We get Nonfarm Payrolls tomorrow

The reciprocal tariffs are due to resume next Wednesday, July 9. Nerves will be jumping until we know whether they are paused again. If not, there will be hell to pay. The 90 deals in 90 days is nowhere close. We have some kind of agreement with the UK and that’s all. India might be close. Already it looks like Japan is digging in its heels on rice imports and Trump is annoyed.

He is, as usual, wrong. Japan does already import rice from the US, some 346,000 tons in 2024, which is about 45% of all the rice it imports from anywhere. Japan has a WTO "minimum access" commitment and is in compliance with it (disclosing that rice has been a giant issue for a very long time and Trump did not discover something to pin anger on). There’s even a website for it, “Rice in Japan”

About a new pause: Trump said last Friday the July 9 deadline is not fixed. Yesterday he said he’s not thinking of extending it. The Friday phrase still holds—“We can do whatever we want.” Sounds like a 3-year old.

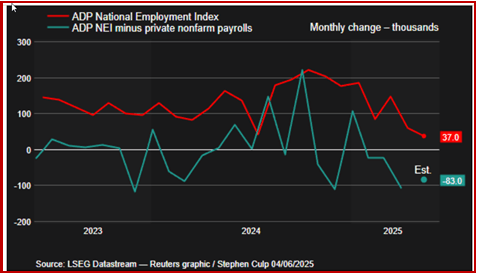

We get nonfarm payrolls tomorrow, a day early because of the holiday. Given the decent numbers from claims and JOLTs, no surprises are in store. The absence of tariff and immigration-induced effects reduces pressure on the dollar, even though most economists expect negatives in the next few months.

Let’s not forget how lousy the jobs and employment data can be. There is simply no way the data can be accurate in such a huge economy and with so much of it off the books. Hard data can be shoved into second and third place, anyway, because the buzz is all about the Fed cutting rates. As noted yesterday, Goldman is forecasting three cuts in a row starting in September. Yesterday morning the CME FedWatch tool had the probability of three cuts by year end at 53.1% from 29.3% a month ago. This morning at about the same time, it’s 54.1% with the month-ago at 25.6%. We do not understand how the CME jiggers the numbers, but we imagined futures were a more reliable indicator than swaps due to a higher participation rate.

And the excellent Authers at Bloomberg says Trump does have a point when he says the US is the only major country not cutting, The list that Trump sent Powell shows the other countries sticking to 4.5% are the likes of Cameroon and Guatemala. Only Norway of the advanced economies is on that list. Trump wants Fed funds art 1-1.5%, alongside Japan, Switzerland, Cambodia (Cambodia?), and Denmark.

We didn’t show the list yesterday because we thought it was stupid. But stupid or not, the idea is grabbing hold that unless Powell agrees with Trump, whether privately or publicly, we are getting those rate cuts. If Powell gets righteous and resists politization of the Fed, Trump will name his successor, making Powell a lame duck and making the successor the dominant sentiment-setter.

We have been worrying about this for some time because the credibility and trustworthiness of the Fed is at stake. It would seem confidence in the US and the Fed would fall hard, putting the US in the same class as (say) Turkey. Note that the Turkish 10-year yield is nearly 30%.

Authers goes on to point out that technically, the Fed doesn’t set any rate other than Fed funds and in any case, Trump’s 1% would be stupid in the face of inflation, however much it goes up by the fall. Conditions are not overly restrictive now, nor is the misery index (inflation + unemployment) a worry. Still, TreasSec Bessent told Bloomberg TV that when the Fed left rates low in 2021 as inflation was climbing sharply, it was “a little frozen at the wheel.” This is the same as Trump saying the Fed is behind the curve.

Something Authers does not address in this article is the possibility of stagflation/recession. An argument can be made that spirits and tides all rise when cuts are in the cards. Maybe that would re-invigorate consumer spending as well as the housing market, although mortgage rates are tied to the 10-year, not Fed funds, and the yield curve would surely steepen.

Bottom line, the combination of dreadful tariffs, a dreadful budget and deficit, Trump’s dreadful deportations (and mindless cuts of federal agencies and use of the military on American streets), and likely rate cuts all point toward an ongoing dollar declines, oversold or not.

Finally, the budget bill is going to the House from the Senate, where some hope for modification. The polls show voters are deeply, seriously against the budget, not because of the debt burden or regressive tax aspect, but because so many Trump voters will lose Medicaid health care insurance and rural hospitals will close. Markets are ignoring it almost entirely.

Forecast

We have plenty of reasons to expect an ongoing dollar decline. We have price history to tell us a consolidation must be on the horizon. ECR Research forecasts the euro to get to 1.2000, then correct toward 1.1200—but “From there, we anticipate an increase towards 1.30.”

This is about right. Today is our last report until Monday. At a guess, the correction that started today won’t go very far, and not as far as 1.1200. On the 240-minute chart, the B band bottom lies at about 1.1695. The correction can go to the midpoint of the 25-38% retracement at about 1.1706.

If the correction does break the B band, it won’t be for long.

Tidbit: WolfStreet reports “Collections from “customs and certain excise taxes” spiked to $28.0 billion in June, after hitting $24.0 billion in May, and $17.4 billion in April, according the Treasury Department’s Daily Treasury Statement today. The June total was up by 214% from February, before the new tariffs were implemented, and by 270% or by $20.5 billion year-over-year.

“This $20.5 billion is additional revenues, compared to a year ago. If tariffs bring in an additional $20.5 billion a month going forward, it would amount to about $250 billion a year in additional revenues.

“So far, there are no signs that tariffs have been successfully passed on to consumers, and consumer price inflation for durable goods, a prime target of tariffs, was 0% month-to-month in May, according to the PCE price index last week, even as durable goods prices have been on an upward trend out of their deeply negative hole for over a year.

Note to Readers: There will be no reports this week on Thursday, July 3, and Friday, July 4. It’s a national holiday in the US and markets will be thin (Thursday) and closed (Friday).

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat