What’s driving the AUD?

Trading the AUD is made tricky at the moment because there are two different factors weighing heavily on it. Those two factors are the Australian domestic economy and the International negotiations going on with the US-China phase 1 trade deal expected to be announced today.

Australian domestic factors

On December 03 the RBA kept rates unchanged as expected, but Governor Lowe indicated the RBA were perhaps happier on the sidelines than the market was expecting. The phrase in focus from the RBA was their hint that the economy was at a ‘gentle turning point’. However, on the next day, the GDP data was a miss at 0.4% vs 0.5% expected. On December 05 retail sales data was another miss at 0.0% vs 0.3% indicating that consumer spending is still under pressure. On December 11, yesterday, the consumer confidence data further undermines the health of the Aussie consumer. The expectations from the investment bank Westpac are now for a RBA rate cut on their February 04 meeting. Domestically the AUD is under pressure. However AUD is rising at the moment due to optimism over the US-China trade deal.

International factors with the US-China trade war

The Australian economy receives around 30% of their GDP from China. So, a booming China is great news for the AUD. A positive resolution to the US-China trade dispute will be very supportive for the AUD. Whenever the market is optimistic about a US-China trade deal we see AUD strength and whenever pessimistic we see AUD weakness.

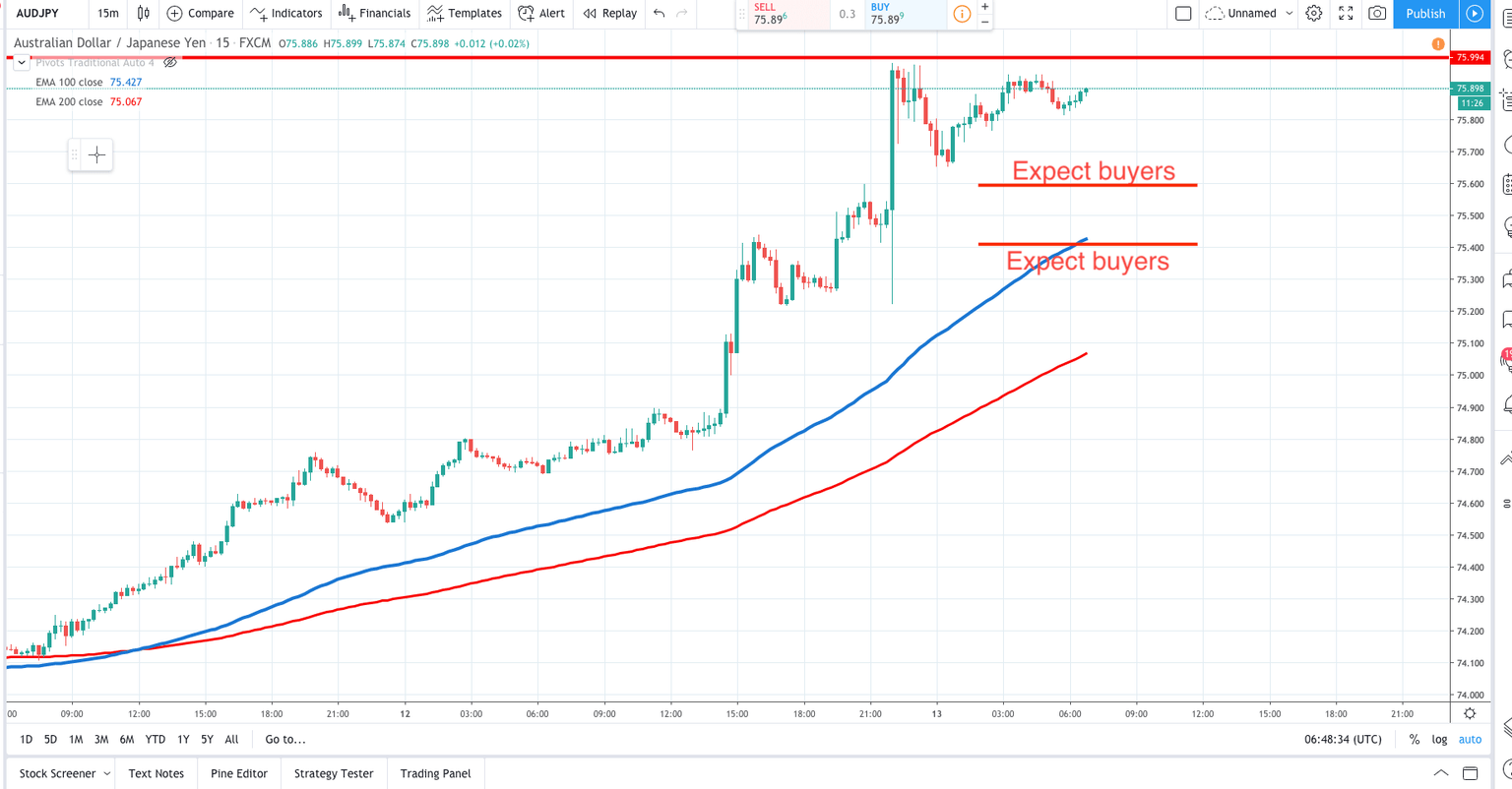

By keeping on top of these two factors we will get a good sense of where the AUD is headed. If, for example, we get a unexpected breakdown in the US-China trade deal in the next few days I expect that negative sentiment to marry together with the weaker domestic picture and create AUD downside. One great pair for a risk off mood is the AUDJPY pair since the JPY is bought on safe haven flows. The AUDJPY is also good for a risk on move since it gains on global optimism. The AUDJPY has been gaining steadily since the US announced that the December 15 tariffs would be delayed. I am expecing buyers on AUDJPY pullbacks today.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.