Was last week debate decisive for Trump's loss?

Outlook: We get very little today by way of data and none of it market-moving. Canada reports jobs, expected nicely higher. That leaves attention free to focus on the second stimulus bill now that there seems to be agreement a bill is needed. Since the airline bailout is linked to the other provisions, you can bet the lobbying is fierce. The Senate, however, is out of session until Tuesday next week.

Hardly secondary is attention to Trump’s mental disorders, some of which is his response to polls showing him losing approval all over the place. The newest Reuters/Ipsos poll showed 59% of adults disapprove of his handling of the pandemic. “The net approval rating of negative 22 percentage points is the lowest in the poll dating back to March 2 and has steadily declined over the last 10 days, as Trump’s illness and his return to work in the White House dominated news headlines. Trump’s rating on the issue was negative 11 points in a Reuters/Ipsos poll taken Sept. 30-Oct. 1.”

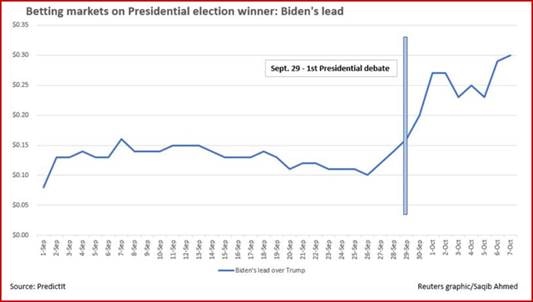

As shown in the PredictIt chart, the debate last week was a decisive loss for Trump. Reuters reports traders are banking on a Biden win, buying pot and solar stocks, while relaxing any impulse to buy dollars on the grounds volatility will not surge because a Biden win will be overwhelming. We say this is a dangerous attitude to take. He will not go quietly.

For all the reasons given above, talk of the 25th Amendment should be a huge factor. Bloomberg puts it this way: “Democrats are set to announce a bill today that would set up a commission to evaluate using the 25th amendment which can remove a sitting president from office.” It’s almost impossible to get done, but it’s real. Imagine being the only president to get impeached and get the 25th Amendment brought down on your head.

Trump won’t do the Oct 15 debate because he doesn’t know how to use a computer and “they can cut you off.” This is more than the usual petulant child—he’s losing his marbles. The debate audience was 70+ million and his rallies, planned for Saturday and again on Oct 15, get far less. As a political judgment, not aiming to enlarge your base is what is waste of time.

Not everyone thinks volatility should continue to fall and the short dollar position continue to grow. To the extent it’s based on the assumption of a stimulus package before Thanksgiving (end-Nov) and on Biden winning the election, it’s a bad set of assumption on which to bet the ranch. Poundsterlinglive.com writes “… the inability of the Dollar to find a clear trend of late could be betraying a market at odds with what the pollsters are saying, and economists at Saxo Bank have told clients that there is in fact only a 40% chance of a ‘blue wave’ outcome.

“The odds of either a Trump win or a contested Democrat win amount to 60% according to Saxobank, which would be interpreted as being bullish for the U.S. Dollar which has benefited from Trump's policies and would do so again during another presidency; it would also benefit from the safe haven demand that a contested outcome would yield.”

If Trump wins just some of the contested states (Wisconsin, Pennsylvania, Florida and Michigan), he can still control the Electoral College. Again it could be a vote count of only 10,000 that makes all the difference. In 2016 Trump won by about 70,000 votes. It can happen again.

For Wall Street to shrug off politics is both a blessing and a curse. It seems silly to see articles on which dividend stocks are better or what sector loses the most if Biden wins when the president is in the grip of steroid-mania, claiming to be cured while coughing on camera, forcing his lackey doctor to “clear” him when every expert says that can’t be done within two weeks, etc. In other words, the risk of another Disruption that becomes a big, fat negative Shock is pretty high. Maybe we should celebrate that greed is ruling and not fear. But remember what happened to the dollar when Trump said he was halting stimulus talks. It could be worse next time.

Oh, yes, and there’s a hurricane headed for New Orleans.

Monday is a national holiday in the US, Columbus Day, with federal offices closed but many businesses and banks open. We will publish as usual except for the spot report.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat