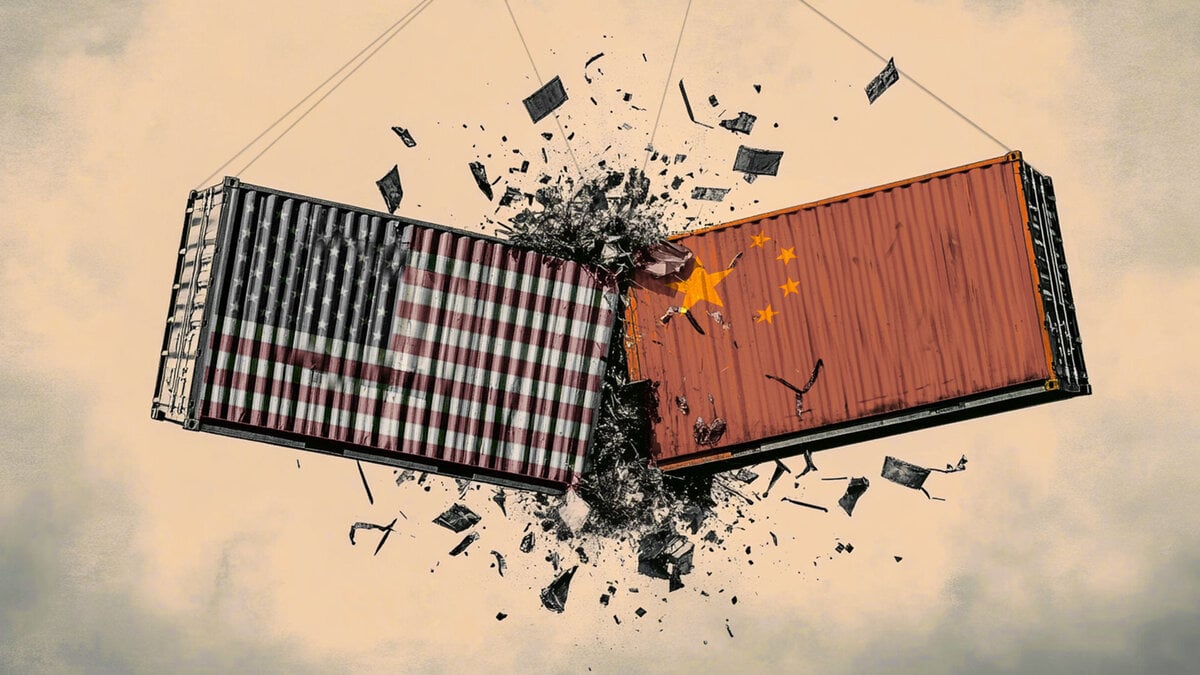

What’s the outlook for US-China relations after the one-year trading truce?

The US-China trade truce came as little surprise to Scope Ratings (Scope) and is no less welcome for that. The agreement appears comprehensive, and the relief from lifting various export controls, import embargoes and fines for the global economy comes at an important juncture. Unfortunately, like past deals between the trading partners, this is just a temporary agreement – for only one year as things stand.

During the negotiations, China used the significant leverage it holds over the US to force Donald Trump to the negotiating table specifically by rationing rare earth exports.

With many US industries heavily reliant on the China-dominated rare-earth value chain, Beijing has the means to extract meaningful concessions during trading disputes. China’s approach might also prove a playbook for larger trading blocs in managing their negotiations with the Trump government.

New trade tensions are very likely to emerge

Many details of the US-China deal remain to be worked out. New trade tensions are very likely to emerge. The upcoming US Supreme Court decision on many of the US tariffs might also create further uncertainty. The pattern observed during both Trump presidencies suggests repeated cycles of escalation for building negotiating leverage followed by de-escalation as a response to market, economic and/or political pressure.

US officials have described as “very successful” and “very substantial” the framework arrangement even as Chinese authorities have sounded far more cautious, describing the agreement as “preliminary” and “basic”. Such contrasting narratives may demonstrate who has held the upper hand (China) and who has been under more pressure to deliver a result (US).

The roller-coaster ride that is US-China trade relations has reached another high point with Trump even building up an idea of a global peace plan with Xi Jinping – demonstrating also how hollow many of the past threats may have been.

Existing tariffs weigh on the two economies

Scope’s modelling suggests existing tariffs weighing on the two economies, curtailing China’s medium-term real output by around 0.6pps while trimming 0.9pps from US GDP. Such mutually damaging economic outcomes underscore the pressure for ultimate de-escalation – even as tariffs stay above pre-dispute levels despite agreement on some reductions.

The cumulative medium-run impact of the tariff barriers on the level of real GDP

Baseline scenario, percentage points.

Source: Scope Ratings. The Scope baseline scenario represents the effects of those measures already announced by US president Trump since his re-inauguration as well as the reactionary counter-measures.

Author

Dennis Shen

Scope Ratings

Dennis Shen is Chair of the Macroeconomic Council and Lead Global Economist of Scope Ratings, the European rating agency, based in Berlin, Germany.