What the postponed Fed pivot means for Gold

As we predicted, Jerome Powell threw a bucket of cold water on gold and the rest of the markets, and we’re now experiencing sell-offs as expectations reset.

Gold – along with just about every other investment sector – continues to sell off in the wake of last week’s Fed meeting.

It wasn’t so bad after the Fed’s policy statement was released, nor during much of Chairman Powell’s subsequent press conference.

But then came a question as to the timing of the first rate cut, to which Powell replied:

"Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that (a rate cut)."

And so the sell-off began.

Then, in an interview on "60 Minutes" Sunday evening, he repeated that statement even more forcefully:

"We've said that we want to be more confident that inflation is moving down to (the Fed's target rate of) 2%. I think it's not likely that this committee will reach that level of confidence in time for the March meeting...."

And so the sell-off continued on Monday.

If you’ve been reading these newsletters, this isn’t coming as a surprise to you. Before the Fed meeting concluded, I wrote that...

"...Jerome Powell is probably going to push back on the idea that the first rate cut will come as soon as March, and this will be bearish for gold in the near term."

Bearish it has been, but perhaps not as bad as one might have expected, given the forcefulness of Powell’s statements. Gold’s lost about $30 since the Fed meeting, and even posted a nice gain last Thursday.

It could’ve been worse, considering how obsessed investors have been over the March meeting.

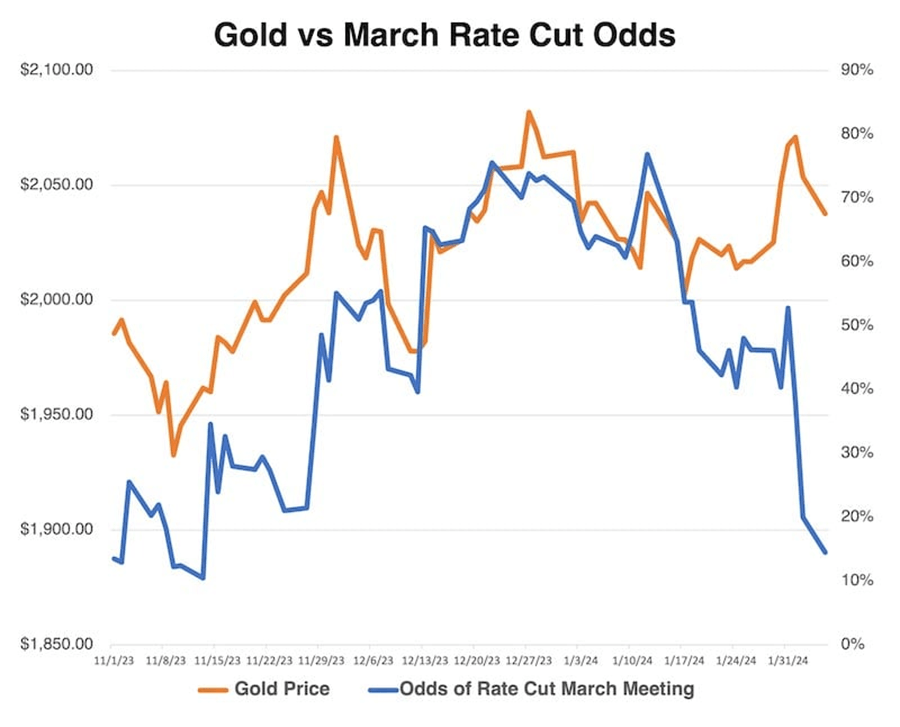

As you can see, over the last few months gold has risen and fallen along with investor expectations that the Fed pivot would begin in March.

The correlation weakened a little last week as U.S. retaliatory strikes on Iranian-sponsored militia groups sparked some gold-buying, but the connection remains the same.

And again, the reaction in gold could have been much worse, as fed funds futures odds for a March cut have plummeted from 53% just before the Fed policy statement last week to only 14.5% as I write.

A Meaningless Exercise

All of this short-term hand wringing and insane focus on every word uttered by any Fed official is ridiculous, to be sure.

I only report on it because gold is, unfortunately, caught up in all of it.

And not in a good way: The obsession with Fed policy has resulted in the weird calculation of current markets that high inflation is actually bearish for gold. It is so, the logic goes, because hotter inflation numbers will lead the Fed toward more-hawkish stances.

Never mind the relationship that has held throughout thousands of years of human history, that gold protects against the ravages of monetary inflation.

Asset values today aren’t established by thoughtful, longer-term investment decisions, but rather by bets on what’s going to move the next day, hour or even minute.

In this bizarro world where every market is dependent upon the flow of liquidity from the Fed like suckling piglets at their mother’s teats, a tilt in the direction of tighter monetary policy means everything gets sold, and vice versa.

No matter whether the policy tilt, tighter or looser, will actually accomplish anything. Because a shift in FOMC mindset will move all markets, the greatest gains go to the quickest actors.

It’s the greatest fool phenomenon in action, of course, but we don’t have to acquiesce and join the parade of fools. The record shows that things even out over the longer term.

Gold, for example, was derided for its lackluster performance during the inflationary spike of last year. What critics failed to understand, however, was that gold soared during the tsunami of monetary and fiscal accommodation that followed the emergence of the Covid pandemic.

Being perhaps the most sensitive of predictive markets, gold anticipated the inflationary wave that was to come.

As I’ve noted, the fact that gold managed to gain over $300 an ounce during what was arguably the harshest rate hiking cycle in the Fed’s history argues for an exceptional performance once the cycle turns toward rate cutting.

Whether that cycle begins in March or May will matter little in the long run. We know it’s coming... and we know we’ll want to be in gold, silver and mining stocks once it begins.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Clint Siegner

Money Metals Exchange

Clint Siegner is a Director at Money Metals Exchange, the national precious metals company named 2015 "Dealer of the Year" in the United States by an independent global ratings group.