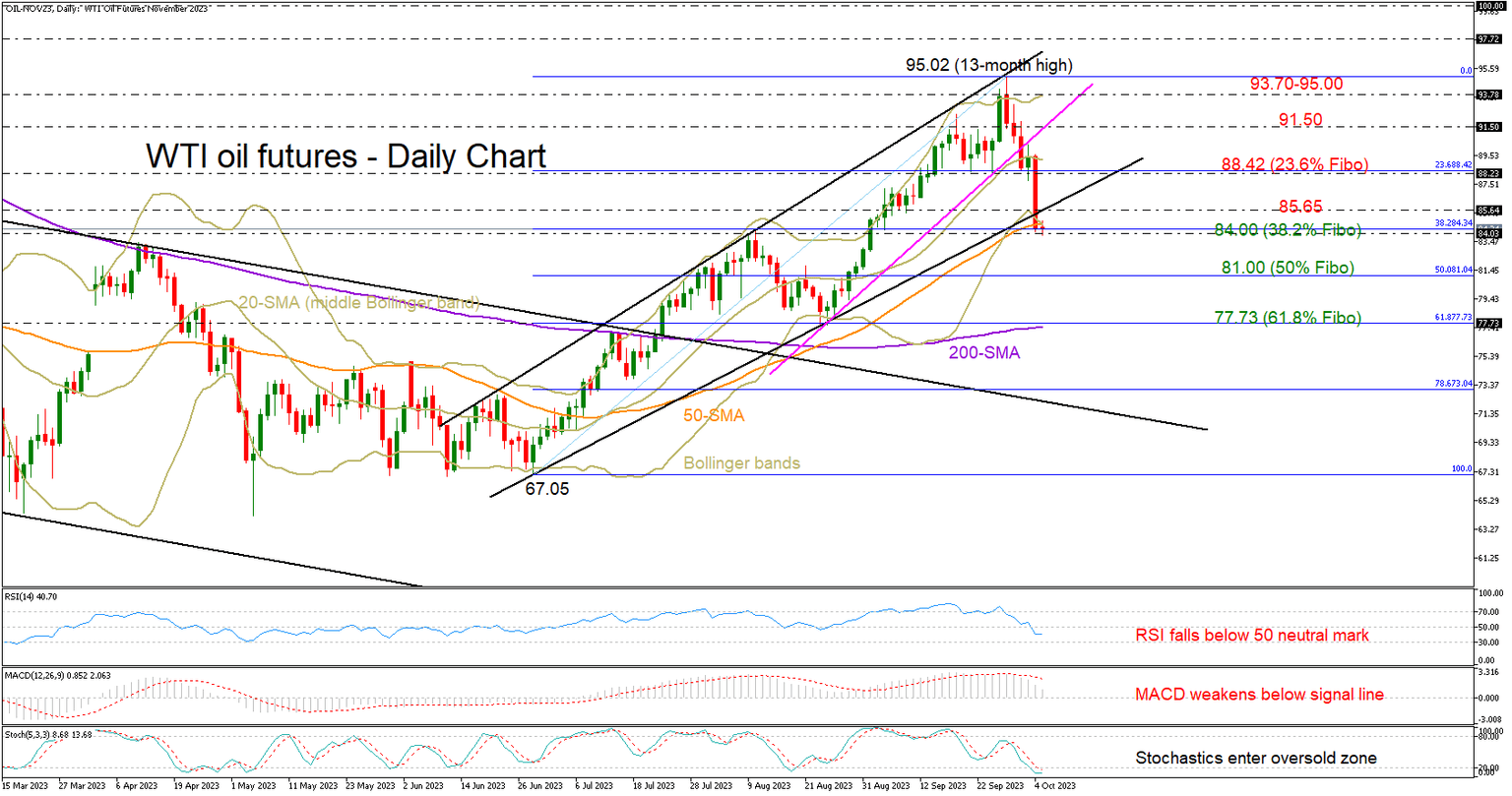

Oil rally at risk near 84.00 after latest freefall.

-

Bearish continuation likely, but patience required.

![WTI Oil’s uptrend faces hazards [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/oil-flows-out-of-barrel-20436219_XtraLarge.jpg)

WTI oil futures closed with heavy losses on Wednesday near a one-month low of 84.16 following the rejection near the 20-day simple moving average (SMA) at 89.40.

The 50-day SMA put the brakes on the bear run marginally below the support trendline from June. But the negative trajectory in the RSI, which has slipped below its 50 neutral mark, and the downward move in the MACD are currently suggesting the freefall has not bottomed out yet.

On the other hand, the oversold signals detected by the stochastic oscillator are leading to speculation that a consolidation phase or an upside correction could be underway. Note that the price is trading around the lower Bollinger band.

Hence, sellers could hold off until the price violates the June-September uptrend clearly below the 84.00 mark and the 38.2% Fibonacci retracement of the latest upleg. Such a downfall could pressure the price towards the 50% Fibonacci of 81.00 and then down to the 61.8% Fibonacci of 77.73, where the 200-day SMA is hovering.

Alternatively, a positive change in sentiment could encourage some buying, especially if the price crawls back above the broken support trendline at 85.65. In this case, the price could advance towards the 23.6% Fibonacci of 88.42 and again fight the 20-day SMA at 89.20. A successful move higher is expected to slow down around 91.40 before stretching towards the critical 93.70-95.00 resistance area.

Summing up, WTI oil futures are still vulnerable to downside risks, with selling forces expected to pick up pace below 84.00. Otherwise, the market may attempt to climb back above 85.65.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.