BTC stabilises as the USD loses ground

The market continues to sell the greenback

The greenback began the week on the back foot yesterday in the FX market and extended its losses in today’s Asian session. The greenback stands before the release of January’s US employment data, which could shake the markets on Wednesday and the US CPI rates for the same month on Friday. Today we highlight the release of the US retail sales growth rate for December and the rate is expected to show an easing of the demand side of the US economy, which could weigh on the greenback. In the Far East, the Yen found some support from the landslide win of Ms. Takaichi in Sunday’s elections, while political uncertainty in the UK may weigh on the pound, as UK PM Starmer is under pressure from members of his own party.

Bitcoin stabilises for now

A sigh of relief was heard in the crypto market over the past few days as Bitcoin’s price seems to have stabilised over the weekend. Yet the market seems to maintain a bearish tendency hence the stabilisation may prove to be sensitive. An intensification of a risk-off market sentiment could weigh on the risky asset.

US stock markets edged higher

US stock markets edged higher yesterday, and mega-cap tech shares may gain some support as the US Government seems to intend to exclude Amazon, Google, Microsoft and other tech companies for tariffs on chips, yet AI investment worries linger on. Meanwhile, in Japan, the Nikkei 225 has reached new all-time highs after Ms. Takaichi’s win in the elections.

Middle East tensions continue to tantalize Oil prices

Oil prices gained yesterday, as the US Department of Transportation warned US-flagged ships to remain as far as possible from Iranian waters causing oil traders to weigh the possibility of a disruption of the commodity’s supply side. The oil market’s focus is currently on the Middle East and a possible easing of US-Iranian tensions could weigh on oil prices and vice versa.

Charts to keep an eye out

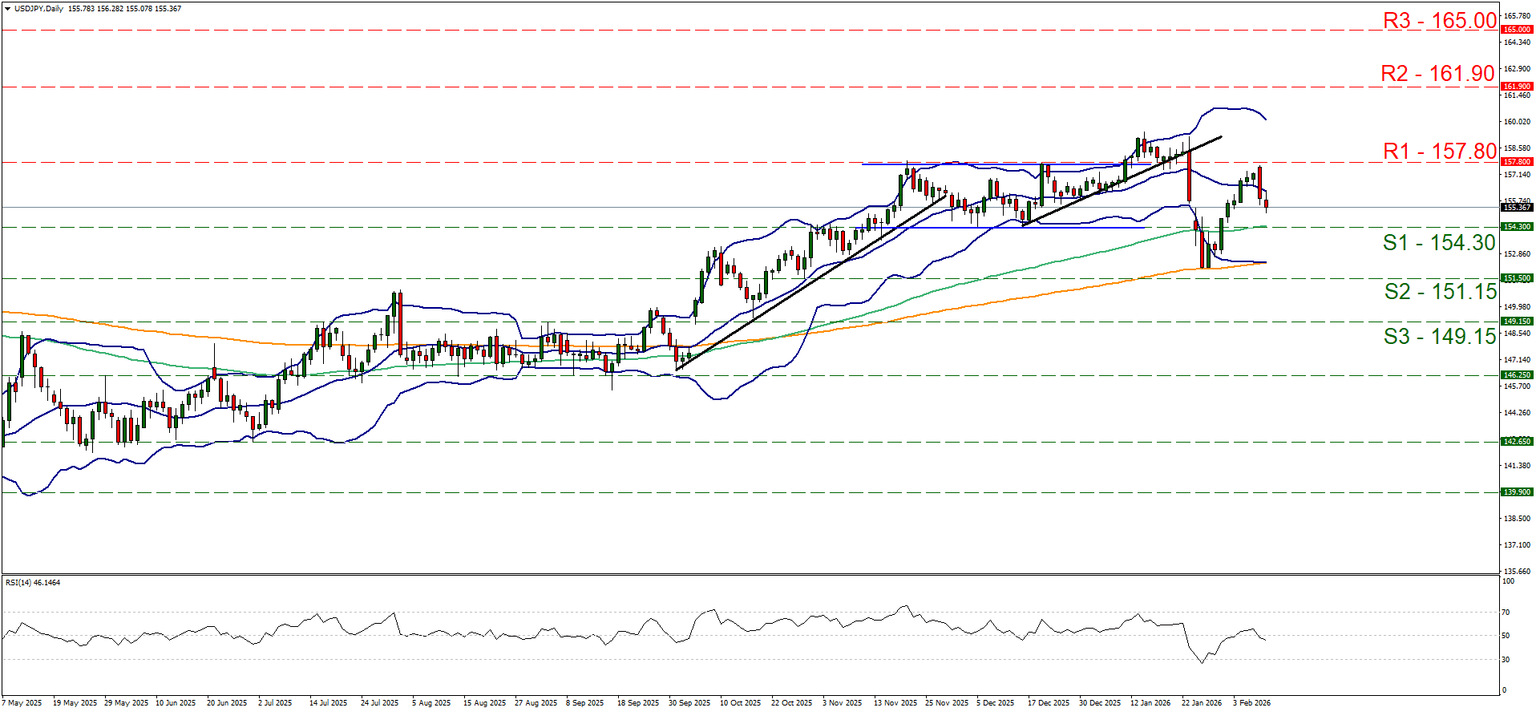

USD/JPY dropped yesterday and is currently aiming for the 154.30 (S1) support line. The drop has nearly wiped out all the gains made in the past week, and the RSI indicator is signaling a considerable easing of market’s bullish sentiment for the pair. We maintain a bias for a sideways motion currently and for a bearish outlook to emerge, we would require the pair to clearly break the 154.30 (S1) support line and start actively aiming for the 151.15 (S2) base. For a bullish outlook to be adopted, we would require the pair to reverse yesterday’s bearish movement, break the 157.80 (R1) line, thus paving the way for the 161.90 (R2) barrier.

BTC/USD remained relatively stable over the past three days between the 74560 (R1) resistance line and the 66750 (S1) support line. We note that the crypto king’s bearish movement has been interrupted as the downward trendline has been broken, hence we switch our bearish outlook in favour of a sideways motion bias, yet also issue a warning for a bearish movement given that the RSI indicator indicates that the market still has a bearish predisposition. Should the bears regain control over Bitcoin’s price we may see it sliding below the 66750 (S1) support line with the next possible target being at the 58900 (S2) support level.

Other highlights for the day

Today we get Norway’s CPI rates for January, the US retail sales for December and on a monetary level, Cleveland Fed President Hammack and Dallas Fed President Logan are scheduled to speak, while oil traders may be more interested in the release of the US API weekly crude oil inventories figure. In tomorrow’s Asian session, we note the release of China’s January inflation measures and in Australia RBA deputy Governor Hauser is scheduled to speak.

USD/JPY daily chart

- Support: 154.30 (S1), 151.15 (S2), 149.15 (S3).

- Resistance: 157.80 (R1), 161.90 (R2), 165.00 (R3).

BTC/USD daily chart

- Support: 66750 (S1), 58900 (S2), 49200 (S3).

- Resistance: 74560 (R1), 81160 (R2), 88000 (R3).

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.