We want deeds, not words

Outlook: Not to be blasé, but crashing consumer sentiment in the US, UK and Europe should come as no surprise. Consumers are still digesting inflation at 8%+ and not as sure as the financial professionals that the central banks can tame inflation, having admitted supply-driven inflation is mostly immune to monetary policy.

Equity markets choose to combine expected earnings shortfalls with consumer gloom to drive equity prices down, but gee, since when does consumer sentiment drive markets? We want deeds, not words, and so far indicators like retail sales point to the consumer not cowed much at all or retreating to the back of the cave.

This is one reason why talk is silly of a flip-flopping Fed that will ease up by year-end as recession appears. El-Erian in the FT makes an eloquent case for how bad a return to stop-go policies would be. But throughout all the talk of the Fed chickening out we never see any evidence of a crack in the resolve to tame inflation. Bad forecasts, yes, Delayed admissions, yes. But now the Rubicon has been crossed, where are the signs of turning back? It’s like beating a horse already running as fast as he can. It’s superfluous. It’s unnecessary. It’s also mean-spirited.

Example: Cleveland Fed chief Mester said the Fed is just beginning to raise rates, which can reach 3% to 3.5% this year and 4% plus next year even if that risks recession. The goal is to prevent a wage-price spiral that would arise if people expect inflation to be lasting. “Job one now is getting inflation under control.”

The Fed’s messaging is consistent now. There’s no need to jab at it for past mistakes.

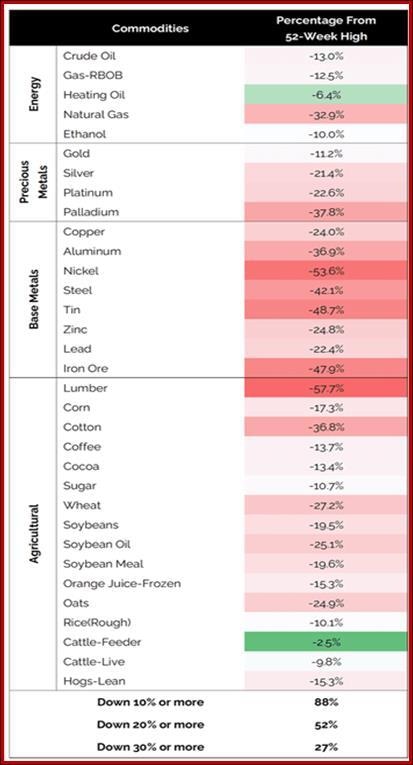

As noted yesterday, the trend in commodity prices is down. The Daily Shot offers this chart showing most are in “bear territory.” That means, to these analysts, more than 20% below their 52-week high. Funny, nobody names this as a potential or probable reason for inflation to moderate–or for emerging markets to fall back on the ropes.

As we head into a thin trading week due to the US July 4 holiday, everyone is puzzled by how it can be possible to hold two conflicting ideas in your head at the same time without going bonkers–central banks resolutely raising rates but not triggering recession–aka the soft or softish landing. Well, it’s in insoluble problem at this point in time. It’s like forming a forecast without the benefit of sampling data. Never before have we had this exact combination–a rise out of a pandemic followed closely by supply chain crises and trade-damaging war.

Fortunately, as time goes on, we will get evidence as to how consumers cope, whether new capital spending improves, how much global trade recovers (a problem, according to Oxford Economics), and other measures of resilient or stagnant economies. In a nutshell, it’s too soon to say, and it’s foolish to draw trendlines on data like retail sales.

We say it’s wise to delay forming a single scenario. It seems as though the new risk-on/risk-off sentiment is based on rising global growth/falling global growth, with outright inflation numbers secondary. And if inflation numbers are secondary, expected future rates and the resulting “real” return is secondary, too. This is a wild hypothesis but it does account for the mysterious movements in the AUD, if not fully the Swissie. The implication is that the RBA and SNB want growth at almost any cost, even the cost of a weak currency (temporarily). If they get their way, weakness will take care of itself. This is an old-timey way of looking at things but not necessarily wrong. In contrast, the Fed is targeting inflation alone and to hell with growth. This puts the dollar on the backfoot. It can take the lead again only if the real rate of return starts getting impressive, and the best way for that to happen is a genuine drop in inflation. Then it’s a battle between wanting that real return (dollar up) and seeking a happy surprise in the Other Dollars and Ems.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat