Week Ahead: The calm before the stimulus storm? [Video]

![Week Ahead: The calm before the stimulus storm? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/money-for-the-table-with-figures-gm118451521-10951870_XtraLarge.jpg)

It looks like a quiet week for global markets, with no major central bank meetings and only a handful of key data releases. The highlight may be the US CPI data, which will tell us how inflationary pressures are evolving, but even that could pass unnoticed. Instead, the main driver for markets may be any signals around a new relief package once the Democrats take over the US government. If so, the ‘reflation trade’ could continue to dominate.

Stimulus hopes overpower social unrest

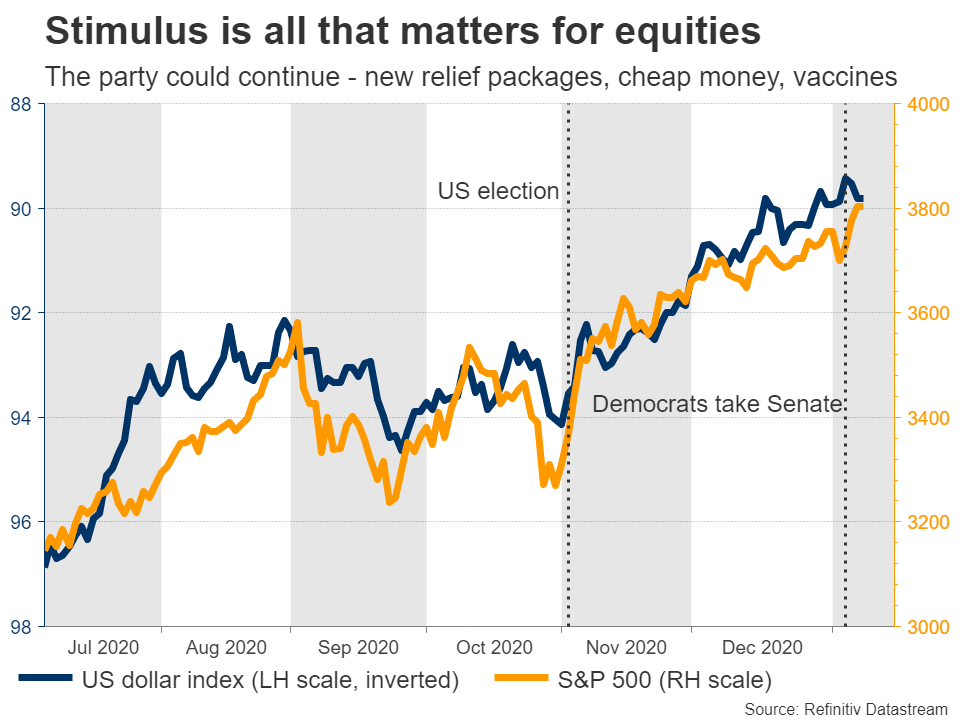

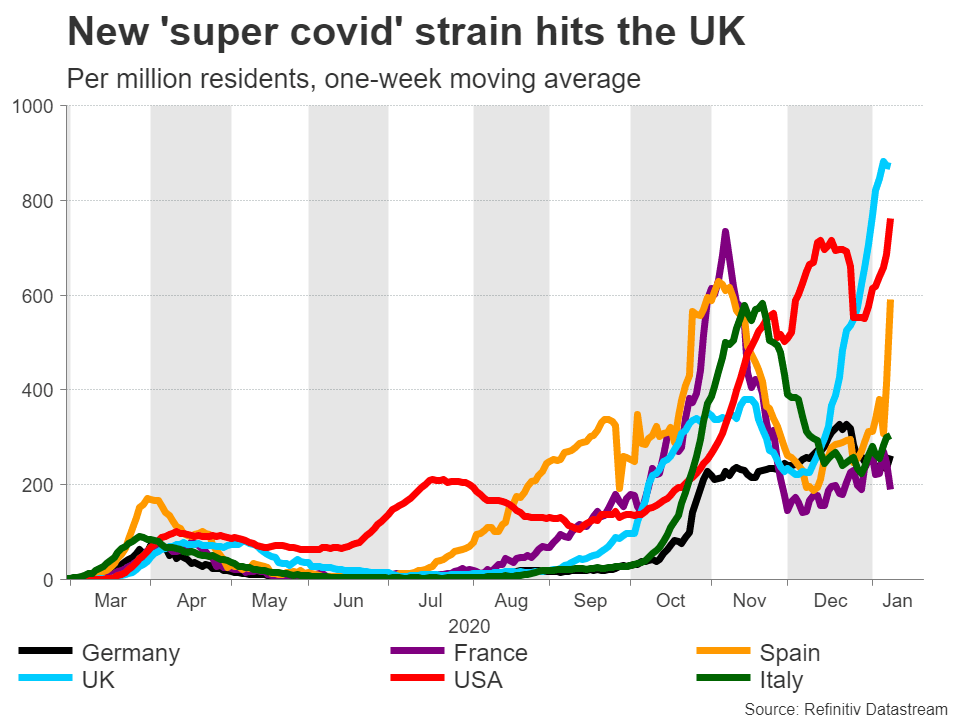

The first week of the new year kicked off with fireworks. The Democratic party took full control of Congress after winning both Senate seats from Georgia, catapulting stock markets to new record highs amid expectations of bigger spending packages to boost the economy. Meanwhile, an angry mob of Trump supporters stormed the US Capitol, the UK went back into full lockdown to contain the new strain of ‘super covid’, and the global vaccine rollout has fallen behind schedule already.

None of that mattered much for the markets though, where the dominant force was the stimulus story again. The Democrats taking full control of the US government means that it will be easier to unleash more spending if the economic recovery hits any road bumps, so investors feel confident that both Washington D.C. and the Fed now have their backs. And since the Democratic majority in the Senate is razor-thin, there is no real threat of significant tax increases on businesses.

Admittedly, this isn’t too surprising. The lesson from last year was that when cheap central bank money meets massive government relief, investors are happy to ignore any grim developments and instead focus on the light at the end of the tunnel. The only things that really matter at this stage are the stimulus measures and the vaccine deployment timeline.

Where does all this leave markets? In a nutshell, the ‘risk on’ party seems likely to continue. The financial system will probably remain flush with liquidity, US government deficits might balloon further, and the global economy could start healing once the vaccines are properly distributed. And if there is trouble along the way, that simply means more spending and more central bank liquidity. As long as there isn’t any catastrophic news, like a new virus mutation that is immune to the existing vaccines, it is difficult to argue for any massive setbacks.

For now, markets will focus on any signals about a new relief package. Media reports already suggest that president-elect Biden is considering a new ‘one-two stimulus punch’ to juice up the economy, first by providing $1400 payments to help suffering Americans and then by unleashing a supermassive $3 trillion infrastructure package. An official confirmation of that in the coming days could keep the reflation trade rolling.

US inflation and Powell speech highlight US calendar

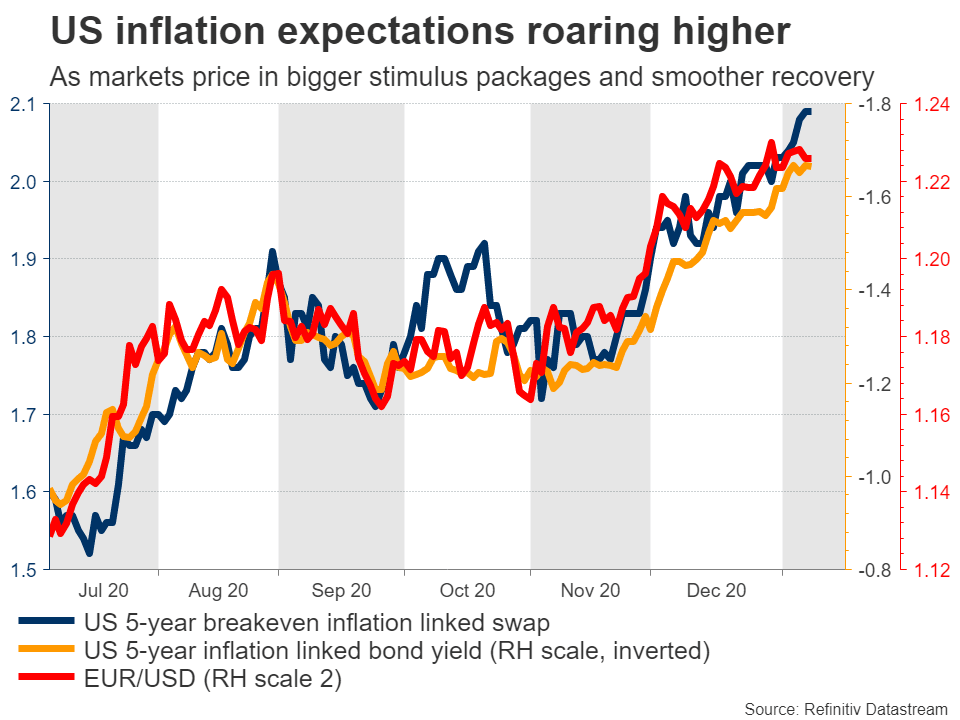

There isn’t much going on in America, but the CPI data for December could attract some attention on Wednesday. One of the big mysteries of 2021 is whether US inflation will accelerate significantly, and if it does, whether the Fed will respond to that by slowing down the pace of its monthly QE purchases.

This is a longer-term story of course, but if we were to see a surprising uptick in inflation now, that could at least wipe out any expectations that the Fed will deliver even more easing measures. In other words, while a spike in inflation wouldn’t be enough to scare markets that the Fed will withdraw any support, it may be enough to eradicate hopes for even more support.

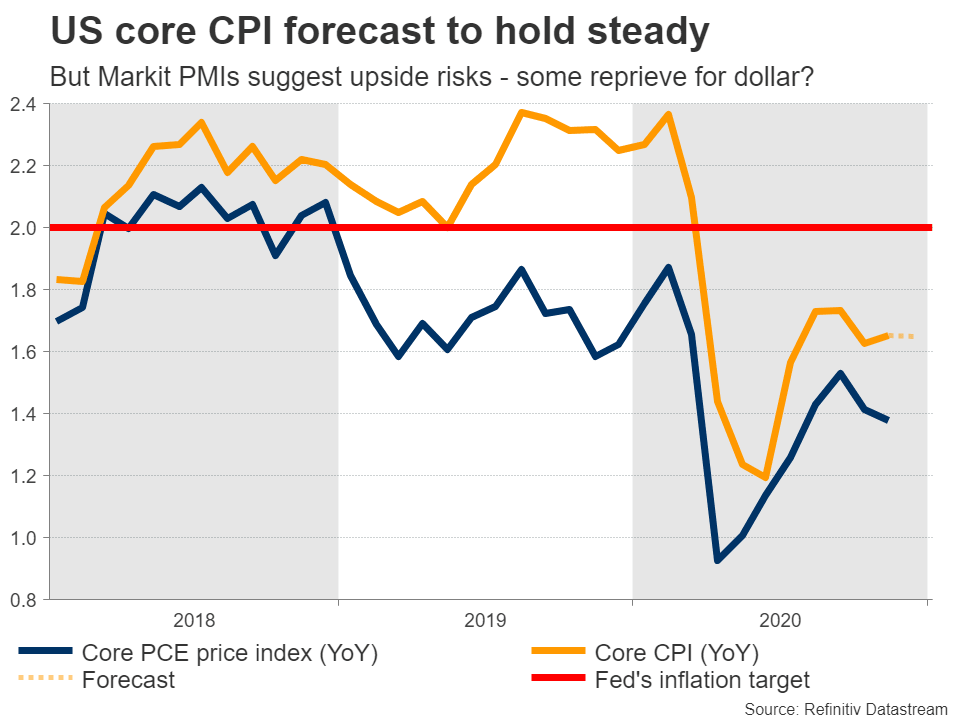

Forecasts suggest the CPI rate ticked up to 1.3% in December from 1.2% the previous month, while the core rate is expected to have held steady at 1.6%. As for the risks, the Markit PMIs for the month suggest that an upside surprise is more likely than a disappointment. Both the Markit manufacturing and services surveys showed a sharp increase in selling prices amid rising cost burdens for firms. If there is a mild upside surprise, that could give the beaten-down dollar some temporary reprieve.

