What is NFP and how could it affect the Forex market?

NFP is the acronym for the Nonfarm Payrolls report, a compilation of data reflecting the employment situation in the United States (US). It shows the total number of paid workers, excluding those employed by farms, the federal government, private households, and nonprofit organisations.

The headline figure, expressed in thousands, is an estimate of the number of new jobs added (or lost, if negative) in a given month.

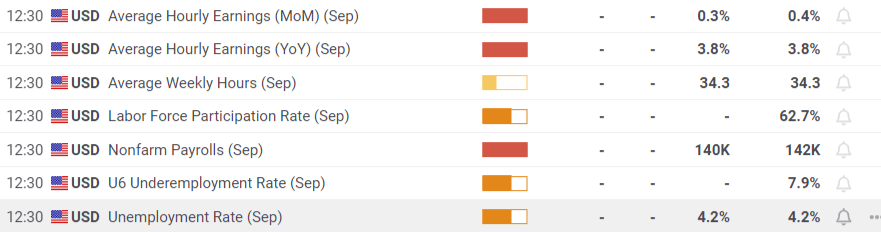

But the report also includes the country’s Unemployment Rate, the Labor Force Participation Rate (or how many people are working or actively seeking a job compared to the total population) and Average Hourly Earnings, a measure of how wages increase or decrease month over month.

Why is NFP important for Forex markets?

The Forex (FX) market pays extra attention to the US macroeconomic figures, as they reflect the health of the world’s largest economy. Employment data is particularly relevant because of the Federal Reserve (Fed) mandate. “The Fed's modern statutory mandate, as described in the 1977 amendment to the Federal Reserve Act, is to promote maximum employment and stable prices. These goals are commonly referred to as the dual mandate,” according to the central bank itself.

Generally speaking, a solid increase in job creation coupled with a low Unemployment Rate is usually seen as positive for the US economy and, hence, the US Dollar (USD). On the contrary, fewer-than-expected new jobs tends to hurt the US Dollar.

However, nothing is written in stone in the FX market.

Ever since the Coronavirus pandemic, markets’ dynamics have changed. The overextended lockdowns and the subsequent reopenings had an unexpected effect: soaring global inflation.

As prices increased fast, central banks had no choice but to lift interest rates because by doing so it contributes to tame inflation. This is because high rates make it more difficult to borrow money, reducing the demand for goods and services from households and companies and thus keeping prices at bay.

Interest rates reached multi-decade peaks in 2022-2023, and economies cooled. But inflation took long to recede. In fact, most major economies are still seeing how prices grow by more than what central bankers would like to.

In the case of the US, the Fed’s goal is for prices to grow at an annual pace of around 2%. Despite having retreated from the highs posted in mid-2022, price pressures remain above desired.

The Personal Consumption Expenditures (PCE) Price Index, the Fed’s favorite inflation gauge, rose by 2.2% year-over-year (YoY) in August, according to the US Bureau of Economic Analysis (BEA). On a monthly basis, the PCE Price Index increased by 0.1%. The core PCE Price Index, which excludes volatile prices such as food and energy, rose by 2.7% YoY and 0.1% on a monthly basis.

But what does employment have to do with the Fed?

Keeping unemployment subdued is also part of the Fed’s mandate, but a strong labor market usually translates into higher inflation. The Fed is in a tough balancing act: controlling inflation can mean more job losses, while a very strong economy can mean higher inflation.

The Chairman of the Fed, Jerome Powell, has long said the central bank needs a “weaker” labor market, meaning that the economy creates fewer jobs, to trim interest rates. Not the case anymore,

