What’s the outlook for the Federal Reserve’s interest-rate policy?

Scope Ratings (Scope) expects the Federal Reserve to deliver a second consecutive 25bp “risk management” cut on Wednesday in response to the softer US jobs market and a slight easing in September core CPI. Futures markets are nearly fully pricing 25bps for this week and recent remarks by Federal Reserve Chairman Jerome Powell point in this broad direction.

Market attention will focus on the press conference and the signals of next steps. A further 25bp cut by December may be the going assumption but this is not pre-determined. Any rise in inflation and/or signs the softening in the labour market is proving temporary may embolden views among some governors for a pause after this week. Nevertheless, with the Fed’s “doves” in the driver’s seat, an early end to quantitative tightening looks likely.

The Fed remains divided

The Fed remains divided not least because of heightened political pressure and growing calls to change the inflation objective, which would facilitate the deep interest-rate cuts that the White House is seeking. Some Federal Open Market Committee members are voting as if the inflation target were already 3% rather than 2%, while others stress that inflation has stayed above a long-held 2% official goal for more than four years, so premature rate cuts could further de-anchor inflation expectations.

More increases in US trade tariffs and broader price pressures emphasise the need for caution. Persistent political interference could undermine the independence of the Fed and credibility regarding price stability, thereby eroding the confidence of capital markets.

The US economy has been growing resiliently, raising some questions around how long the softer labour-market data will last. The lack of official data during the current government shutdown also complicates decision making, encouraging policymakers to maintain the course they laid out during September in the absence of much further information.

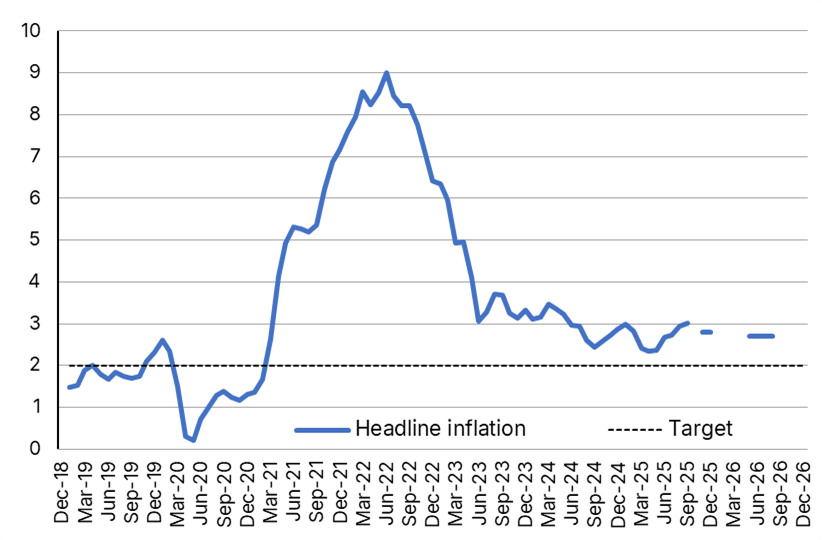

US inflation remains well above the official target

US headline consumer price index, % year on year.

Dashed lines on the graphic in 2025 and 2026 designate Scope estimates for calendar-year average inflation in 2025 and 2026. Source: US Bureau of Labor Statistics, Scope Ratings forecasts.

Author

Dennis Shen

Scope Ratings

Dennis Shen is Chair of the Macroeconomic Council and Lead Global Economist of Scope Ratings, the European rating agency, based in Berlin, Germany.