Will these Green Energy Stocks Gained 400% - 1300% in 2021? [Video]

![Will these Green Energy Stocks Gained 400% - 1300% in 2021? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/EnergyStocks/power-grid-637435385726548930_XtraLarge.jpg)

2021 Week 3 Market Recap

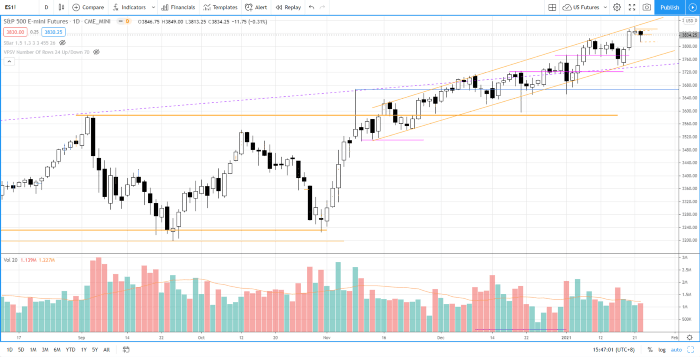

After S&P 500 futures (ES) tested the demand line of the up channel on 15 Jan’s break down with increasing supply, it quickly reversed up and broke the all time high again. In general supply has been decreasing since the start of 2021 while the price is trending up within the channel.

Long term & medium term uptrend are intact while short term is overbought and vulnerable for a consolidation or a pullback. Immediate support is at 3800–3815.

Strong Momentum Green Energy Stocks

With the prospects of the green infrastructure plan by Joe Biden, green energy sector has seen a resume of interest from the investors and traders. Five green energy stocks with strong momentum have been selected from from the PBW ETF (Invesco ETF Wilderhill Clean Energy), which are potentially near the buy point based on the technical analysis with price action trading and volume spread with Wyckoff analysis.

Check out the trading plan of each stock with entry point and stop loss based on either breakout trading or simple pullback trading strategy for these stocks — PBW, FUV, NIO, TSLA, ENPH, IEA. Watch the video below:

Timestamps

-

0:35 PBW (Invesco ETF Wilderhill Clean Energy).

-

3:02 FUV (Arcimoto INC).

-

7:05 NIO (NIO INC).

-

10:57 TSLA (TESLA INC).

-

14:03 ENPH (ENPHASE Energy INC).

-

17:13 IEA (Infrastructure & Energy Alternative).

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.