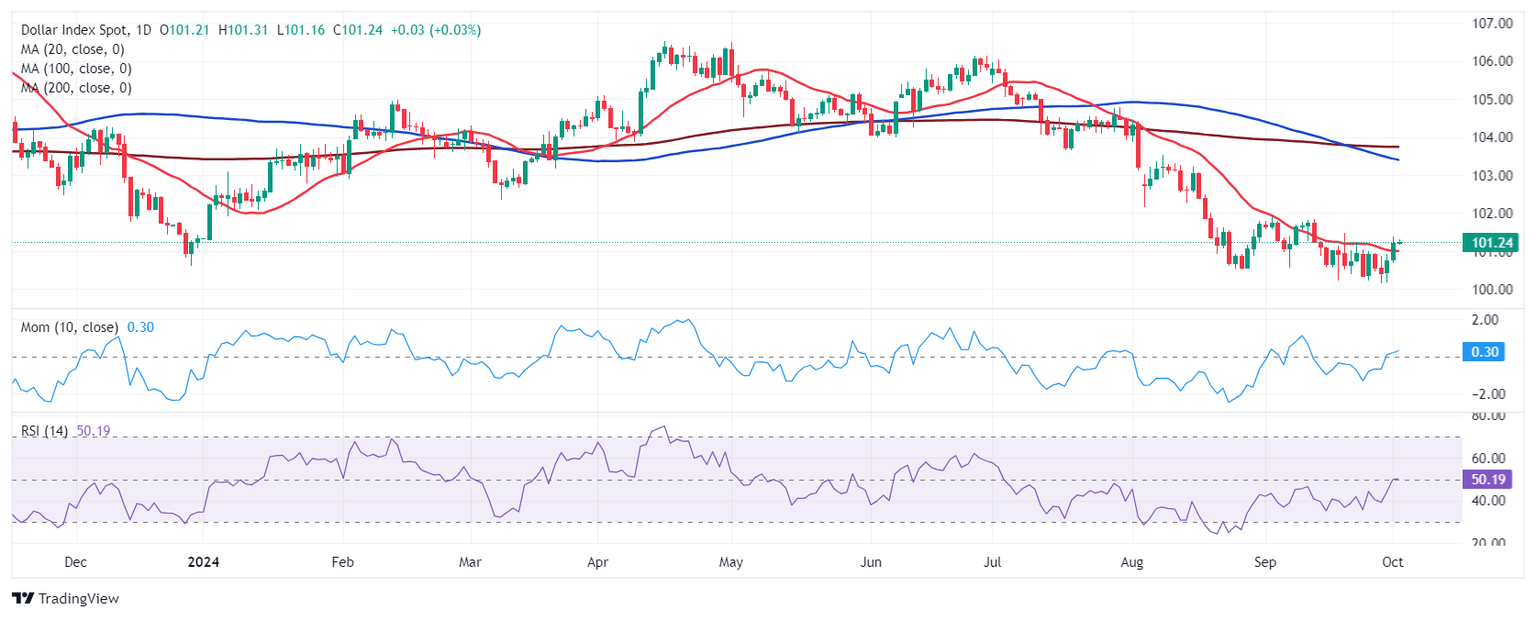

The US economy has consistently performed very well after the pandemic, creating plenty of jobs month after month. Even though this seems a desirable situation for the country, the Fed read it as a potential risk to inflation. US policymakers kept interest rates high for as long as possible. Finally, the Fed decided to trim interest rates, delivering a 50 basis points (bps) rate cut in September. The announcement brought relief to financial markets, which now see borrowing costs going further down in the upcoming months. As a result, investors seek for high-yielding assets, opposite to the safe-haven US Dollar.

What to expect from the September NFP report?

The August NFP report showed that the US economy created 142,000 new jobs in the month, while the Unemployment Rate was confirmed at 4.2%. The US Dollar initially fell with the news but quickly trimmed losses and posted gains that day, as speculative interest believed the Fed would respond to it by trimming the benchmark interest rate by a smaller 25 basis points (bps).

As said before, the Fed proceeded with a more aggressive cut. Even further, US policymakers anticipated they would be cutting interest rates by another 50 bps before year-end.

The case for more aggressive interest rate cuts meeting after meeting will only likely be backed by weak economic indicators.

With that in mind, an NFP report that shows fewer jobs created than what is expected could boost the odds for another 50 bps cut in November.

The USD will then fall.

On the other hand, a report indicating solid job creation should hint at a more modest 25 bps trim in interest rates.

In this scenario, the USD could take advantage of such figures.

For September, economists expect the US economy to have created 140,000 new positions after the 142,000 jobs created in August. The Unemployment Rate is foreseen at 4.2%, unchanged from the previous month.

As always regarding macroeconomic data, the divergence between expectations and the actual result will determine the strength of directional movements across the FX board.

The more significant the deviation, one way or the other, the wider the market reaction. That means that, for example, if the headline reading results in 150,000, the market would barely react.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation. A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work. The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower. NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa. Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold. Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components. At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary. The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.