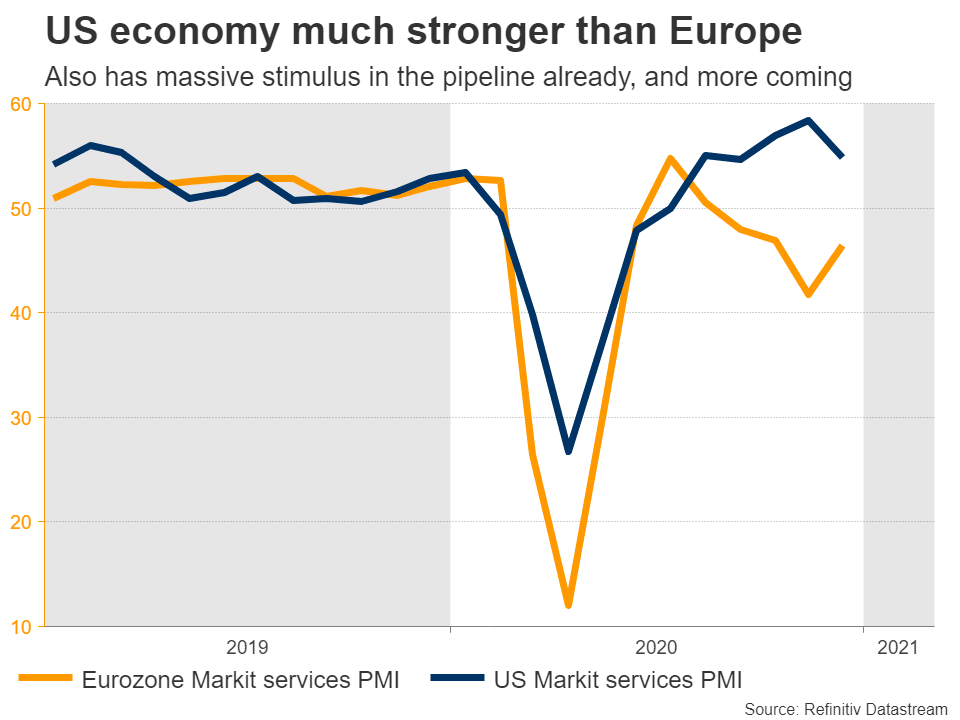

In the bigger picture, this new era of huge US deficits argues for the downtrend in the dollar to continue. While that may turn out correct in the short term, the longer-term outlook for the dollar doesn’t seem quite as bleak as many suggest. Yes, the US is running huge deficits and will likely experience higher inflation than most other nations – both negatives for the dollar.

However, there are positive longer-term effects from bigger spending. If all the spending implies a shallower recession and stronger growth going forward, that could negate deficit concerns coming out of a crisis. Capital ultimately gravitates towards growth, not the deflation that is brewing in Europe and Japan. At some point, relative economic performance will come into play. The US is currently much stronger than other regions, has more stimulus in the pipeline already, and might receive even more relief once Biden takes office.

In addition, this week saw the US 10-year Treasury yield jump over 1% for the first time in 9 months. Higher Treasury yields could cushion the dollar by providing it with a significant yield advantage in a largely zero- or negative-interest rate global developed government bond market. Should the increase in treasury yields continue, it could have important consequences not only for currencies but for other markets too such as stocks.

There is also a speech by Fed Chairman Powell on Thursday, before a deluge of second-tier data hits the markets on Friday, including the New York Fed’s manufacturing survey and the Michigan consumer confidence index for January.

UK monthly GDP unlikely to excite

Over in Britain, the GDP print for November will be released Friday. Forecasts point to an eye-watering 5% drop from the previous month, but considering this was the period when England went back into lockdown, this is natural. Additionally, markets may view the November data as outdated already.

And with Brexit out of the spotlight for now, the main variable for the pound may instead be the vaccine deployment timeline, as that could determine how quickly this rolling shutdown game ends and how quickly the economy recovers. The logistics of rolling out the vaccines rapidly are admittedly a nightmare, but so far so good in the UK, with only minor setbacks to speak of.

Finally, Chinese trade data for December will also hit the markets early on Thursday, and the export numbers in particular may attract some attention as a gauge of global demand.

Author

Marios graduated from the University of Reading in 2015 with a BSc in Economics and Econometrics. Prior to joining XM as an Investment Analyst in December 2017, he was providing financial analysis, reporting and consulting service