Will Drive the Traders' Euphoria to Dow Jones Till 28K?

This week the stock markets seem to be showing indications of euphoria. The Dow Jones index has reached new record highs exceeding 27,700 pts. Dow Jones earns 20.21% during this year.

The mood of traders seems to be increasingly relieved as tensions between the United States and China decrease.

Representatives of the governments of China and the United States said on Friday that both sides agreed to reduce tariffs if "phase one" of the trade agreement is completed.

The Minister of Commerce of China confirmed that both countries agreed to cancel tariffs in phases; however, there is no defined calendar yet.

White House spokeswoman Stephanie Grisham, meanwhile, said the United States is "very, very optimistic" in reaching an agreement to end the trade dispute that has lasted more than one year.

On the other hand, the third-quarter earnings season has shown substantial gains despite the trade war. With which the stock market is showing signs of recovery, and consequently, investors expect higher returns.

Technical Overview

Dow Jones 30 index in its daily chart, shows to the Industrial Average running in a rally after the contracting triangle breakout commented on November 01st.

According to the Elliott wave theory, the current path should develop in five waves. The acceleration observed in the 4-hour chart shows the possibility of a "climatic" movement.

Likely, a bullish movement to the 28,000 pts as a psychological level will be reached, creating a "spike" pattern.

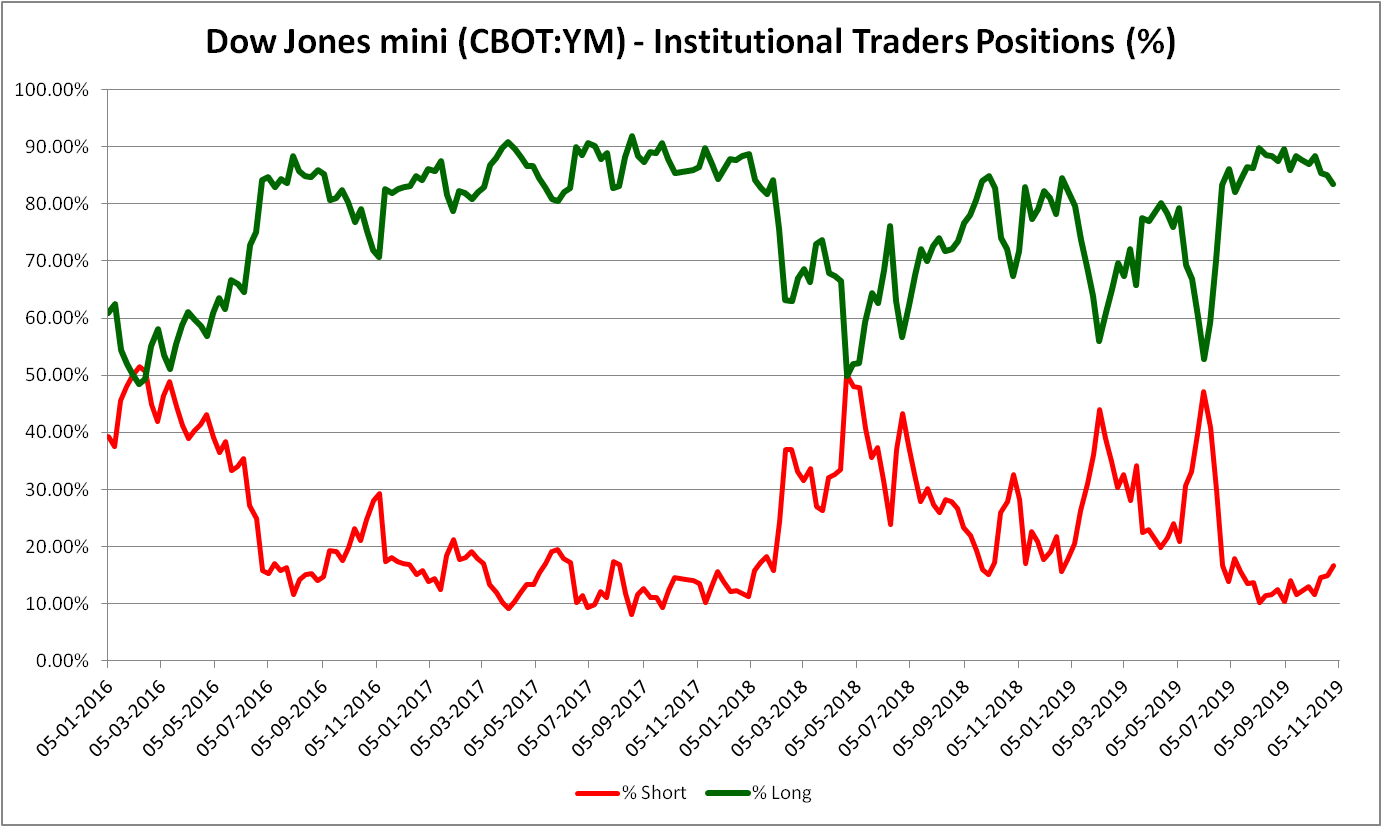

The latest CFTC report revealed that institutional traders increased their short positioning by 15.76% (WoW). With this increase, speculative traders jumped their sell-side positions to 16.63%.

In terms of the number of contracts opened, institutional traders hold 10,055 positions in the bearish side. This level is above the 13-weeks average at 7,059 contracts.

The Net Positions chart shows a decrease in the bullish bias. This context could provide a clue of the bull-market exhaustion.

As a summary, the market bias on Dow Jones still shows a bullish sentiment. However, both price action and institutional activity, the bull market looks in an exhaustion phase.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and

-637088275716210748.png&w=1536&q=95)